How much is enough?

On March 1, 2025, IFE Management Advisers Inc. held its annual economic briefing at the Discovery Primea with this year’s theme as "How Much Is Enough? The Path to Financial Freedom." Attendees were clients of IFE Wealth and their family and friends. They’re mostly high achievers starting their families.

I delivered the welcome remarks by sharing a personal story when I had to face this very question of “How much is enough?” back when I was working as an investment banker raising our young sons. If you have read my books, attended my talks and workshops, you may already know this story. When I would miss out on our first-born Martin’s baby milestones, I would say to my husband, “Hon, when your salary reaches x amount, I will stop working for the meantime so I can devote more time raising our children.” It was when our second son, Enrique, was born that it became obvious that the quantity and quality of time I was giving our children was not enough. There was a disturbance in my gut as the days went on. I was unhappy. Then I realized that my husband’s salary had already reached that x amount, but of course we had more expenses and we were even building a house! That’s when the big question confronted me, “So, when is enough really going to be enough?”

It was a good thing that I was able to articulate early on a core value of mine. From the very start, I think even prior to having my first boyfriend, I’ve always told myself that when I become a mother, I will see to it that I will raise my children to the best of my ability. Unfortunately, keeping my demanding job then made it impossible for me to be meaningfully involved in our sons’ day-to-day activities. After a lot of discussions, pencil-pushing, and prayers, I bowed out from a promising investment banking career to become a full-time mother at the age of 29.

As they say, everything happens for a reason. Because we gave up half of the family income, I had to watch our expenses like a hawk complete with financial statements, we did away with unnecessary ones, tried hard to continue the habit of saving and investing, and delayed enjoying some wants. All these became the seeds of my becoming FQ Mom!

Interesting points discussed

Enrique, who now heads IFE Wealth, did the main presentation of the economy and a good overview of how one can determine what is enough.

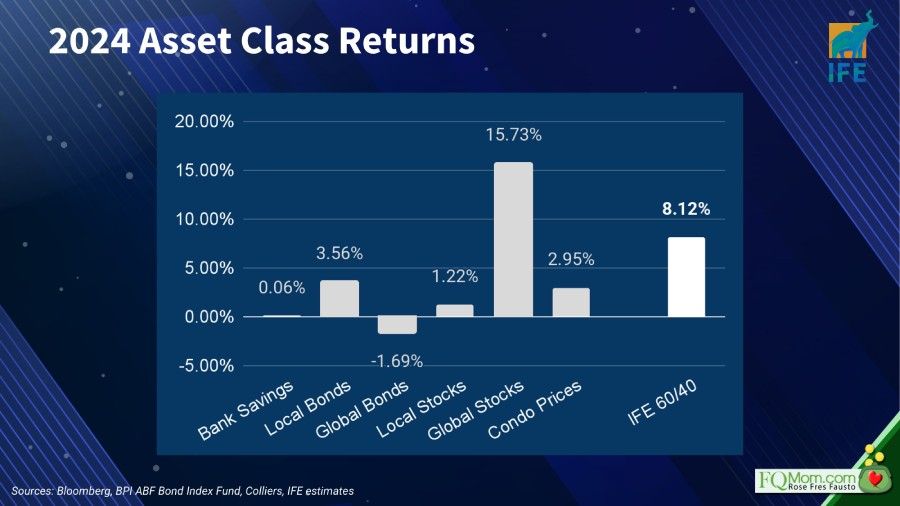

Last year, the Philippine stock market only delivered an unexciting 1.22% return compared to the global market return of 15.73%. On the other hand, the local bonds did better at 3.56% return as compared to the global bonds’ -1.69%. Below is the graph of the annual returns of the different asset classes for 2024.

Given the above, we are reminded of the importance of diversification. For 2025, investment themes should take into account the new Trump era of higher tariffs, lower taxes and regulations, and stricter immigration rules. Moreover, we should expect a bumpy path to lower interest rates, and the battle for AI dominance, currently being controlled by ChatGPT, Gemini, and DeepSeek.

What is enough for you?

Answering the question, “What is enough?” is very personal. That is why any financial planning should be tailor-fit. At IFE, we call this your bespoke Financial Architecture. We always start with your core values and help you see your blind spots before we proceed to the actual design and implementation.

Enrique also discussed whether that saying, “Hindi ka yayaman kung empleyado ka lang!” is true or just a myth. (I also wrote an article about this in 2023, click Is it true that you will never become rich as an employee?).

He went on to discuss active versus passive income, the importance of the snowball effect, and many more. (Click What is the snowball effect? to know more about this.)

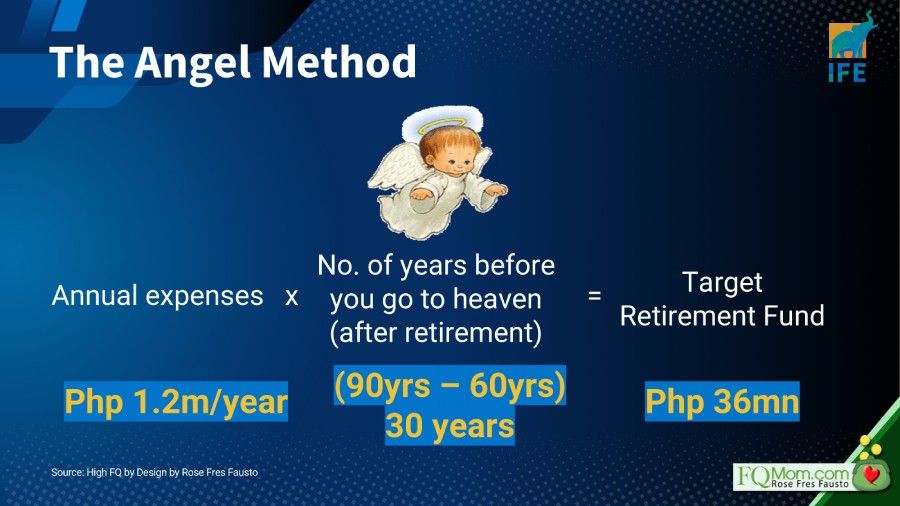

To give the audience a glimpse of how to compute for their “What is enough” retirement nest egg, he discussed two methods namely, the angel method and the 4% rule.

Computing for your retirement nest egg

Many years ago, when Marvin and I were trying to figure out what was enough for our retirement fund, we came up with a very simple formula. Then when we started to give talks on this subject matter, we used the image of an angel complete with moving wings, and that’s why we started calling it the Angel Method. This is how it goes:

The other method is from financial adviser William Bengen when he published his research in October 1994. This is what he said:

These two methods are more thoroughly discussed in FQ Book 3, High FQ By Design.

Marvin closed the event with a reminder to everyone to take advantage of the demographic sweet spot (the period when the country’s working age population, 15-64 years old, is large relative to the dependent population and is expected to bring about economic growth) that we are in right now and is expected to last until 2050.

He reminded all the participants to save and invest in order to achieve financial freedom and happiness which is best defined as follows:

I’m sure you’d love to be able to also do what you want, when you want, with whom you want, for as long as you want. If you haven’t yet, take the first step now. You can take the FQ Test and follow the steps carefully outlined for you in the FQ Trilogy.

Cheers to high FQ!

ANNOUNCEMENTS

1. For bespoke financial architecture, book your free initial consultation with IFE Wealth.

2. Watch out for my gguesting on Bilyonaryo News Channel’s Trade Talks with Maiki Oreta.

4. Do you know where you are now in your FQ Journey? Take the FQ Test, click here.

5. Get your copy of the FQ books to start your FQ Journey now. Click here.