Loss aversion explained with the help of Mak and Emong

In FQ Book 2 "Why Financial Education Alone Does Not Work" (back-to-back with 'The Psychology of Money'), I discuss 16 behavioral biases that affect the way we deal with money.

Loss aversion is the first one I discuss because it is fundamental in the development of Behavioral Economics, as demonstrated in a landmark study by Daniel Kahneman and Amos Trevsky in March 1979. If you want to unleash the geek in you, go ahead and check out "Prospect Theory: An Analysis of Decision Under Risk". Kahneman won the Nobel prize in 2002 for this study; unfortunately, his co-author, Trevsky, had already died six years prior.

Let Mak and Emong show you

To avoid nose bleed, let’s allow Makatwirang Mak and Emotional Emong to show us how this Behavioral Economics principle works.

Mak and Emong are ready to invest in the stock market. They pick Blue Chip Company A, a conglomerate that has been in existence for over a hundred years that remains financially sound. They both purchase 100 shares at P100 per share, for a total investment cost of P10,000 each.

After one month, Blue-chip Company A stock price goes up to P110, earning them 10% return. However, two weeks later, it went down by P10 per share, bringing them to their original purchase price.

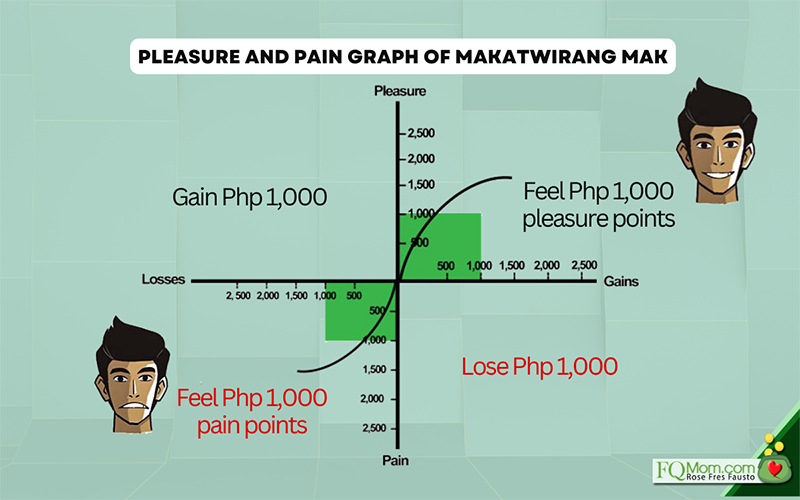

To understand the principle of loss aversion, let us look at the Pleasure and Pain Graphs of Mak and Emong.

Above is Mak’s Pleasure and Pain Graph. When the stock price went up by P10.00 per share, Mak earned P1,000 and felt 1,000 pleasure points. He tells his family and friends how he is making 10% return on his stock investment. He feels like he gained 1,000 pogi points!

When his investment went down by P10.00 per share, he lost P1,000 and felt 1,000 ouch points as shown in the graph. He feels he is back to his original pogi rating.

Rational as he is, Makatwirang Mak felt the impact of the gain in the same way that he felt the impact of the loss, no more, no less.

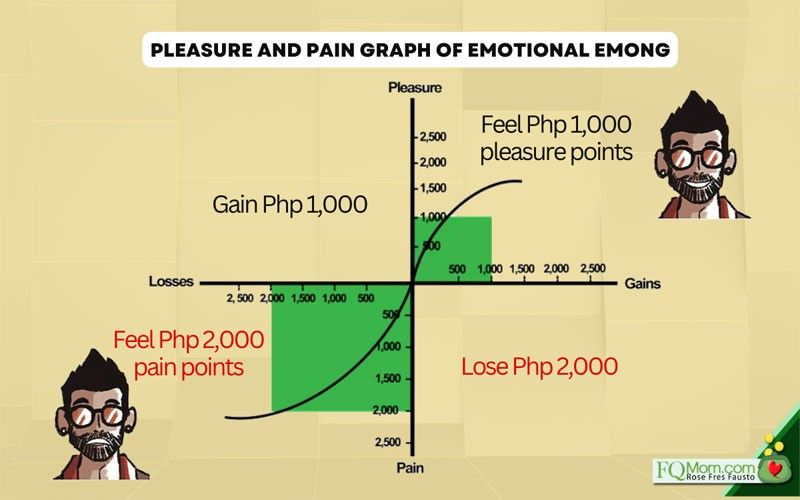

Let’s look at how Emong felt with the same price movements of his investment.

Above is Emong’s pleasure and pain graph. When the stock price went up by P10.00 per share, Emong earned P1,000 and felt 1,000 pleasure points. He tells his family and friends how happy he is making 10% return on his stock investment. He feels like he gained 1,000 pogi points!

When the stock price went down by P10.00 per share, he lost P1,000.00 on his investment, and can you guess how many pain points he felt? Not 1,000 but at least 2,000 pain points! It’s as if he lost P2,000.00. He didn’t feel being back to his original pogi rating, but down by at least 2,000 pangit points! Ugh! He felt so awful saying, “I should have sold when it was P110.00 per share!”

The principle of loss aversion states that losses loom larger than gains. We feel the impact of a loss at least twice as much as that of a gain.

So my dear reader, do you see what’s happening here? I hope you can honestly figure out your own rating on this behavioral bias. When it comes to Loss Aversion, how much of you is Makatwirang Mak and how much is Emotional Emong? Go ahead, rate yourself. This is a good beginning for you to honestly size up yourself, then you can come up with a design that will allow you to overcome excessive loss aversion for a healthy and peaceful investing.

To know more about this, you may check out the other examples in FQ Book 2.

******************************

ANNOUNCEMENTS

1. How good are you with money? Do you want to know your FQ score? Take the FQ test and get hold of your finances now. There are 3 ways to take the test, scan the QR code, FQMom Channel or click here.

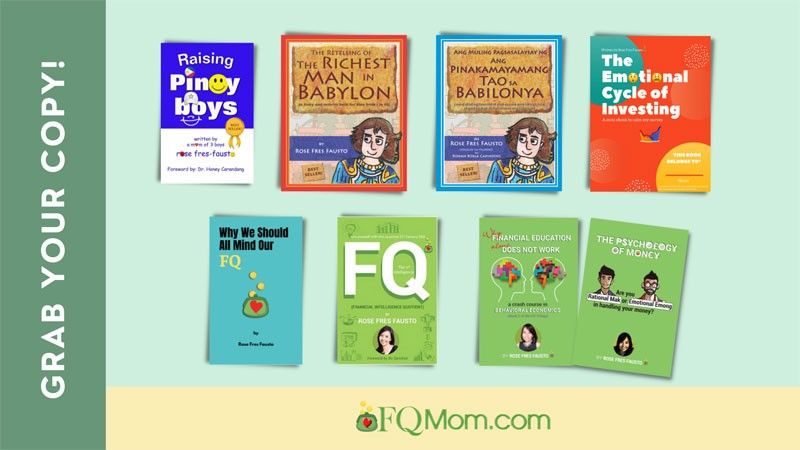

2. After the test, make them understand the basic laws of money, understand their relationship with money, including their own money biases, so they can improve their FQ, their money knowledge and behavior. Give them the gift of any or all of the FQ Books. Click here.

This article is also published in FQMom.com