Trump wants mighty dollar to continue

US President-elect Donald Trump escalated tensions with BRICS nations. He threatened to impose 100 percent tariffs if the bloc, consisting of Brazil, Russia, India, China and South Africa, pursues alternatives to the US dollar.

“The idea that the BRICS Countries are trying to move away from the dollar while we stand by and watch is OVER,” Trump wrote on his social media platform Truth Social.

“We require a commitment from these countries that they will neither create a new BRICS currency, nor back any other currency to replace the mighty US dollar or, they will face 100 percent tariffs and should expect to say goodbye to selling into the wonderful US Economy,” he added.

US dollar as a weapon

Trump’s threats come amid growing international efforts to reduce reliance on the US dollar. The push gained momentum in 2022 after the US-led sanctions on Russia following its invasion of Ukraine exposed the vulnerabilities of dollar-reliant economies. Russian President Vladimir Putin has been particularly vocal, describing the dollar as “being used as a weapon” after the US and its allies froze $300 billion of its assets.

BRICS: A growing economic alliance

At the forefront of these de-dollarization efforts is the BRICS, one of the world’s largest and influential economic blocs. What began as Goldman Sachs acronym has evolved into a powerful alliance led by China and India – the world’s second and fifth largest economies. The group expanded in January 2024 to include Egypt, Ethiopia, Iran and UAE. The bloc’s influence grew further at the October 2024 Kazan summit in Russia, where it approved 13 new countries as partner states. These include Algeria, Belarus, Bolivia, Cuba, Indonesia, Kazakhstan, Malaysia, Nigeria, Thailand, Turkey, Uganda, Uzbekistan and Vietnam.

De-dollarization initiatives

At the 2024 October Kazan summit, the BRICS announced several strategic initiatives to reduce dollar dependence. These include developing a common payment infrastructure to bypass the US-led SWIFT system and expanding trade in local currencies. They also plan to establish a BRICS grain exchange to challenge the dollar’s dominance in commodity trading. These measures aim to shield member economies from dollar-related vulnerabilities and Western sanctions.

Implementation hurdles

Despite the ambitious plans, the bloc faces many obstacles in its de-dollarization efforts. The US dollar is a deeply entrenched position in global finance which is a fundamental challenge. Economic disparities among member states and lack of consensus on implementation strategies have slowed progress. Technical complexities in establishing new payment systems and the limited international trust in proposed alternatives pose additional hurdles.

Economic stakes

The US maintains significant trading relationships with the original five BRICS nations. In 2023, US imports from these countries totaled $578 billion, with China accounting for $427 billion – a substantial $109.1-billion drop from a year earlier. Evidence suggests this decline reflects trade realignment with Mexico and Vietnam emerging as prime beneficiaries. US exports to the bloc reached $242 billion in 2023, including $148 billion to China alone.

Challenges to tariff implementation

BRICS’ recent expansion to include major Middle Eastern and African economies has further amplified its economic clout. It brings strategic resources and key markets to the group. Moreover, the Kazan’s summit’s attendance of 13 partner states – including leading emerging economies like Indonesia, Turkey and Nigeria – signals possible future membership expansion. This growing coalition could significantly complicate any US efforts to impose widespread tariffs on BRICS nations.

Ironically, Trump’s aggressive tariff threats may accelerate rather than prevent de-dollarization, as nations seek to reduce vulnerability to US economic pressure.

BRICS currencies extend losses

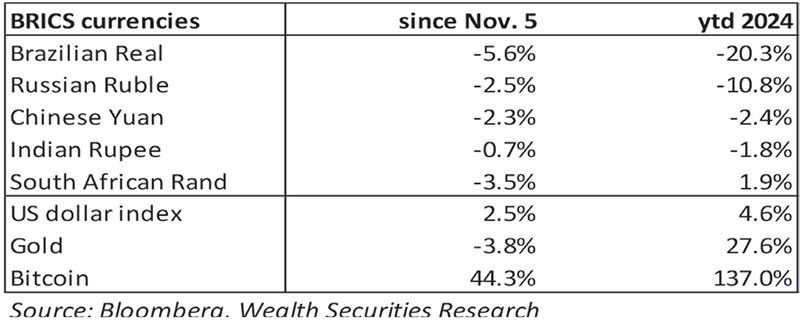

Already under pressure throughout 2024, BRICS currencies now face additional volatility following Trump’s threats. Year-to-date, the Brazilian real has plummeted 20.3 percent against the dollar and the Russian ruble has fallen by 10.8 percent. The Chinese yuan has weakened by 2.4 percent, while India’s rupee hit historic lows. Trump’s election victory last Nov. 5 has accelerated these losses, with the real dropping by 5.6 percent, the ruble falling by 2.5 percent and the yuan declining by 2.3 percent since the vote.

A challenging year for EM investors

The combination of currency weakness and geopolitical tensions has made 2024 a challenging year for emerging market investors. While BRICS and other emerging market assets struggled, the US stock markets surged to new all-time highs, with the Nasdaq up by 32.3 percent, S&P 500 gaining 27.7 percent and the Dow rising by 18.4 percent year-to-date. Against a rampaging Trump, investors found refuge in safe havens and Trump trades like the US dollar, US Treasuries and US stocks. Meanwhile, alternative assets have seen extraordinary gains. Gold is up by 27.6 percent this year, while Bitcoin crossed $100,000 last week to reach a 137-percent year-to-date return.

These market movements not only show growing investor preference for US assets but may signal an emerging theme for 2025 under Trump’s Make America Great Again policies.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending