Asiabest Group to be backdoored by Francis Lloyd Chua

Bilyonaryo [link] reported that Francis Lloyd Chua has “struck a deal” to buy a controlling 67% stake in Asiabest Group International [ABG 26.20, down 1.1%; 294% avgVol]. According to the article, Francis Lloyd Chua will make the acquisition through his companies, PremiumLands Corp and Industry Holdings and Development Corp. No terms of the deal were disclosed. ABG’s stock is up over 400% over the past two months, and up over 770% since the start of the year.

> Who is Francis Lloyd Chua? Good question. I honestly didn't know. The Bilyo article says that he owns a stake in EEI [EEI 3.20, down 5.9%; 592% avgVol] and has a “growing investment portfolio” with interests in construction, infrastructure development, and real estate. A Google search for the name returns a top result (also from Bilyonaryo) that says Mr. Chua also owns (or owned) Mac Builders, the company that was awarded a P389 million contract by the Duterte administration to construct the dolomite beach in Manila Bay. The article, which refers to Mr. Chua as the “Dolomite beach developer”, was published in 2023 but appears to have been deleted by Bilyonaryo, but the text is visible using the Wayback Machine Internet Archive. That same internet search also returned an article from 2015, titled, “Remember the Honest NAIA Janitor?”, that talks about NAIA Janitor Ronald Gadayan’s return of a lost pouch from a Cebu-bound PAL flight that contained P1.8 million worth of “cash, jewelry, wristwatches, and expensive sunglasses” to “passenger Francis Lloyd Chua Ty”. The same guy? Who knows! However, he is referenced as “Francis Lloyd T. Chua” in documents relating to his EEI stake, so it seems more likely than not. Does it matter? Not really. But it's there and I'd not take any due diligence researcher seriously that didn't include that link in their report.

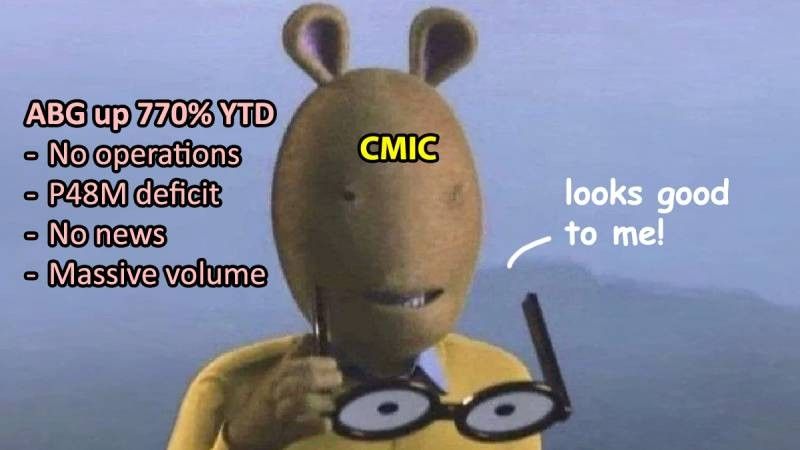

> What is ABG? It’s a zombie company. It used to be a mining company in the old days, but control was sold to Tiger Resort Asia Limited (TRAL) (the parent company of Okada Manila). According to their FY23 Annual Report, ABG hasn’t operated since 2017, has a deficit of P48 million, and is in the process of “implementing a business plan.” ABG also indicated that it is working on “completing the Follow-On Offering as required by the Revised Backdoor Listing Rules” for the transaction with TRAL but that “the management is yet to decide on the offering date”.

> What’s going on with the stock? This is where things get weird for me. ABG’s stock price almost hit P40/share after the TRAL backdoor, but lost half of that value over the following two months and settled into a consistent pattern of loss that pushed the stock price down to a low in the P2.60 region by late 2022 and early 2023. Things weren’t significantly different until around May of this year, when the price started to display more volatility, lurching up and down, but generally floating upward. Then, on August 15, the stock increased 24% on 15 million shares of traded volume, which was a lot for a stock that was trading in the double-digit thousands on most days at the time. The price didn’t start its dramatic rise, however, until around mid-October, when ABG started to experience a sequence of 10% and 20% gains which pushed the share price from P5.29 on October 18 to its current price of P26.20/share.

> Was there any public news? No. There was some news action around ABG in May related to speculation about Okada Manila’s plans to conduct an IPO, but ABG’s involvement was to say “there is no definite plan or decision to do an initial public offering of Okada Manila”, adding, “[ABG] does not expect or anticipate any effects on the business, financial condition, or operations of [ABG]”.

> Why didn’t CMIC inquire about the unusual price movement? No idea. Is it unusual for the PSE’s top-performing stock to be a non-operational zombie company that pumps on no news? I’d say that it is, but I guess it wasn’t unusual enough for the Capital Markets Integrity Corporation to make an official inquiry with ABG. It seems like CMIC is most likely to consider something “unusual” if the price hits the ceiling (+50%) or the floor (-30%) on a single day, but it’s not clear what they’d consider “unusual” outside of that framework. Based on this, +400% over two months was not unusual enough to prompt further action.

MB bottom-line: So what does this all mean? Well, not a lot. Backdoor listings are mysterious things by design since there’s a lot less information made available to the investing public when a company simply buys its way onto the exchange as opposed to the high level of disclosure and transparency that is required of IPO candidates getting to the market through the regular route. Even in this particular case, the original backdoor listing of TRAL through ABG amounted to nothing. The stock pumped 100% in anticipation, then promptly fell off a cliff after the transaction was completed. TRAL did nothing with ABG. Remember the backdoor listing of Filoil Group through Basic Energy [BSC 0.13, up 3.2%; 207% avgVol] back in late 2020? The price of BSC’s stock shot up 900% in anticipation, then promptly fell off a cliff after the transaction was completed and has since fallen back below its pre-backdoor price over the past four years. All we know for sure is that this change of control is going to require some kind of follow-on offering as per the PSE’s backdoor listing rules. But seeing as how ABG was still working on the follow-on offering triggered by its first backdoor listing six years ago, who knows when that could happen. I’m sure we’ll get a lot more context and color on what Mr. Chua has planned for this acquisition today and in the coming weeks, but for me, backdoor listings have not earned the benefit of the doubt, so I’ll be waiting to see concrete plans (that’s a construction pun, I’m sorry) before I even consider getting involved.

Merkado Barkada is a free daily newsletter on the PSE, investing and business in the Philippines. You can subscribe to the newsletter or follow on Twitter to receive the full daily updates.

- Latest