Financial checklist before getting married (applicable also to those already married)

Checklists are our hacks to make sure we cover all important items in performing tasks, whether they’re small regular ones or big projects.

Marriage is one huge life project. The late taipan John Gokongwei Jr. was quoted as saying, “The most important decision you’re going to make in your life is whom you will marry.” And to make your marriage really work, one of the important aspects but not always discussed is your shared money values with your spouse.

Today’s article talks about ten items that should be in your financial checklist before you say “I do.” These items are still applicable to already married couples, in case you didn’t discuss this well enough because you were caught up the in the thousand and one items in your wedding checklist.

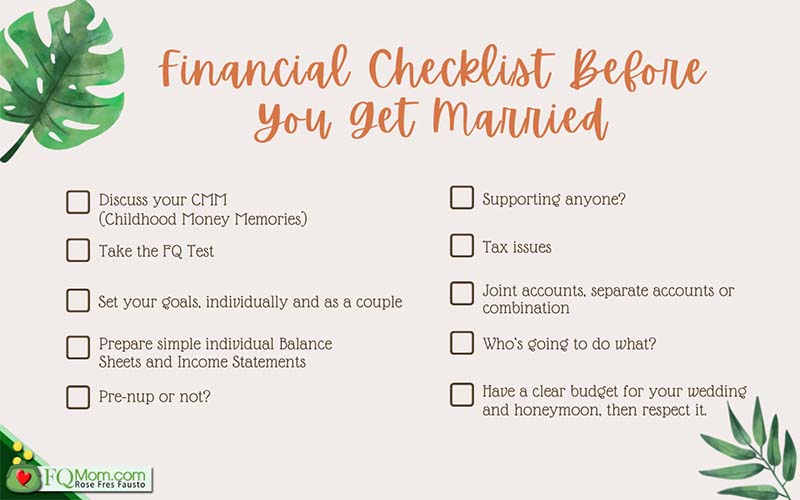

1. Discuss your CMM (Childhood Money Memories). Why? Because our money triggers are usually deep-seated in our childhood experiences about money. When you understand each other’s CMM and the effect these had in your current relationship with money, your differences in money values and behavior can be addressed more healthily, avoiding contempt in the future when money challenges arise. (Examples: 1. One who is so irritated by the spouse’s rich relative; it turns out he grew up with cruel rich relatives. 2. One does not want to talk about money; it’s because she grew up seeing his parents fight about money.)

In FQ Book 1, there is an exercise on CMM with guide questions that will help you go back to your childhood and allow you to unearth some experiences that have become your money triggers right now. This is the first step to having a healthy relationship with money.

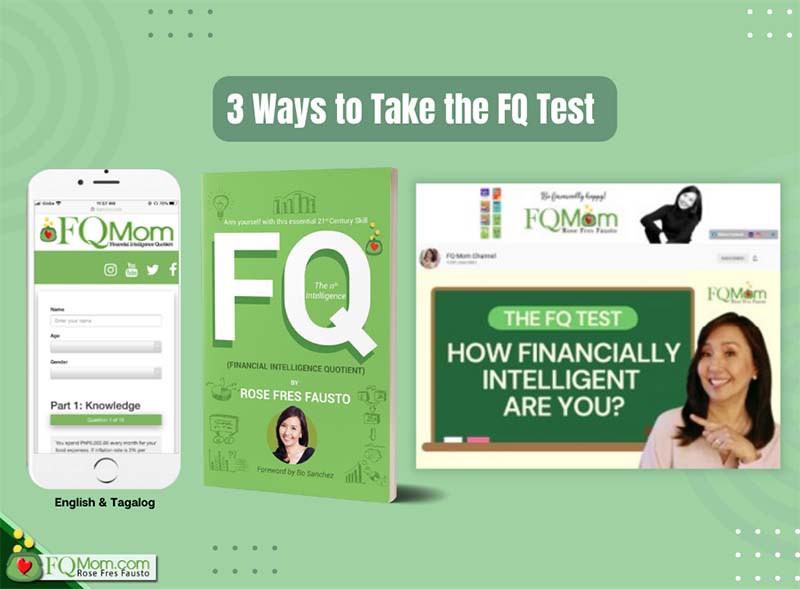

2. Take the FQ test. It is very important to know where each partner is at when it comes to knowledge and behavior about money. There are three ways to take the FQ test now: a) online test and the good news is it now comes in English and Tagalog; b. old school style printed test by using FQ Book 1; c) video.

3. Set your goals, individually and as a couple. The goal-setting activity will serve you well when you go into the details of your money management as a couple. It is because money is your important tool in achieving your goals and dreams. Share your individual goals then try to come up with one that will be the start of your Family Goal Setting. When do you plan to have kids? Buy a house? Travel? What kind of lifestyle? I have created various contents about this: 1, 2, 3. If you want to have a copy of the FQ Mom Goal Setting Template, you can send email to FQTeam@FQMom.com with subject: Goal Setting Template, and we would be happy to send you the excel file. Feel free to tweak it to suit your own tastes and needs.

4. Prepare simple individual Balance Sheets and Income Statements. After you set your goals, prepare this important financial statement that will show your starting point. It is impossible to reach your goals if your starting point is not clear. Make this a fun activity that is sensitive to your own issues about money. It is so much better to know the debts, resources, income sources, expenses of each other now than be surprised later on after signing the marriage contract that legally binds you to each other.

5. Pre-nup or not? This is still a taboo topic for most Filipino families to talk about. It is probably the most unromantic thing to talk about when one is getting married. But hey, a great marriage cannot survive only on romance. It has to take in everything - both the lovable and unlovable parts, the beautiful and the ugly aspects of life. After seeing each other’s assets and liabilities in your respective Balance Sheets, you are now better equipped to decide whether your marriage will be more successful under the standard provisions for property ownership in our constitution – i.e. Absolute Community of Property, or execute your own terms and conditions under a Pre-Nuptial Agreement. But this is best made as a mindful decision of the couple instead of just something imposed by other parties.

6. Supporting anyone? This can be the unwritten part of the Balance Sheet and Income Statement. Is anyone supporting anyone? Your parents? Siblings? A cause? It is best to discuss this and decide what changes, if any, will happen once you say “I do.” Remember, for you to function well as a single unit of society (yes, that’s the definition of family in our constitution), you will have to be clear on financial commitments because you will now be having your own set of financial needs as a family.

7. Tax issues. You may also include figuring out if you are better off filing your income taxes separately or together as a couple. This is a very timely topic right now because it is tax season.

8. Joint accounts, separate accounts or combination. Figure out how you want to handle cashflows moving forward as a family. Would you like to have separate accounts? Joint accounts? Or combination? A combination might be the best option. No matter what your choice will be, it is still better to know about the existence of all the accounts, even if you don’t handle them. This ensures that if one goes away, the surviving spouse is not left clueless of the accounts left behind.

9. Who’s going to do what? Decide who will take care of monthly budgeting, saving, investing, and other matters related to money. Assign it according to the partners’ expertise and fondness. Since money may bring stressful events once you’re married, it is best to assign the different functions of money management to the suitable partners. But this is best shared and never allow just one person to know everything while the other person is totally clueless. Again, this is prone to a disastrous outcome not just in the event of death of the partner solely in charge of the money, but also in the day-to-day handling of family money. Isn’t it so much easier to achieve your financial goals if both of you know where you are?

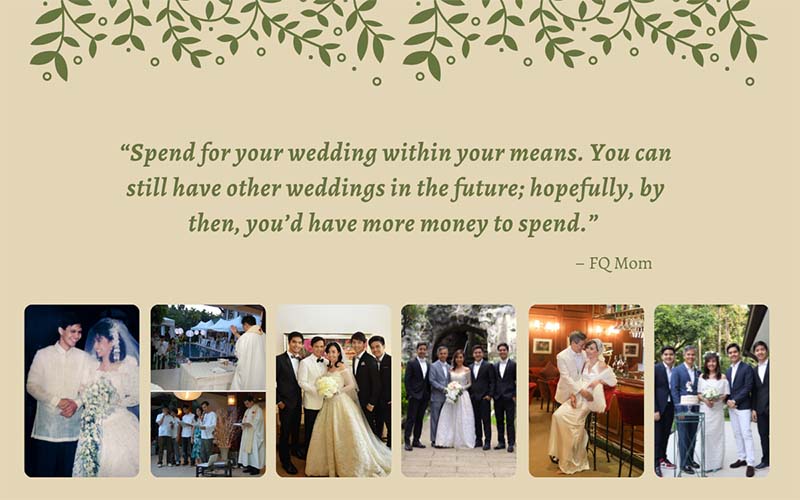

9. Have a clear budget for your wedding and honeymoon, then respect it. Comparing our first wedding in 1989 and our silver wedding in 2014, I saw that so many things to spend for have been invented that can really put big financial pressure for the couple. No wonder, many are delaying their weddings these days. I know all these wedding gimmicks labeled as “must haves” are so exciting to have, but always remember that this is just one day, no matter how important it is. Don’t go overboard and regret it after. Here’s a tip I give young couples planning their wedding, “Spend for your wedding within your means; hopefully, by then, you can still have other weddings in the future; hopefully, by then you’d have more money to spend.”

I hope this financial checklist before getting married helps you have a High FQ Family.

On Thursday, we will continue this conversation about preparing for a great marriage together with relationship expert, Maribel Dionisio. Join us.

ANNOUNCEMENTS:

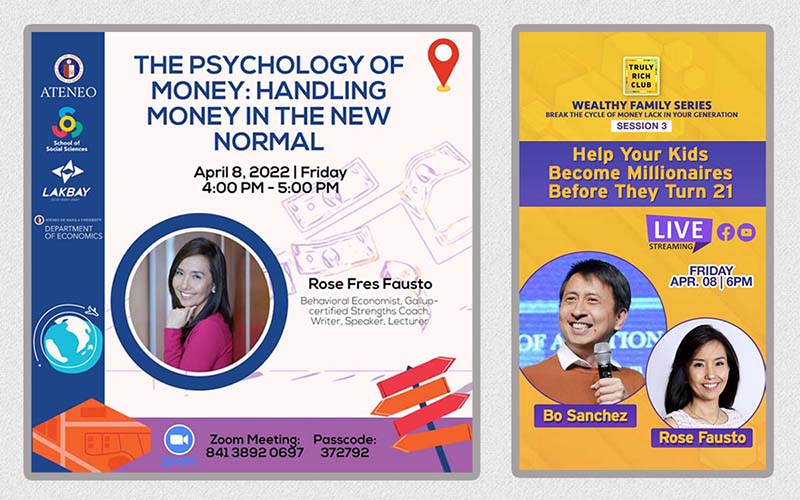

1. Back-to-back talks on Friday! Thanks to the online magic, this can be made possible!

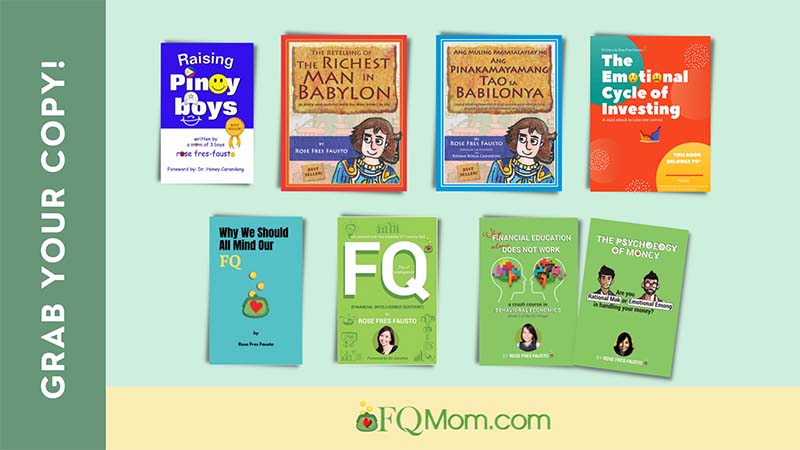

2. To learn more about your money behavior, get your copy of FQ Books and for your loved ones too. The principles you will learn from here are not only applicable in your financial life but all the other important aspects of your life. https://fqmom.com/bookstore/

To know more about FQ Book 2, watch this short video.