What is the snowball effect?

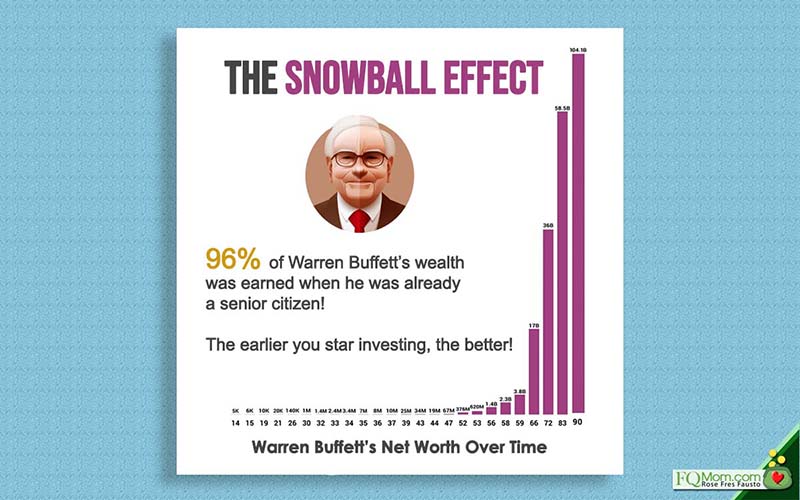

The NAV (Net Asset Value) or net worth of Warren Buffett is US$104.1 billion as of mid-June 2021. That’s almost a third of our entire country’s GDP! That’s why he is considered the best investor in the world.

But do you know how much of that was earned by Uncle Warren when he was already in his 60s? Can you try to guess?

Here’s the answer: A whopping US$100 billion! A massive 96% of his wealth was earned when he was already a senior citizen! Mind-boggling, right? See the graph of his historical wealth growth.

That is the power of snowball effect! And that’s the reason why his biography, the only one Buffett authorized among the thousands of books written about him, is entitled “The Snowball (Warren Buffett and the Business of Life)” by Alice Schroeder.

Since we live in a country without snow, let me discuss the literal snowball effect. Imagine a small snow ball at the top of a hill covered in snow. As you roll down the small snowball, it will pick up more snow, gaining more mass and surface area, and picking up even more snow and momentum as it rolls along. (If you know of a tropical country version that we can use as analogy for the power of compounding, please tell me.)

The snowball effect is a powerful analogy used to explain the potential growth of our investments. Oftentimes, it is hard to imagine this. Our Emong side (our quick System 1 that uses heuristics or rules of thumb) usually thinks only in linear terms. We have to summon our Mak side (our slow System 2 that uses our rational brain) to actually understand how our investments can grow exponentially over time.

Warren Buffett started investing at age 10. At age 30, he already accumulated US$1 million. Let’s imagine that in his twenties and thirties he decided to be YOLO and instead of US$1 million, he only had US$25,000. Even if he is able to make his impressive 22% annual returns on his investment portfolio from then on, then quit at age 60, his net worth would just be US$11.9 million, an infinitesimal percentage of his actual net worth today!*

After all these decades of studying Buffett’s phenomenal investment history, it is safe to say that the most important factor in his success is time and consistency. He started very young at 10 and continues to do so well into his geriatric years. This is a lesson for all of us to stop chasing returns but just keep still, and continue to do regular saving and investing, and wait for our own snowball effect to happen.

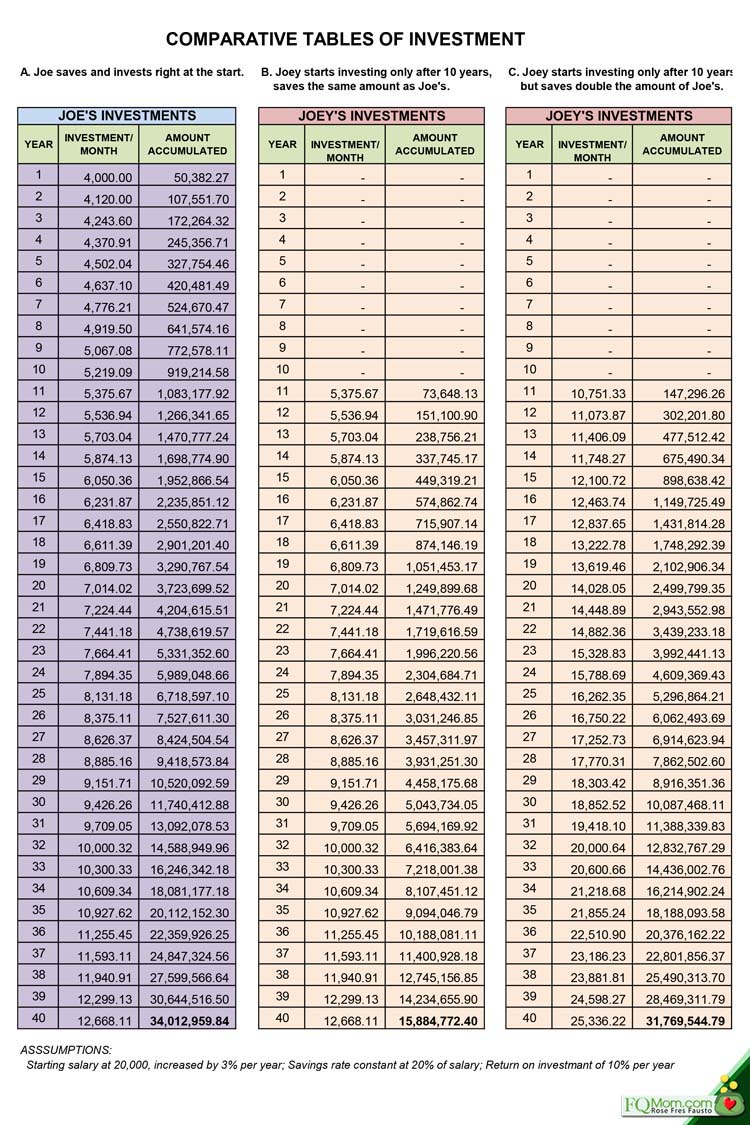

Okay, let’s go to an example of ordinary mortals. There are two friends Joe and Joey. They are generally the same in intellect and industry. When they had their first jobs, they both started with the same salary. Joe started saving and investing right away. He paid himself first! Joey decided to chill and YOLO a bit. A bit turned into a decade. But he was very serious when he started and invested exactly as much as his friend Joe did. At the end of 40 years, right about their retirement, you can see the results of their respective portfolios in the table below.

The cost of YOLO-ing for a decade for Joey is over P18 million, losing the chance of having 214% of what he accumulated in his retirement nest egg! That’s a big difference in the lifestyle that he will have as a retiree. He accumulated less than half of Joe’s, even if he only chilled one-fourth of the time of the 40-year period. Mahirap maghabol! (It’s hard to catch up.) Here’s more. What if Joey decided to save and invest more than Joe in order to catch up? Here’s what will happen. Even if Joey invests double the amount of Joe’s investment each month, he will still end up with a few millions short.

That’s the cost of YOLO without regard to YAGO (You Also Grow Old).

Do you know that the above scenario may also be true even if Joey started investing as early as Joe did. How? Let’s assume that for the first 10 years, Joey kept chasing returns. He ended up doing his own stock-picking but done haphazardly. He even added some high-risk instruments in his portfolio. Eventually, Joey loses everything! After 10 years, he decides to just do peso-cost averaging on equity index funds, just as what Joe had been doing all along.

Whatever the cause of his 10-year delay, we see the power of snowball effect, the magic of compounding at work. It shows how important it is for us to start early and to do it consistently. No need to chase returns. Keep calm and do peso-cost averaging in equity index funds. ![]()

Can you imagine if it becomes a common practice to start our children’s investment journey right out of their diapers? The power of compounding in an excel file that I showed to my sons when they were still in grade school blew their minds! They realized that they could be millionaires even at a young age. If you want to show that to your own children, just go to FQMom.com and search for Magic of Compounding.

The other side of snowball effect

In the same way as a hundred billion of Warren Buffet’s wealth was earned much later on in his life starting in his 60s due to the snowball effect, this same force can also happen in the other areas of life.

Let’s start with debt. A small innocent swipe on your credit card followed by another and another while you just pay the minimum balance can also snowball into a million pesos in credit card debt, as narrated in a true-to-life story of a simple cook found in Chapter 7 of FQ Book 1.

What else? The snowball effect is also applicable to our health. One tiny dessert too many can snowball into getting out of shape during the latter part of our life. The challenge is real, my friend. As we get older, the harder it is to maintain our waist-to-height ratio. (Click https://fqmom.com/hacks-to-attain-your-whr-waist-to-height-ratio-goal-in-2020/ and to see what your WHR should be). The same goes to the other abuses we do to our body – sleeping late, not exercising, smoking, heavy drinking, drug abuse, etc. All of these may not hurt us significantly right away, especially if you’re young, but come midlife, everything will catch up and show that snowball effect someday.

The same thing goes with the way we handle our career and relationships. All the little things we do or fail to do will blow up at a certain time.

How to use the snowball effect

Knowing what you know now, try to use the snowball effect to your advantage. Start those good habits early on. Just keep at them even if you don’t see the desired effect just yet. Remember your “little ball” right now is just starting to roll. Continue doing what you should be doing patiently and allow your ball to pick up its speed. Once it gains its momentum, growth will become exponential. Things (whether it be in your investment portfolio, career, relationships, health) will improve and as you go on, it will start happening at a faster rate. And you will be there at the foot of the hill to enjoy the fruits of your snowball effect.

Here's wishing you all a great snowball effect in the important aspects of your life!

ANNOUNCEMENT

1. For this quarter’s issue of Money Sense, we are featured on the cover. When I read the title given to our family, I kinda cringed. (smiley) But thanks Money Sense and we do hope that more families will be inspired to talk about money healthily instead of leaving it as the elephant in the room. You may get your digital copy of Money Sense here - https://www.moneysense.com.ph/product/digital-copy-moneysense-q2-2021-family-finance/.

2. I invite you to join this event. It's free but you have to register to reserve your slot. There's also a chance to win prizes. To register, click bit.ly/FQAdvance.

3. Please join me tomorrow live on Kumu or FB Page with my son Anton to discuss "What is the snowball effect?” and get a chance to win Kumu coins!

4. To learn more about your money behavior, get your copy of FQ Book 2. Get copies for your loved ones too. The principles you will learn from here are not only applicable in your financial life but all the other important aspects of your life. https://fqmom.com/bookstore/

To know more about FQ Book 2, watch this short video.

5. How good are you with money? Do you want to know your FQ score? Take the FQ test and get hold of your finances now. Scan the QR code or click the link http://fqmom.com/dev-fqtest/app/#/questionnaire.