Tracking car prices under TRAIN Law

Automobile prices recently changed because of the Tax Reform for Acceleration and Inclusion (TRAIN) Law which took effect in January this year. Most consumers wonder: did TRAIN Law cause automobile prices to go up? The short answer is, not exactly.

Among the declared policies of the TRAIN Law is to “enhance the progressivity of the tax system” and to provide “an equitable relief to a great number of tax payers and their families… to improve levels of disposable income and increase economic activity”.

Under a “progressive” tax system, the tax increases as the tax-base increases. This type of system imposes a higher burden on people who have the ability or the means to pay higher taxes (such as the wealthy or high-income earning individuals). The “inclusion” or “inclusive” part of the TRAIN Law aims to ensure that poor and middle class Filipinos can enjoy the benefits of economic growth.

A tax law that aims to be “inclusive” and “progressive” would then be expected to reduce prices for vehicles that cater to low or middle income consumers, and increase prices for luxury vehicles. However, there is a perception that the TRAIN Law increases the prices for low-end or average vehicles and reduces prices for high-end or luxury vehicles.

The TRAIN Law (and its corresponding Bureau of Internal Revenue Regulations No. 5-2018) imposes on automobiles an Ad Valorem Tax ranging from four to 50 percent based on the manufacturer’s/assembler’s or importer’s selling price, net of Excise and Value-Added Tax at rates.

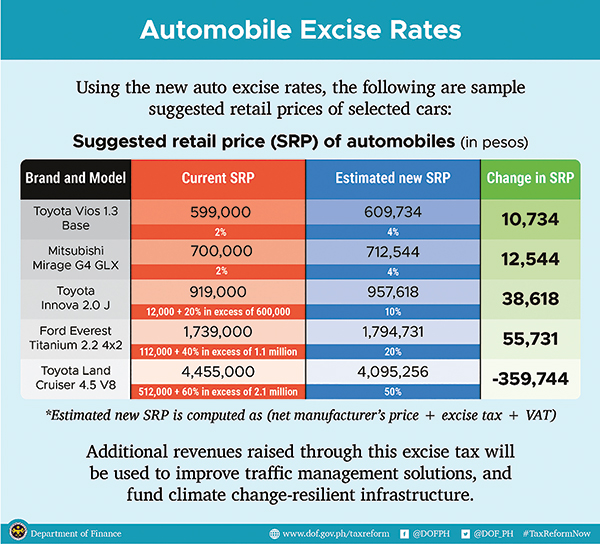

To illustrate, Table 1 shows the effect of the new excise tax rates on suggested retail prices of sample vehicles:

Table 1: Effect of TRAIN Law on sample vehicles

Table 1 shows that the prices of cheaper vehicles (like the Toyota Vios and Mitsubishi Mirage) became more expensive when the new rates under the TRAIN Law are applied. More expensive vehicles, such as the Toyota Land Cruiser, became cheaper under the TRAIN Law. This seems to run counter to the goal of making automobiles more affordable for the average Filipino.

Nonetheless, to say that the TRAIN Law makes average/low-end cars more expensive and high-end cars cheaper, is an over-simplification and inaccuracy. This conclusion is contrary to the illustration in Table 1 when the TRAIN Law rates are applied to the Toyota Innova and the Ford Everest Titanium. The price of both cars increased under the TRAIN Law, and the more expensive car (the Ford Everest) has a higher rate of increase in Suggested Retail Price.

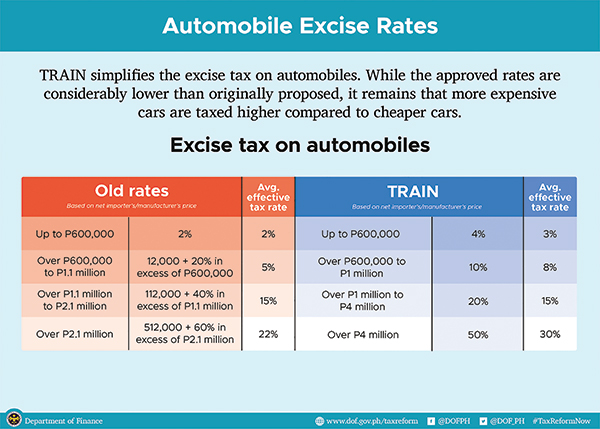

The difference in effect on automobile prices stems from the difference in the manner in which taxes are imposed under the old system versus the TRAIN Law system. The old system applies a fixed tax rate based on certain amounts (2% for vehicles costing up to P600,000) and then combines a fixed tax rate with a fixed monetary value which vary based on the value of the car. In contrast, the TRAIN Law applies a fixed tax rate which increases as the value of the car increases.

Table 2 shows the difference in rates under the old law and the TRAIN Law.

Table 2: Tax rates under old system vs. Train Law

Under both systems, the tax rates (and the fixed monetary amounts under the old system) increase as the value of the automobiles increase. In other words, both systems are “progressive”. Tax rates are meant to be higher for individuals who can afford more expensive vehicles. This is evident from the TRAIN Law tax rates (4%, 10%) which go as high as 50% for vehicles priced over P4 million. Looking at the net effect on SRPs alone may give the impression that the TRAIN Law is “anti-Progressive” or “Pro-Rich” because it decreases the Suggested Retail Price (SRP) for SOME expensive vehicles (such as the Toyota Landcruiser example in Table 1). Note that under the old system, the Landcruiser will be taxed based on a fixed amount of P512,000 plus a 60 percent tax rate for its SRP over P2.1 million. Under the TRAIN system, the tax will be a fixed 50 percent rate based on the net importer’s/manufacturer’s price. The old system’s mixed approach (fixed monetary amount plus tax rate) versus the TRAIN Law’s unitary approach (fixed tax rate) makes comparison based on SRPs tricky and challenging. The comparison is not “apples to apples”, so to speak.

A more objective comparison can be made using the “Average Effective Tax Rate” (i.e., the percentage of the tax base that is effectively paid in taxes). A look at the Average Effective Tax Rate column in Table 2 shows that the tax rates increase progressively with the increase in net importers/manufacturers price under BOTH the old system and the TRAIN Law system. In contrast to the old system, the Average Effective Tax Rate is higher under the TRAIN Law for vehicles falling under the most expensive bracket.

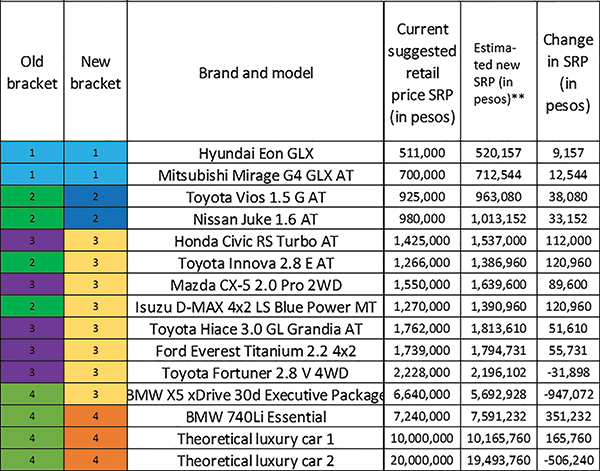

Table 3 shows the effect of the TRAIN Law on SRPs and tax brackets for various car models.

Table 3: Estimated price changes for various car models

Notably, some cars (such as the Toyota Innova and Isuzu D-Max) moved-up to a higher tax bracket which made their corresponding SRPs increase. On the other hand, some luxury vehicles (like the BMW X5) moved-down to a lower tax bracket which resulted to a decrease in SRP.

While it may be difficult to grasp or track the changes in car prices under the TRAIN Law, the bottom line is—change has occurred. While the immediate change is only on car prices, the long-term change is aimed at more ambitious, noteworthy goals. It would be too simplistic or short-sighted to demand from TRAIN that vehicles become more affordable for the average Filipino. That is not the goal of a tax/revenue measure like the TRAIN Law. The value of the TRAIN Law comes from a desire to raise funds for government programs (as declared in TRAIN’s Section 2): “the provision of better infrastructure, health, education, jobs, and social protection for the people.”

- Latest