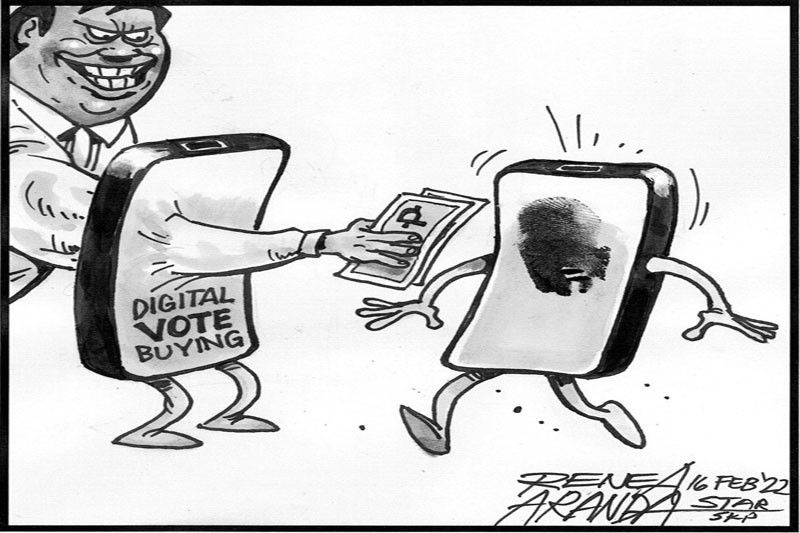

EDITORIAL - Digital vote buying, laundering

Digital technology has facilitated many aspects of life, unfortunately including illegal activities. In this election season, digital technology is being used for unfair campaigning including spreading fake news, revising history, trolling rivals and sowing scurrilous disinformation.

It may also be used for money laundering and vote-buying during the election period, the Anti-Money Laundering Council has warned. In an advisory, the AMLC reminded banks and financial institutions to conduct customer due diligence measures and file reports on suspicious transactions, as stipulated in the Anti-Money Laundering Act of 2001.

Also covered by the AMLC advisory are foreign exchange dealers, money changers, remittance companies, pawnshops, jewelry dealers, casinos, offshore gaming operators, and real estate brokers and developers.

The task isn’t as daunting as it seems. The covered institutions and transactions can watch out for red flags such as large transactions within a short period of time, and those that seem inconsistent with a customer’s financial profile or business. Also suspicious are “unjustified” large cash deposits and withdrawals, transactions that are unusual when compared with everyday dealings, and structured cash deposits and money transfers.

The use of multiple accounts by a single person as well as the use of several money service businesses to send funds are also red flags. On Dec. 31 last year, the Bangko Sentral ng Pilipinas had issued a similar warning about vote buying through online banking and mobile wallet applications.The absence of a law regulating campaign finance has made election spending an ideal way of laundering dirty money. In certain cases, those directly engaged in jueteng, smuggling and drug trafficking have used their illegal earnings to propel themselves to elective office. Others have seen their personal wealth rise through hefty contributions from supporters who often become influence peddlers if the candidates win. Such assets are not declared and are beyond the reach of the tax police.While the Commission on Elections has been largely toothless in enforcing caps on campaign spending, banks and financial institutions can do their part in curbing illegal campaign activities and money laundering.

This would also help the country get out of the money laundering gray list of the Financial Action Task Force. Inclusion in the gray list makes financial transactions in the country more difficult, affecting business dealings and the remittance of overseas Filipino workers’ earnings.

Banks that exert effort to reinforce the electoral process and promote good governance will reap the returns in the form of a grateful public’s trust – a critical element in banking strength.

- Latest

- Trending