Arthaland offers second tranche of up to P3 billion ASEAN green bonds

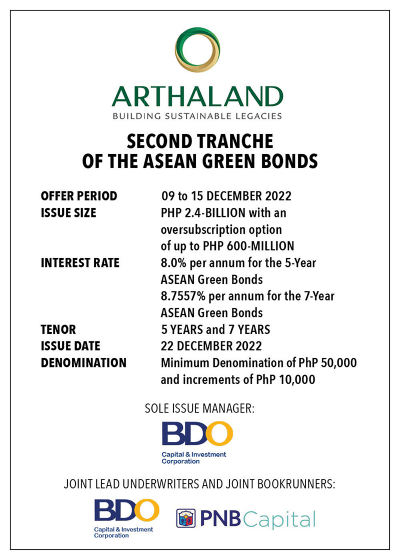

MANILA, Philippines — Arthaland, the foremost sustainable real estate developer in the Philippines, kicks off its public offering of up to P3 billion ASEAN Green Bonds which will be issued in two tenors: 5 years at 8.0% pa and 7 years at 8.7557% pa.

The ASEAN Green Bonds are scheduled to be issued and listed on the Philippine Dealing and Exchange on December 22.

The offer comprises the second tranche of Arthaland’s P6 billion ASEAN Green Bond Program for which Arthaland established the first Green Framework by a real estate company in the Philippines.

Refer to Offer Supplement at https://www.arthaland.com/investor-relations/green-bond

Arthaland’s commitment to sustainability

The offer aligns with the company’s unparalleled commitment to sustainability. Arthaland is the only developer which has a development portfolio composed entirely of sustainable projects certified under multiple global and national standards for green buildings.

It was the first real estate developer in Asia and the first signatory from the Philippines to the Net Zero Carbon Building Commitment of the World Green Building Council. As a signatory to this program, the company is officially committed to decarbonize its portfolio by 2030. By doing so, it placed itself and the Philippines at the forefront of the global initiative for climate action.

Arthaland’s flagship office project, the Arthaland Century Pacific Tower, was recognized as the first Net Zero Carbon Project in the world as certified under the EDGE Green Building Program of the IFC.

“Climate change is pervasive and does not discriminate. That is why everyone should join hands to help address it. Our ASEAN Green Bonds allow people to participate in climate solutions to help make the world greener.” said Arthaland Vice-Chairman and President Jaime C. González.

Key milestones

This year, Arthaland celebrated several milestones on its path towards dramatically growing its portfolio of high-quality, sustainable projects in key urban areas in Metro Manila, Cebu and Laguna.

Handover of two of Arthaland’s largest projects

Cebu Exchange and Savya Financial Center, two of Arthaland’s largest multi-certified sustainable projects, are operational in 2022. Both projects successfully initiated handover to its buyers in accordance with pre-pandemic handover schedules.

Launch of new residential projects

Una Apartments (Biñan, Laguna). On-track to be the first multi-certified sustainable mid-market development in the Philippines.

Arthaland launched two new residential projects within the second half of 2022:

Una Apartments is the first of six mid-rise residential towers in Sevina Park, an eight-hectare master-planned sustainable residential community in Binan, Laguna.

Eluria (Legazpi Village). Envisioned to be the most exclusive residential address in Makati, pushing the boundaries of sustainable living.

Eluria, Arthaland’s multi-certified luxury condominium project in Legazpi Village, Makati, offers spacious limited-edition designer homes differentiated by its unsurpassed quality, attention to detail and exceptional white glove services.

The launch of these new residential projects adds to the ongoing residential projects including the Sevina Park Villas, a low-density community within the Sevina Park estate and Lucima, the first premiere, sustainable condominium project in Cebu Business Park, Cebu. Given these, Arthaland has visibility in achieving approximately five-fold growth in its development portfolio in the next few years.

Lucima (Cebu City). Poised to be the country’s first quadruple-certified sustainable high-rise residential development in Southern Philippines.

Use of proceeds for the offer

Arthaland’s ASEAN Green Bond offering comes at a time when Arthaland is preparing for the next stage in its story. A substantial portion of the proceeds from the offer will fund the necessary investment of Arthaland in new certified sustainable residential projects which will allow Arthaland the flexibility to develop and launch within the next 10 years or more.

The intended use of proceeds for the offer complies with Arthaland’s Green Framework which provides the basis for the issuance of green bonds and loans and which enables the company to use the proceeds to finance a portfolio of eligible projects relating to green buildings.

PhilRatings assigned an issue credit rating of PRS Aa with a Stable Outlook for this offer. Obligations rated PRS Aa are of high quality and are subject to very low credit risk. The issuer’s capacity to meet its financial commitment to the obligation is very strong. A Stable Outlook is assigned when a rating is likely to be maintained or to remain unchanged in the next 12 months.

“With the built sector generating close to 40% of annual global CO2 emissions, our commitment to sustainability stems from the desire to provide a better tomorrow for future generations. There is more work to be done and we hope that, with the support from regulators and the financial sector, more institutions will be motivated to issue green financial instruments.” González concluded.

- Latest