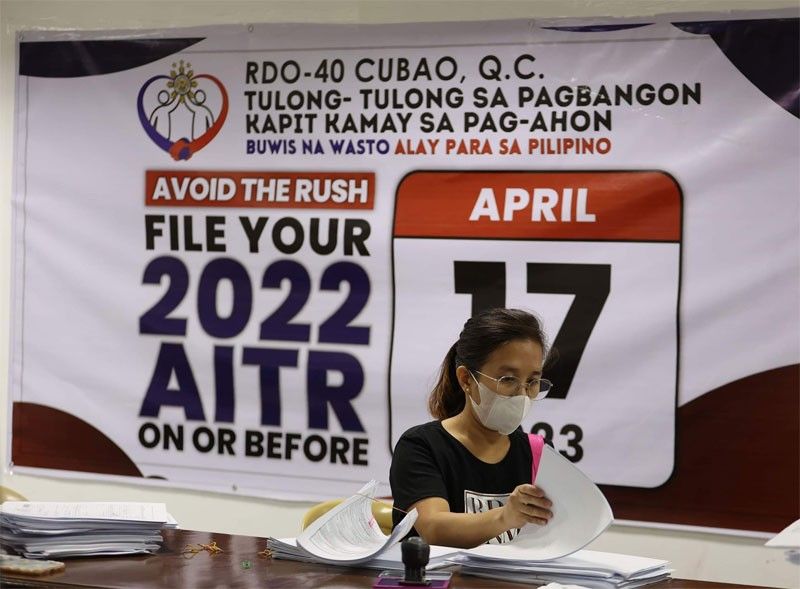

Pagbabayad ng income tax, hanggang April 17 lang – BIR

MANILA, Philippines — Muling ipinaalala ni Internal Revenue Commissioner Romeo Lumagui Jr. sa mga taxpayers na mag-file at magbayad ng kanilang 2022 Annual Income Tax Return (AITR) kahit saan lugar dahil hanggang April 17, 2023 na lamang ang deadline na walang kaukulang penalties.

Pinayuhan din ni Commissioner Lumagui o ang mga taxpayers at Certified Public Accountants (CPAs) na huwag gagamit ng pekeng resibo at transaksyon upang mabawasan ang kanilang babayarang buwis.

Sinabi ni Lumagui na ang Taxpayers na mandated na gamitin ang BIR’s Electronic Filing and Payment System (eFPS) ay maaaring mag-file ng kanilang AITRs electronically at bayaran ang tamang buwis sa pamamagitan ng eFPS-Authorized Agent Banks (AABs) kung saan sila naka enrolled.

Kung ang filing ay hindi puwede sa eFPS, ang taxpayers ay gagamitin ang eBIRForms facility sa filing ng kanilang AITR. Ang tax returns na nai-file sa pamamagitan ng eBIRForms facility ay hindi na kailangang mai-file sa eFPS.

Ang pagbabayad ng taxes due para sa tax returns na naihain gamit ang eBIRForms ay maaaring dalhin sa Revenue Collection Officers (RCOs) sa Revenue District Offices (RDOs), o sa alinmang Electronic Payment (ePayment) channels ng BIR.

Ang ePayment Channels ay tumatanggap ng bayad sa buwis gamit ang online payment facility (i.e. LBP’s LinkBiz Portal, DBP’s Pay Tax Online, etc.), credit/debit/prepaid cards, at mobile payment facilities tulad ng GCash, Maya at MyEG. Ang link ng BIR ePayment channels ay accessible sa BIR website na www.bir.gov.ph.

Ang taxpayers na magpa-file manually ng kanilang AITR at magbabayad ng buwis sa RCOs ng RDO ay maaaring magbayad naman ng cash ng hanggang P20,000 lamang o naka-tseke na payable sa “Bureau of Internal Revenue”.

- Latest