Metro Manila office rents seen declining further next year

MANILA, Philippines — Office rents in Metro Manila are projected to further decline in the coming year mainly due to an oversupply of vacant space, according to a global commercial real estate services firm.

In its latest Asia Pacific Outlook 2025 report, Cushman & Wakefield said average headline rents are forecast to decline by an additional 3.20 percent in 2025.

“Average headline rents are expected to decline further by 3.2 percent in 2024–2025, following a 2.8-percent decline in 2023–2024, due to an oversupply of vacant space,” Cushman & Wakefield said.

Latest figures from Cushman & Wakefield showed that average headline rent of prime and Grade A office developments in Metro Manila closed at P1,003 per square meter per month, 67 basis points lower than the P1,010 per sqm per month in the previous quarter. This is also lower than the P1,041 per sqm per month in the same period a year ago.

In the third quarter alone, the Metro Manila office market registered a vacancy rate of 18.2 percent, 136 basis points lower than the previous year’s levels, the highest level since the second quarter of 2004.

“Due to the volume of expected office space turnover in response to the total ban on Philippine offshore gaming operators (POGOs), annual net absorption drastically declined to 1,500 sqm in 2024 from approximately 271.250 sqm in 2023,” Cushman & Wakefield said.

From 2025 to 2029, Cushman & Wakefield said it projects the average annual net absorption level to increase by 36 percent compared to the average levels recorded between 2020 and 2024.

“Office space absorption is expected to increase in the medium-term as a flight-to-quality mentality drives demand for innovative office space designs that incorporate collaborative spaces, alongside sustainable facility and property management technologies and practices,” the real estate services firm said.

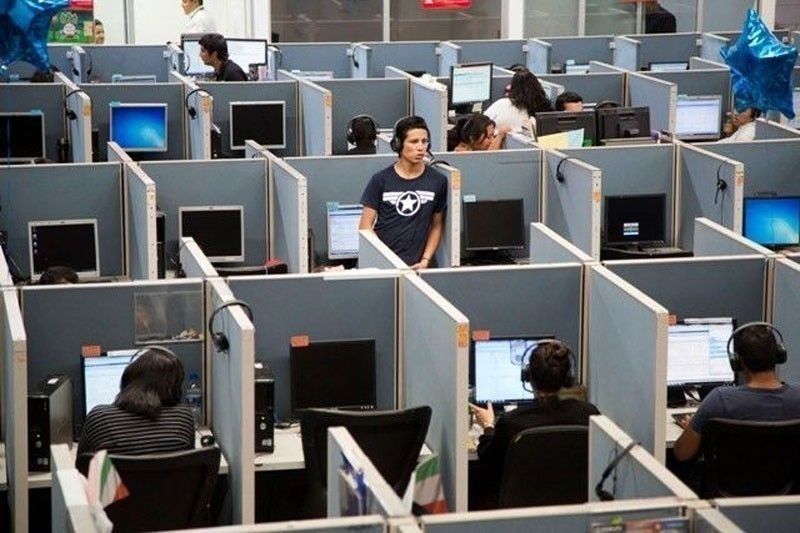

It added that new entrants and the expansion of real estate needs from the IT-BPM sector, including rising demand from global capacity centers (GCCs), will drive the growth in 2025.

However, vacancy rates are likely to remain elevated due to space rationalization and completion of new supply.

“The full implementation of the CREATE More Act will allow local IT-BPM companies, among other occupiers, to implement remote work setups, altering space demand growth in the short- to medium-term,” Cushman & Wakefield added.

Cushman & Wakefield earlier attributed an elevated vacancy projection for the medium term to the total ban on POGOs and the implementation of the CREATE MORE Act, which supports flexible work arrangements and will likely result in more vacant spaces.

Moreover, the real estate services firm said it projects the annual level of new supply to decrease in the next five years.

“An average of 138,000 sqm of new supply per annum is expected in the next five years, 23 percent lower than the projected five-year new supply in 2024 and 80 percent lower than the average in the five years before the pandemic,” Cushman & Wakefield said.

As the pipeline for office developments continues to clear, it emphasized that absorption is expected to stay in positive territory.

“As the new supply completions decline in the medium term, the risk of lease rollover is reduced, although at a slower rate than anticipated,” Cushman & Wakefield said.

It added that headline rents are projected to recover by 2026, growing at an average annual rate of 3.5 percent until 2029.

- Latest

- Trending