The knowledge-behavior gap

Once we learn about a vital information, we get excited. Sometimes we even feel privileged and inspired to do something about that information. One important advantage we humans have over all the other natural creatures in the world is our ability to gather, record and make use of information. Books and recording of history are great human inventions. Through them, we can learn something even without going through the actual experience. We can avoid mistakes by learning from others.

Through recorded history and studies, we know what causes most diseases. We know what it takes to be healthy: Eat well, exercise regularly, sleep well. But do we? In the realm of personal finance, we know that we have to save and invest for retirement as soon as we earn our first pay. But do we?

Indeed, there is a huge gap between knowing and doing. This knowledge-behavior Gap is what we should mind. The reminder, “Please mind the gap” is what we hear when we are at train stations because missing this gap is very dangerous that it can bring us into a terrible accident. It is the same thing when it comes to our personal finances. If we don’t mind the gap between our knowledge and actual behavior, we may end up in a disastrous financial condition.

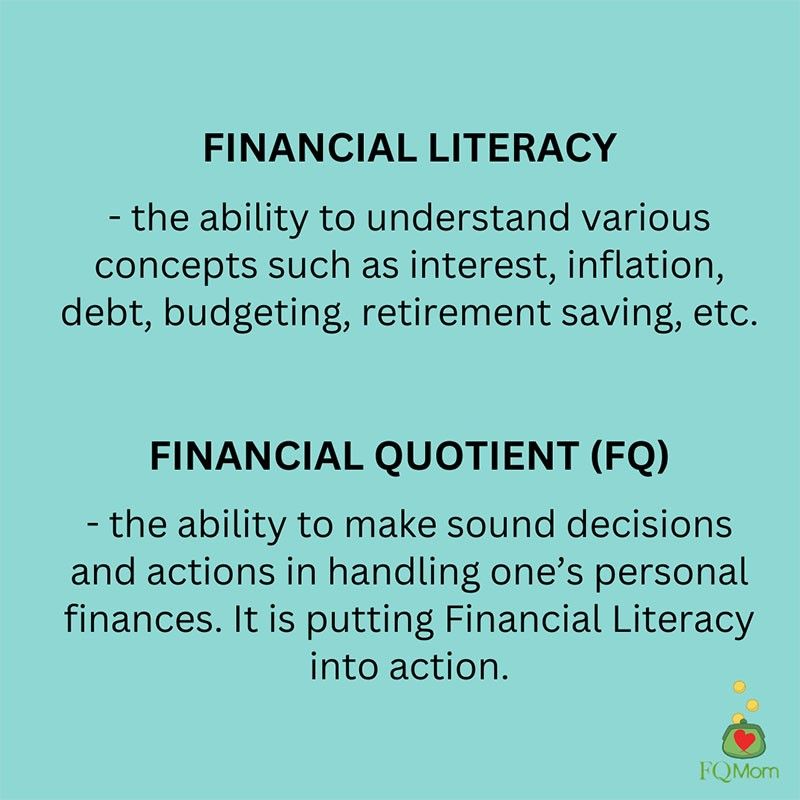

Financial literacy versus financial intelligence quotient (FQ)

Financial literacy is the ability to understand various financial concepts such as interest, inflation, debt, budgeting, retirement saving, etc. Most financial literacy tests examine the ability to grasp these concepts.

Financial intelligence quotient or financial quotient (FQ) is the ability to make sound decisions and actions with regard to one’s personal finances. It is putting financial literacy into action. The financial knowledge has to translate into the right money behavior. That is why FQ is the IQ and EQ of handling money. To know your FQ score, click FQ test, you may take it in English or Tagalog.

It is not enough to ace your financial literacy course, you have to apply what you know.

Cause and effect

We have an easier time doing the right thing if the cause and effect relationship is felt in a timely manner.

Imagine yourself in your kitchen. You accidentally put your hand on your hot stove. What do you do? You take out your hand right away. The pain that you feel gives you quick feedback that your hand is in danger of getting burned. Imagine if there’s no painful sensation upon touching the hot stove. It’s possible that you would only notice the damage when it’s too late like you already smell the odor of burned skin or see the smoke coming from your hand!

The immediate feedback allows us to react appropriately and quickly. Unfortunately, for most of our important life decisions, there is no immediate feedback.

You eat a lot today. Your dress size will still be the same tomorrow. Nobody gets fat overnight! But do it again and again and again, day after day, month after month, year after year… and before you know it, you won’t see your toes while standing up anymore.

You use up all your first pay and miss saving and investing for retirement. You will still live in the same house, eat the same meals, feel the same way tomorrow. Under normal circumstances, nobody gets poor overnight. You do the same thing next month and next, month after month, year after year after year… and before you know it, it’s just a few years before your retirement and there’s still nothing in your nest egg.

Come to think of it, for the high stakes’ decisions in life – good health, decent retirement, happy marriage, well-raised children, successful career, great relationships – we do not receive the full and immediate feedback on the action we take today. It is the accumulation of the many actions we take and inactions we allow to happen in our life that will determine the final outcome. Because there is a big gap between the time of the first action/inaction and the time we see the end game/result, we find it hard to do the right thing. And this is even if we already possess the knowledge of what it takes to be healthy, financially happy, have a good career, have a good marriage and other relationships, and so on.

The space between the action taken (or not taken) today and its long-term effect is another gap we have to mind. If we don’t, we will always allow our Emotional Emong to prevail over our Makatwirang Mak to choose the smaller but sooner reward over the larger but later reward, as discussed in FQ Book 2 of the FQ Trilogy Why Financial Education Alone Does Not Work back to back with The Psychology of Money.

In the first few weeks of the year, what actions have you taken (or not taken) that sacrificed your long-term goals and well-being to give way to your short-term pleasure? How do you intend to bridge the gap between your knowledge of what is good for you and what you actually do?

ANNOUNCEMENTS

1. Join the first all-female national art competition in the Philippines.

2. If you want to know where you are in your FQ journey. Click here.

3. If you want to know your FQ, buy our books. Click here.