How to avoid scams

I received requests from my readers to discuss how they can protect themselves from scams.

The best protection is understanding the anatomy of a scam. What makes up a scam? For scams to succeed, you need certain elements to be present. So, watch out for these red flags.

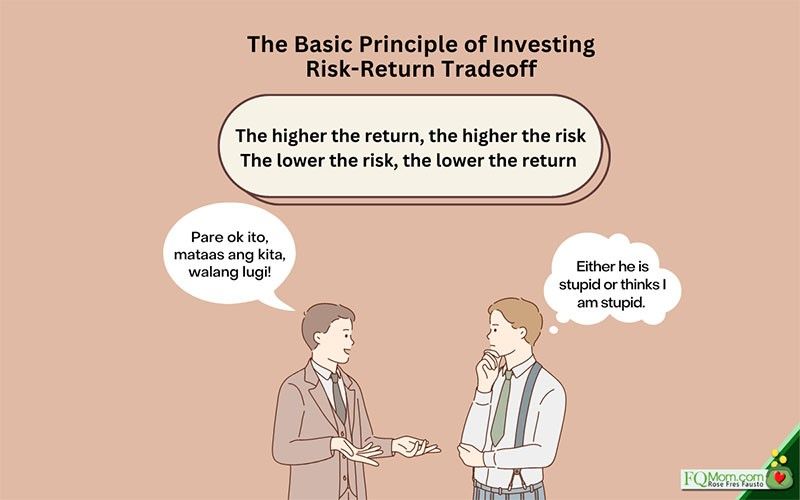

1. The promise of a high return over a short period of time with no risk. There is no such thing as risk-free investment. The one who is selling you a risk-free investment is either stupid or thinks you are. A basic principle in investing known as the risk-return tradeoff states “The higher the return, the higher the risk; the lower the risk, the lower the return,” and yet a lot of people still fall for the risk-free assured high return sales pitch.

You must have heard of the Luis Manzano/FlexFuel investment scam where investors were lured to the sales pitch of a pandemic-proof lifetime investment. When considering an investment, always ask what, how, where, and why. Demand for an explanation, “How on earth can this instrument be exempt from the basic risk-return tradeoff investment principle?”

2. There’s a lot of hyping and considerable pressure. If you attend the recruitment seminars of pyramid schemes under the guise of selling “superior products” which are not available in the traditional stores, you see the main speaker very upbeat in delivering his talk as if he discovered the secret to living forever and is just so excited and generous to share it with you. There are a few participants who are actually planted in order to increase the pump and they are the ones who pretend to sign up with lots of fanfare. There is pressure to sign up, “Sign up now or you lose this rare chance of a lifetime!” All these excite their Emotional Emong side to join in instead of going home to summon their Makatwirang Mak in order to make the rational decision.

3. The promise of change. Recruiters would say, “Do you want to stay in your dire situation? These are my last three checks, this is my car, my house… Are you going to let this opportunity of a lifetime pass you by or do you want a better life now? I’m not saying that someone who promises change is an automatic scammer, just beware of the change he/she is promising. If it’s too good to be true, it is not true!

4. Desperate customers. Sometimes we find ourselves in situations that make us want to change something desperately – be it a financial situation, state of our love life, our country’s situation, etc. Incidentally, a combination of desperation and desire for immediate change is what sells to the Emotional Emong voters who continue to elect corrupt and inept leaders, forgetting that real structural change, especially in a country deep in corruption, takes time; in fact, it takes generations. For your love life, it can make you hook up with an unworthy person because last Valentine made you feel so sad. For your dire financial situation, you may be lured to get into dubious investments.

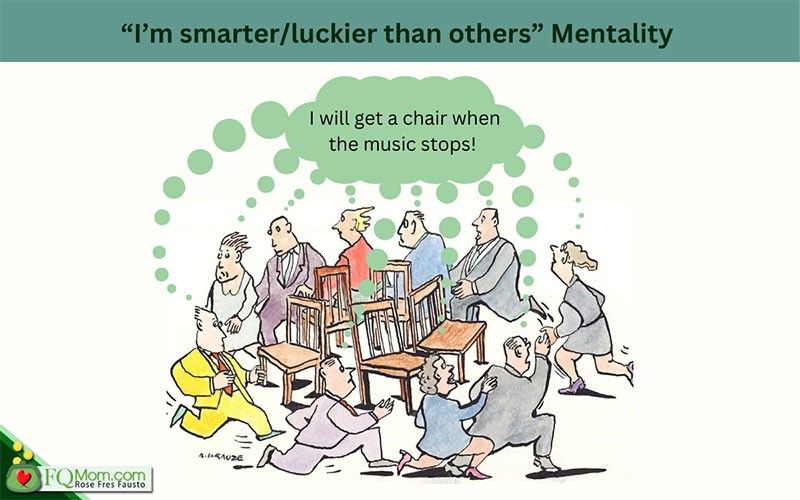

5. “I’m smarter than others” mentality. This is very much present in stock trading, especially the active kind. It’s a zero sum game in stock trading and you would have to believe that you (even if you don’t have the necessary trading skills) could always beat the market! The same goes for pyramid or Ponzi schemes. Believe it or not, some scam victims already smell something fishy, but just go on with the ride hoping that they would be able to get out “before the music stops.” They think of themselves as smarter than others. Unfortunately, nobody knows when the music will actually stop. In some cases, even the perpetrators don’t exactly know when.

6. Once in, victims are under a spell. Just like the previous number, they already smell something fishy but still refuse to do something about it. As if hypnotized, they still turn a blind eye on what’s obviously wrong and just hold on to the promise of the scammer that everything will be okay. Heck, they don’t even ask for proper documents. Going back to the FlexFuel scam, a PhilStar article in 2021 already states, “The SEC issued a certification to the effect that some companies engaged in the sale of petroleum products are not authorized to sell securities to the public because they have not been issued registration/permit to sell securities. These include PetroMobil, FlexFuel, Jeafer Fuel, Maximum Fuel, Power Fill, Nirvana Fuel Corp., Marz Fuel, Ofir Petroleum, Astral Fuel, and iFuel.” (Too Good To Be True to see article.)

I watched the series on Bernie Madoff (mastermind of the largest Ponzi scheme in history worth $64.8 billion) and Elizabeth Holmes (founder of a highly celebrated biotech fraud, Theranos). Note that like most fraudsters, they had charisma and hypnotized the world receiving accolades and key and respected positions. Madoff was the chairman of the NASDAQ stock exchange and had strong ties with the SEC. Holmes was praised (the youngest self-made female billionaire) and featured on the cover of respected publications such as Fortune, Forbes, New York Times, etc. She even sat on the board of the Harvard Medical School. So, beware!

7. Victims cry out for help when it’s too late. Time and again, we see the victims come out only when the perpetrator has fled with all their money. In the end, they realize that they weren’t smarter than others as discussed in no. 5.

If you take a look at the above elements of a scam, you see that both the scam perpetrator and the victim seem to almost have a 50-50 share in responsibility why the fiasco happened. As we say in our language, “Walang manloloko kung walang magpapaloko!”

***************************

ANNOUNCEMENTS

1. Another safeguard against scams to have a high FQ! Someone with a high FQ ay hindi nagpapaloko sa mga scams. Take the FQ test to know where you stand in your high FQ journey. You will not only avoid scams but also set yourself to have a financially happy life.

This article is also published in FQMom.com.