Petron [PCOR] board votes to file shelf registration for P50-B bond sale

Oil giant Petron [PCOR 3.60 7.78%], a subsidiary of San Miguel [SMC 117.00 0.86%], disclosed yesterday that it would file the registration statement and prospectus with the SEC for the sale of P50 billion in fixed-rate bonds by way of shelf registration, with the first tranche amounting to P18 billion.

PCOR’s president, Ramon Ang, said that the proceeds would be used to refinance old debt as those obligations mature. The bonds will be listed on the Philippine Dealing & Exchange Corporation (PDEx), which is our secondary market for government- and corporate-issued fixed income securities (like bonds).

MB BOTTOM-LINE

Investors and traders seemed to love the move, as the stock was up over 7% on the day. Hard to say exactly what they might have liked from the announcement, since it’s not like PCOR is using the proceeds to make any changes to its business model, or acquire a business, or otherwise do something that has a multiplicative impact on earnings going forward. This was basically a debt-shuffle: since interest rates are super low right now, PCOR will borrow P50 billion from investors and institutions now, at these low rates, and use the money to pay off debts they already have that are at higher rates.

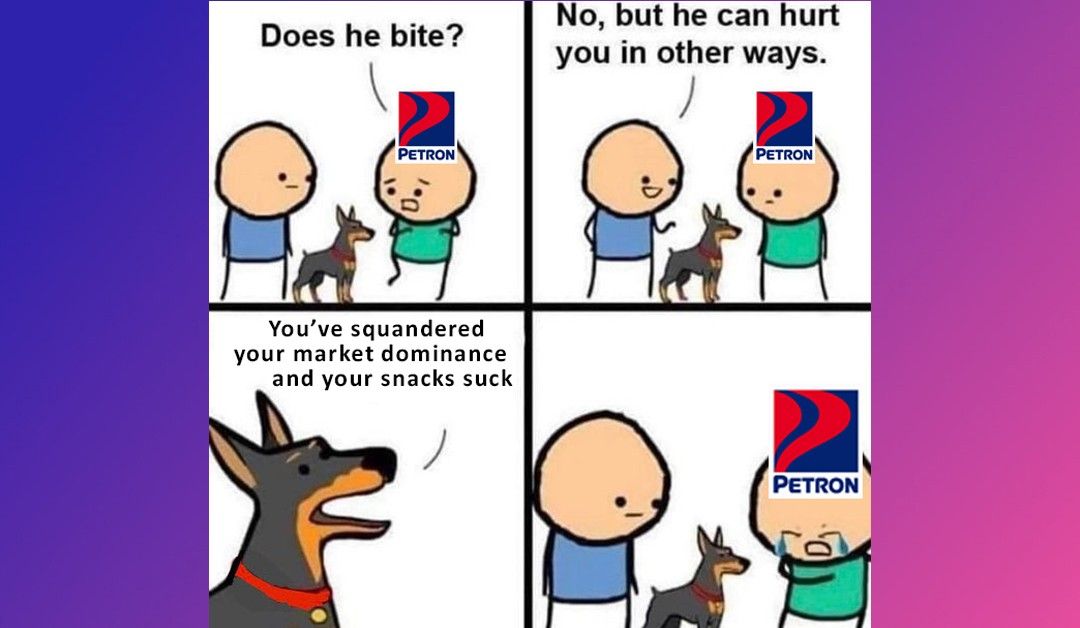

PCOR saves money. It’s a good thing to do, and solid business practice, but this kind of thing is done every day and is not -- by itself -- exciting enough to prompt such a big pump in the stock price. Probably had more to do with PCOR’s announcement that its Bataan refinery was operating again, and had been since June 1. As for the stock price, though, I feel the need to rant a bit about PCOR because the stock has been a dog for years. For 5 years, to be exact; PCOR was worth P11.32/share just after Duterte’s win in 2016 (the PSE was about 8,000 then), and while the PSE went on to flirt with 9,000 and then largely move sideways until it was hulk-smashed by COVID, PCOR has just steadily and consistently shed share price since that high-water mark. In July 2017, it was P9.70. In July 2018, it was P8.60. In July 2019, it was P5.70. During the lockdown, it was P3.10. The price briefly recovered to P4.00/share during the Q4/20 pump around the excitement of our premature economic re-opening, before being smashed back down to its lockdown level when we headed back into our lockdown alphabet soup.

PCOR is our nation’s undisputed dominant market player in terms of retail gasoline sales, location network, and overall market footprint, and yet what’s it doing with that position? I think the market has been asking the same questions of PCOR and has been similarly unimpressed with PCOR’s answers. Will the stock price increase as the “demand destruction” of COVID slowly eases? Probably, but its pre-COVID price was only around P4.00/share amid a terrible downward trend that did not show any signs of letting up.

--

Merkado Barkada is a free daily newsletter on the PSE, investing and business in the Philippines. You can subscribe to the newsletter or follow on Twitter to receive the full daily updates.

- Latest