+ Follow Banking Tag

Array

(

[results] => Array

(

[0] => Array

(

[ArticleID] => 2426884

[Title] => Women leading the way: Breaking barriers in Philippines banking, finance

[Summary] => In honor of women’s achievements and the ongoing pursuit of gender equality across all sectors, government leaders in banking and finance are driving initiatives to foster inclusivity and empower women through financial opportunities and support.

[DatePublished] => 2025-03-09 00:00:00

[ColumnID] => 0

[Focus] => 1

[AuthorID] => 1808134

[AuthorName] => Keisha Ta-Asan

[SectionName] => Business

[SectionUrl] => business

[URL] => https://media.philstar.com/photos/2025/03/08/3_2025-03-08_19-21-11962_thumbnail.jpg

)

[1] => Array

(

[ArticleID] => 2419644

[Title] => SB Finance and TrueMoney partner to empower small businesses with accessible financing solutions

[Summary] => SB Finance Inc., an affiliate of Security Bank, has partnered with TrueMoney Philippines, Inc. (TMPI), a non-bank financial institution, to bring accessible and convenient financing solutions to its own merchant network, and dealer-partners of its affiliate company Charoen Pokphand Foods Philippines Corporation (CPF).

[DatePublished] => 2025-02-06 14:40:00

[ColumnID] => 0

[Focus] => 1

[AuthorID] =>

[AuthorName] =>

[SectionName] => Banking

[SectionUrl] => banking

[URL] => https://media.philstar.com/photos/2025/02/06/1_2025-02-06_11-52-50487_thumbnail.jpg

)

[2] => Array

(

[ArticleID] => 2411420

[Title] => All in the card: Financial fitness, health perks to gift oneself this New Year

[Summary] => It has become a preferred way for many to bring money around, purchase items or settle bills that the card game is growing in terms of perks and features being offered by companies and brands.

[DatePublished] => 2025-01-03 16:04:00

[ColumnID] => 0

[Focus] => 1

[AuthorID] => 1807004

[AuthorName] => Kathleen A. Llemit

[SectionName] => The Budgetarian

[SectionUrl] => the-budgetarian

[URL] => https://media.philstar.com/photos/2022/11/16/credit2022-11-1218-39-23_2022-11-16_19-36-02400_thumbnail.jpg

)

[3] => Array

(

[ArticleID] => 2391276

[Title] => ANZ Research: RRR cuts to 'bolster bank profitability'

[Summary] => ANZ Research, the research arm of the Australian bank, said that the BSP’s recent reduction in the Reserve Requirement Ratio (RRR) by 250 basis points is a “positive development”, but one that is “unlikely to materially accelerate [credit growth]”.

[DatePublished] => 2024-10-09 08:20:00

[ColumnID] => 0

[Focus] => 1

[AuthorID] =>

[AuthorName] =>

[SectionName] => Stock Commentary

[SectionUrl] => stock-commentary

[URL] => https://media.philstar.com/photos/2021/07/01/stock-commentary-thumbv3jpg_2021-07-01_08-58-57178_thumbnail.jpg

)

[4] => Array

(

[ArticleID] => 2382836

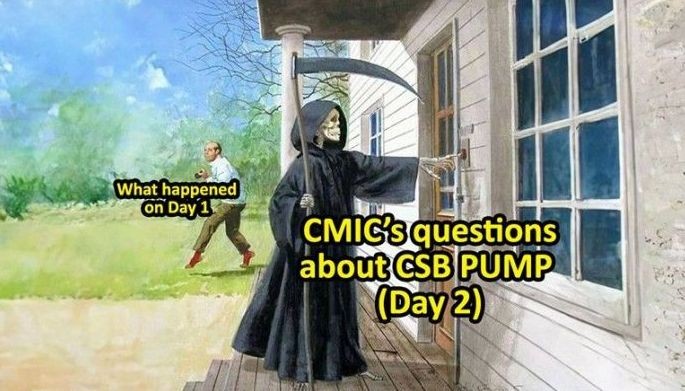

[Title] => Citystate Savings hit the ceiling for 2nd day in a row

[Summary] => Citystate Savings Bank made news on September 2 when it revealed a Hong Kong-listed company called CSC Holdings had signed an agreement to acquire 26.8% of CSB’s outstanding shares from a collection of CSB’s existing shareholders in a secondary share sale.

[DatePublished] => 2024-09-04 08:00:00

[ColumnID] => 0

[Focus] => 1

[AuthorID] =>

[AuthorName] =>

[SectionName] => Stock Commentary

[SectionUrl] => stock-commentary

[URL] => https://media.philstar.com/photos/2024/09/04/cmic_2024-09-04_15-19-32503_thumbnail.jpg

)

[5] => Array

(

[ArticleID] => 2378284

[Title] => BSP cuts interest rate 25 basis points

[Summary] => The Monetary Board of the Bangko Sentral ng Pilipinas decided to cut interest rates by 25 basis points to 6.25% (from 6.50%).

[DatePublished] => 2024-08-16 08:00:00

[ColumnID] => 0

[Focus] => 1

[AuthorID] =>

[AuthorName] =>

[SectionName] => Stock Commentary

[SectionUrl] => stock-commentary

[URL] => https://media.philstar.com/photos/2021/07/01/stock-commentary-thumbv3jpg_2021-07-01_08-58-57178_thumbnail.jpg

)

[6] => Array

(

[ArticleID] => 2377541

[Title] => RCBC intensifies drive for responsible credit card use

[Summary] => With the high interest of young adults in using credit cards for transactions, Rizal Commercial Banking Corporation (RCBC) is intensifying its campaign for responsible credit card use, especially among the younger generation.

[DatePublished] => 2024-08-13 00:00:00

[ColumnID] => 0

[Focus] => 1

[AuthorID] => 1804802

[AuthorName] => Ehda M. Dagooc

[SectionName] => Freeman Cebu Business

[SectionUrl] => cebu-business

[URL] =>

)

[7] => Array

(

[ArticleID] => 2373416

[Title] => Thrift banks poised for growth

[Summary] => Amid the changing landscape of the country’s banking sector, thrift banks are emerging as key players poised for significant growth as they capitalize on market opportunities and cater to the credit demand of households and small businesses.

[DatePublished] => 2024-07-28 00:00:00

[ColumnID] => 0

[Focus] => 1

[AuthorID] => 1808134

[AuthorName] => Keisha Ta-Asan

[SectionName] => Business

[SectionUrl] => business

[URL] => https://media.philstar.com/photos/2024/07/27/2_2024-07-27_17-31-36355_thumbnail.jpg

)

[8] => Array

(

[ArticleID] => 2362369

[Title] => Philippines banking sector ‘improving’ – Fitch

[Summary] => Global credit watchdog Fitch Ratings has revised its outlook for the Philippine banking sector to ‘improving’ from ‘neutral’ as higher for longer interest rates could further boost banks’ rising net interest margins.

[DatePublished] => 2024-06-13 00:00:00

[ColumnID] => 0

[Focus] => 1

[AuthorID] => 1808134

[AuthorName] => Keisha Ta-Asan

[SectionName] => Business

[SectionUrl] => business

[URL] => https://media.philstar.com/photos/2024/06/12/fitch_2024-06-12_18-57-50475_thumbnail.jpg

)

[9] => Array

(

[ArticleID] => 2354109

[Title] => Montinola resigns as independent director of RCI

[Summary] => Retired banking executive Aurelio Montinola III has resigned as independent director of Roxas and Co. Inc. (RCI) after seven years following the purchase of shares in the company by a firm chaired by his wife.

[DatePublished] => 2024-05-11 00:00:00

[ColumnID] => 0

[Focus] => 1

[AuthorID] => 1805259

[AuthorName] => Richmond Mercurio

[SectionName] => Business

[SectionUrl] => business

[URL] =>

)

)

)

Banking

Array

(

[results] => Array

(

[0] => Array

(

[ArticleID] => 2426884

[Title] => Women leading the way: Breaking barriers in Philippines banking, finance

[Summary] => In honor of women’s achievements and the ongoing pursuit of gender equality across all sectors, government leaders in banking and finance are driving initiatives to foster inclusivity and empower women through financial opportunities and support.

[DatePublished] => 2025-03-09 00:00:00

[ColumnID] => 0

[Focus] => 1

[AuthorID] => 1808134

[AuthorName] => Keisha Ta-Asan

[SectionName] => Business

[SectionUrl] => business

[URL] => https://media.philstar.com/photos/2025/03/08/3_2025-03-08_19-21-11962_thumbnail.jpg

)

[1] => Array

(

[ArticleID] => 2419644

[Title] => SB Finance and TrueMoney partner to empower small businesses with accessible financing solutions

[Summary] => SB Finance Inc., an affiliate of Security Bank, has partnered with TrueMoney Philippines, Inc. (TMPI), a non-bank financial institution, to bring accessible and convenient financing solutions to its own merchant network, and dealer-partners of its affiliate company Charoen Pokphand Foods Philippines Corporation (CPF).

[DatePublished] => 2025-02-06 14:40:00

[ColumnID] => 0

[Focus] => 1

[AuthorID] =>

[AuthorName] =>

[SectionName] => Banking

[SectionUrl] => banking

[URL] => https://media.philstar.com/photos/2025/02/06/1_2025-02-06_11-52-50487_thumbnail.jpg

)

[2] => Array

(

[ArticleID] => 2411420

[Title] => All in the card: Financial fitness, health perks to gift oneself this New Year

[Summary] => It has become a preferred way for many to bring money around, purchase items or settle bills that the card game is growing in terms of perks and features being offered by companies and brands.

[DatePublished] => 2025-01-03 16:04:00

[ColumnID] => 0

[Focus] => 1

[AuthorID] => 1807004

[AuthorName] => Kathleen A. Llemit

[SectionName] => The Budgetarian

[SectionUrl] => the-budgetarian

[URL] => https://media.philstar.com/photos/2022/11/16/credit2022-11-1218-39-23_2022-11-16_19-36-02400_thumbnail.jpg

)

[3] => Array

(

[ArticleID] => 2391276

[Title] => ANZ Research: RRR cuts to 'bolster bank profitability'

[Summary] => ANZ Research, the research arm of the Australian bank, said that the BSP’s recent reduction in the Reserve Requirement Ratio (RRR) by 250 basis points is a “positive development”, but one that is “unlikely to materially accelerate [credit growth]”.

[DatePublished] => 2024-10-09 08:20:00

[ColumnID] => 0

[Focus] => 1

[AuthorID] =>

[AuthorName] =>

[SectionName] => Stock Commentary

[SectionUrl] => stock-commentary

[URL] => https://media.philstar.com/photos/2021/07/01/stock-commentary-thumbv3jpg_2021-07-01_08-58-57178_thumbnail.jpg

)

[4] => Array

(

[ArticleID] => 2382836

[Title] => Citystate Savings hit the ceiling for 2nd day in a row

[Summary] => Citystate Savings Bank made news on September 2 when it revealed a Hong Kong-listed company called CSC Holdings had signed an agreement to acquire 26.8% of CSB’s outstanding shares from a collection of CSB’s existing shareholders in a secondary share sale.

[DatePublished] => 2024-09-04 08:00:00

[ColumnID] => 0

[Focus] => 1

[AuthorID] =>

[AuthorName] =>

[SectionName] => Stock Commentary

[SectionUrl] => stock-commentary

[URL] => https://media.philstar.com/photos/2024/09/04/cmic_2024-09-04_15-19-32503_thumbnail.jpg

)

[5] => Array

(

[ArticleID] => 2378284

[Title] => BSP cuts interest rate 25 basis points

[Summary] => The Monetary Board of the Bangko Sentral ng Pilipinas decided to cut interest rates by 25 basis points to 6.25% (from 6.50%).

[DatePublished] => 2024-08-16 08:00:00

[ColumnID] => 0

[Focus] => 1

[AuthorID] =>

[AuthorName] =>

[SectionName] => Stock Commentary

[SectionUrl] => stock-commentary

[URL] => https://media.philstar.com/photos/2021/07/01/stock-commentary-thumbv3jpg_2021-07-01_08-58-57178_thumbnail.jpg

)

[6] => Array

(

[ArticleID] => 2377541

[Title] => RCBC intensifies drive for responsible credit card use

[Summary] => With the high interest of young adults in using credit cards for transactions, Rizal Commercial Banking Corporation (RCBC) is intensifying its campaign for responsible credit card use, especially among the younger generation.

[DatePublished] => 2024-08-13 00:00:00

[ColumnID] => 0

[Focus] => 1

[AuthorID] => 1804802

[AuthorName] => Ehda M. Dagooc

[SectionName] => Freeman Cebu Business

[SectionUrl] => cebu-business

[URL] =>

)

[7] => Array

(

[ArticleID] => 2373416

[Title] => Thrift banks poised for growth

[Summary] => Amid the changing landscape of the country’s banking sector, thrift banks are emerging as key players poised for significant growth as they capitalize on market opportunities and cater to the credit demand of households and small businesses.

[DatePublished] => 2024-07-28 00:00:00

[ColumnID] => 0

[Focus] => 1

[AuthorID] => 1808134

[AuthorName] => Keisha Ta-Asan

[SectionName] => Business

[SectionUrl] => business

[URL] => https://media.philstar.com/photos/2024/07/27/2_2024-07-27_17-31-36355_thumbnail.jpg

)

[8] => Array

(

[ArticleID] => 2362369

[Title] => Philippines banking sector ‘improving’ – Fitch

[Summary] => Global credit watchdog Fitch Ratings has revised its outlook for the Philippine banking sector to ‘improving’ from ‘neutral’ as higher for longer interest rates could further boost banks’ rising net interest margins.

[DatePublished] => 2024-06-13 00:00:00

[ColumnID] => 0

[Focus] => 1

[AuthorID] => 1808134

[AuthorName] => Keisha Ta-Asan

[SectionName] => Business

[SectionUrl] => business

[URL] => https://media.philstar.com/photos/2024/06/12/fitch_2024-06-12_18-57-50475_thumbnail.jpg

)

[9] => Array

(

[ArticleID] => 2354109

[Title] => Montinola resigns as independent director of RCI

[Summary] => Retired banking executive Aurelio Montinola III has resigned as independent director of Roxas and Co. Inc. (RCI) after seven years following the purchase of shares in the company by a firm chaired by his wife.

[DatePublished] => 2024-05-11 00:00:00

[ColumnID] => 0

[Focus] => 1

[AuthorID] => 1805259

[AuthorName] => Richmond Mercurio

[SectionName] => Business

[SectionUrl] => business

[URL] =>

)

)

)

abtest

February 6, 2025 - 2:40pm

September 4, 2024 - 8:00am