The basics of borrowing

History/origin

According to David Graeber of the London School of Economics, debt originated as early as 3,500 B.C., long before the advent of coinage or money in 600 B.C., refuting the traditional explanation of monetary economies from primitive bartering system as laid out by Adam Smith, the Father of Modern Economics. That means loans have been part of human existence for many centuries and yet up to now, there are still a lot of confusions about it.

Some would generalize that debt is evil. The reality is that there are good debts and there are bad debts. And your debts can fall in either categories, depending on the usage, terms and behavior of the two parties – the borrower and the lender.

I am so happy that Home Credit Philippines, a leading consumer finance company that supports financial literacy and inclusion, requested me to write an article about debt that’s easy to understand in order to properly inform the public about the basics of borrowing. With the right knowledge given at the right time, Filipinos can use loans and other financial tools to their benefit.

Definition

Let’s start by defining debt. The dictionary defines it as something, typically money, which is owed or borrowed. This connotes that it is something temporary and should be given back to the one you borrowed it from.

Another way of looking at debt is this: Debt is a privilege. And I think that is why another word for debt is credit, which also means praise (as in “Give credit where credit is due.”). Why is credit or debt or loan a privilege? Because it allows you to make use of a sum of money, which is not yours. It is a privilege extended to you because of a certain level of trust and a positive assessment of your eligibility – i.e. your credit worthiness.

Given the above, it is everyone’s concern to take care of that credit-worthiness, for it is definitely an important part of one’s reputation. If there is anything about our character that can be quantified and recorded in public documents, it is our credit-worthiness.

Are we a good credit or a bad credit?

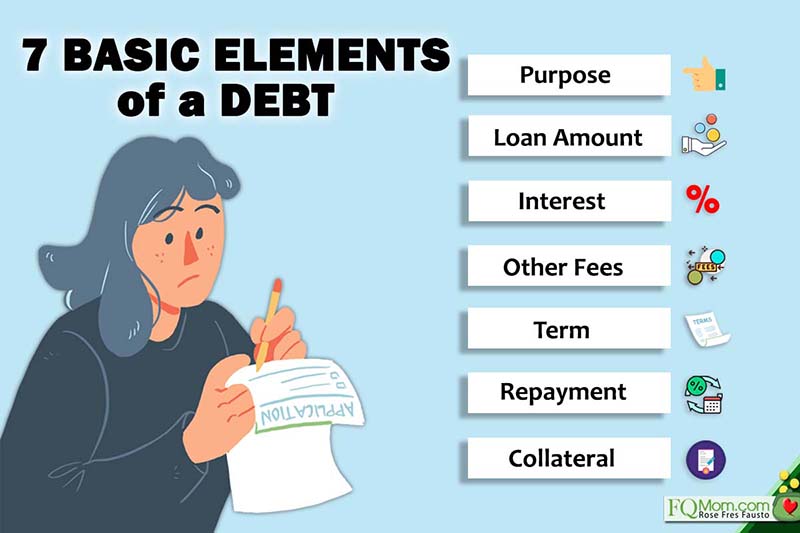

The basic elements of borrowing

In order to become a good credit, we must understand the basic elements of borrowing. We should endeavor to understand them in order guard us against becoming a bad credit, which consequently, leads to a stressful life.

1. Purpose

Why are you borrowing? Are you purchasing something that will improve your condition? There are some purchases that are difficult to buy with cash. For example, how many people can buy a house and other big-ticket items in cash? If there are growth potentials in your business that require additional funding, are you better off using outside funding?

Money is fungible and you can actually use loan proceeds in various ways, even in ways outside of what you applied the loan for. However, remember that you will still be the one to pay for it. So, you are better off being honest with yourself and your creditors when it comes to the purpose of your loan.

2. Loan amount

This is the total amount you are going to borrow. This is the principal of the loan, the amount used as the basis for computing interest (which is discussed in no. 3.) Note that most of the time, the loan fees are deducted from the loan amount such that the net proceeds to you is less than the principal amount.

In computing for the amount that you can borrow, lenders use different factors such as your credit limit and your collateral (discussed in no. 5). From their perspective, the loan amount is usually based on how much they think you, as the borrower, can repay. They look at your cashflow – your take-home pay, your credit-worthiness and the value of your collateral (discussed in no. 7).

From your perspective as the borrower, consider the above but add something more. You should also consider your actual need for external funding. There should be no pressure to max out your credit limit. It is best to borrow only what you need instead of what you can. This way, you are not burdening your cashflow with too much debt repayment. You give yourself enough safety net in case there are unexpected expenses and other cash outflows, and decrease in income and other cash inflows.

3. Interest

Interest is the rent price for the use of money. If you don’t own a house and need a place to stay, you rent, right? Rent is what you pay for the use of an asset you don’t own. When a resource or asset is borrowed, the borrower pays the lender (the owner of the asset) for the use of the resource.

The rent price for the use of money is expressed as interest rate.

When money is borrowed, the lender defers use of his money for a period of time. He does this in exchange for the interest income to be earned. On the part of the borrower, he is able to use the cash he does not own and for this, he pays interest.

Interest is typically expressed per year or per annum (p.a.). For example, 10% p.a. interest on a debt of P1,000.00 for one year is computed as follows:

(0.10) x P1,000.00 = P100.00

Please make sure to ask if the interest rate indicated is per month or per annum because it makes a world of difference.

If the 10% interest rate in the example is per month instead of per annum, the interest payment will be 12 times more. Instead of P100.00 it will be P1,200.00.

It might seem not seem like a lot of money looking at the above example, but if your principal amount is in the millions, then it could mean the difference of being a good credit or a bad credit for you if you fail to pay your debt on time and with the correct amount.

The interest may either be fixed or variable. Fixed is when the interest rate is the same throughout the term of the loan. Variable is when the interest is re-priced after a period of time, usually on a yearly basis.

4. Other fees

Depending on the lender, there are some fees related to loans on top of the interest. Examples are application/processing fees, appraisal fee (if you’re using a collateral that needs appraisal), service fees, etc.

If you fail to pay on time, there are also penalty fees.

This is where you have to be careful. Know what all these are. Remember, when you pay your lender, the amount they receive from you is first applied to these fees, followed by interest and the last is the principal.

If this is not understood perfectly, conflicts may arise. The borrower may unnecessarily accuse the lender of being unfair, not applying the payments to retire the loan. Believe me, I’ve heard of stories of such accusations, especially among relatives, “How can this happen? I have paid much more than what I borrowed and yet I still have an outstanding balance!”

5. Term

The term or tenor refers to the length of time of the loan agreement. The end of the loan is also called maturity, the agreed upon time when the loan should have been fully paid.

Big-ticket items usually have longer terms, like for housing loans where it could be as long as 10 years or even 20 – 30 years in other countries. Choosing the term of your loan is a balancing act between how long you want to be in debt and how much regular repayment (discussed in no. 6) you can afford, usually on a monthly basis. Just remember that the longer your loan term is, the more you will spend on interest.

6. Repayment

This is the amount you pay your lender regularly until you fully pay the loan. Usually, this is on a monthly basis. For the typical loan amortization schedule, repayment is usually a fixed amount for a certain period. This amount is applied to these two – the interest and the principal.

At the start of the repayment period, most of the amount goes to the interest portion. As you progress in your repayment, the portion that goes to the interest goes down while the portion that goes to the principal goes up, until you fully pay the loan.

7. Collateral

Not all loans require collaterals. Big-ticket items usually require them. Collateral is the asset that a lender accepts as security for a loan. It may take the form of real estate or other kinds of assets, depending on the purpose of the loan. The collateral acts as the protection for the lender in the event that the borrower is unable to repay the loan, or what we call as default. The value of the collateral is usually higher than the value of the loan.

In a society where everything is expected to be done quickly, where loans can be had in a few minutes, we might end up getting into something that we don’t really understand. This may later on turn what was originally a good debt into a bad debt.

Good debt vs bad debt

A general rule, we can determine if a debt is good or bad by answering these two basic questions:

1. Will the use of the debt proceeds improve my condition?

2. Are the terms and conditions of the debt fair?

The sub-question to this main question is this: Will I be in a better condition post-debt as compared to pre-debt, even after fulfilling the loan’s terms and conditions?

If you answer yes to all of the above, then it is a good debt.

Vet your Lender

Lenders choose their borrowers well because they are in the business of lending money, not in foreclosing properties. So, believe me when I say that good lenders don’t want you to default on your loans.

If lenders choose their borrowers well in order to stay in business, borrowers should also choose their lenders well so that they find real partners in their business and life.

Check out the track record of your lender. How long have they been in the industry? What are their affiliations? How is their customer service? Do they show care for their clients? Do they employ “goon-like” collectors? Research on your prospective lenders as well. Home Credit Philippines is present in 10 countries in Central and Eastern Europe, Asia and North America. As a group, they promote the principles of financial inclusion and safe lending.

Knowing these basic elements of a loan, the difference of a good debt vs bad debt and choosing your lender well are all very important for a long-lasting and mutually beneficial relationship between the borrower and lender, just the way it should be.

Cheers to high FQ!

*****************

ANNOUNCEMENTS

1. Be among the first to read FQ Book 2 before its launch! This is a product of my years of studying, writing, rewriting, some more writing and rewriting. To get your copy, click https://fqmom.com/bookstore/.

To know more about FQ Book 2, watch this short video.

2. How good are you with money? Do you want to know your FQ score? Take the FQ test and map out your 2021 FQ plan. Scan the QR code or click the link http://fqmom.com/dev-fqtest/app/#/questionnaire Insert FQ Test poster