5 ways to protect your health and safety during rainy ‘ber’ months

Be #LagingHanda this rainy season with an affordable safety net you can easily access through GInsure on GCash

MANILA, Philippines — “Ber” months in the Philippines should be known for its festive, chilly and cozy “sweater weather” but nowadays, the weather has been so unpredictable.

You wake up to a thunderstorm, endure a hot and humid day when the sun suddenly comes out, and then brave flooded streets on your way home due to another downpour. Slippery roads, reduced visibility and the humid weather not only make everyday tasks more difficult, but also make us more at risk for certain illnesses and accidents.

While you’ll never know what the day will be like, you and your loved ones can take extra measures to protect yourself from potential inconveniences they might bring.

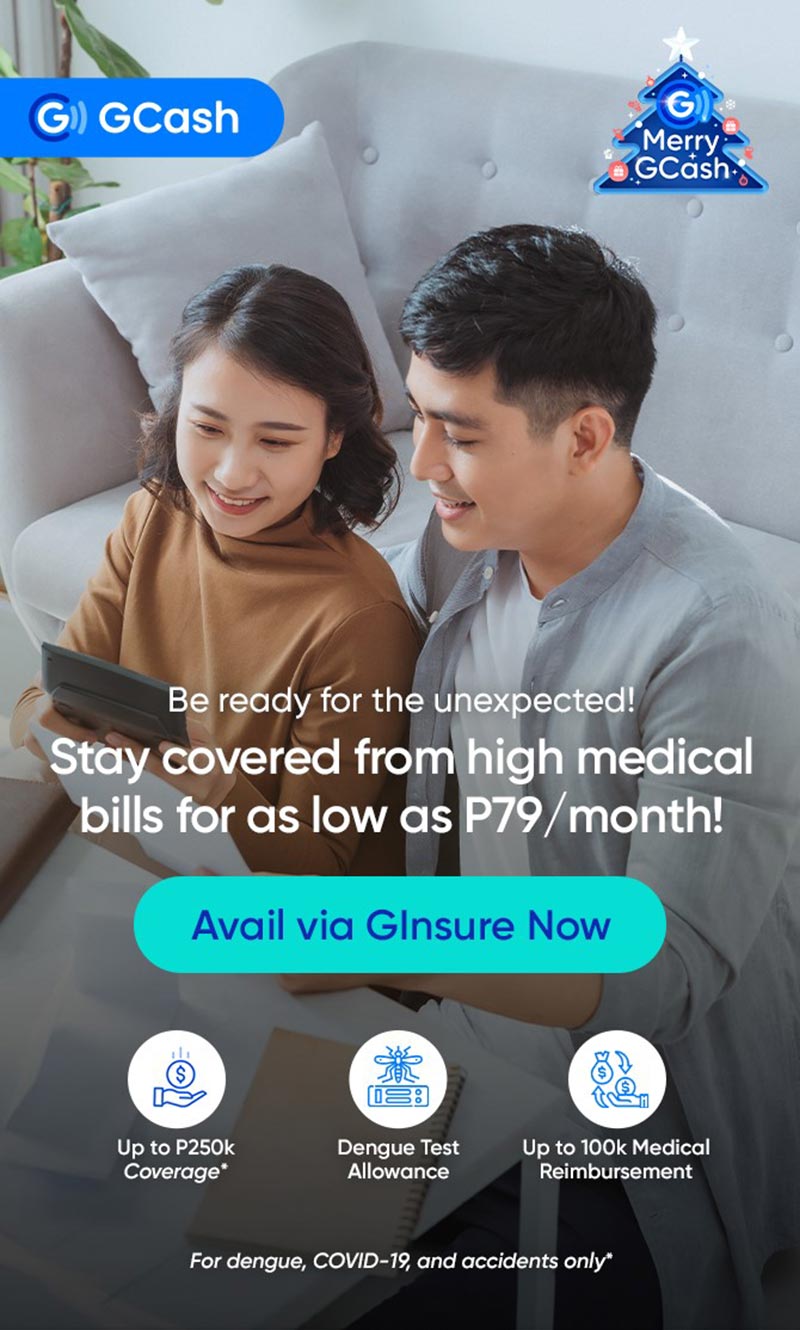

Financial super app GCash, through its platform GInsure, offers credible and affordable health protection and personal insurance to cover unexpected costs that may arise from illnesses and accidents, including those that are likely to happen during the wet season.

Aside from making sure your umbrella, rain boots and emergency kits are ready, here are some ways to make sure you are safe and healthy during the rainy season.

1. Update your flu shot

Getting your flu shot is best done at the start of the rainy season in June, but if you haven’t yet, it’s never too late to do so. Not only can it protect you from the virus or reduce the severity of your symptoms, it can also help prevent you from spreading the flu to others, including your loved ones who may be at risk of complications.

As the circulating flu virus is different every year, the Department of Health (DOH) recommends getting an updated flu vaccine annually.

2. Plan your commute or drive ahead

Before you go out for work or errands, check the weather forecast. If you are driving or biking, set time aside to check your vehicle’s tires, brakes and headlights and plan your route.

If you plan to take public transportation, invest in non-slip footwear and walk slowly and carefully as surfaces tend to be extra slippery. It is also wise to bring a spare pair of socks and a change of clothes in case you end up soaking wet.

3. Ensure your surroundings are clean and dry

Dengue fever is at an all-time high from May to November. The most effective line of defense against this mosquito-borne disease is ensuring your home cannot host mosquitoes, which breed in stagnant water.

Always check for standing water from your home and yard, especially after a rainy day—including in vases, plant pots, even discarded trash that can accumulate water.

4. Be on the lookout for unhealthy stress

When we are under stress, the body releases hormones such as adrenaline and cortisol, which can impair judgment, reduce focus and slow down reaction time, making us more prone to accidents and injury.

These hormones can also weaken the immune system and make us susceptible to diseases and illnesses. Rainy days can be a lot stressful—but this is precisely the time to find healthy ways to deal with stress and get enough hours of rest.

5. Invest in health and personal protection

While we do our best to be careful and healthy, getting into a medical emergency or accident is always a possibility. In some cases, emergency funds and healthcare benefits might not be enough and you have to shell out money to cover additional expenses.

Accidents may also render you unfit for work, leading you to lose your income. Investing in health and personal insurance will provide you with an extra layer of protection and peace of mind, making sure that you can still provide for your family’s future even in cases of loss of income and medical expenses.

GCash offers affordable health and personal protection

Getting insurance is often seen as an added expense, but it is possible to get one without costing an arm and a leg. For as low as P79, you can get protection for your and your family’s health as GCash has partnered with Singlife Philippines to offer health insurance, which can be availed of in under three steps through GInsure.

Singlife’s 3-in-1 protection covers up to P250,000 in medical costs associated with dengue, COVID-19 and accidents; while its Cash for Medical Costs covers up to P1.275 million in hospitalization and critical condition costs.

To ensure regular monthly income for you and your family in case of accidents, disabilities or death, you can also purchase personal insurance on GInsure for as low as P10, taking only three steps to complete.

You can purchase personal insurance products according to your budget, lifestyle and needs, from credible insurance providers Cebuana Lhuillier, Sun Life, Singlife, Pru Life, Pioneer Insurance and Generali.

Whichever season you are in, it always pays to be prepared for you and your loved ones’ futures. Have peace of mind that whatever storm comes your way, literally and figuratively, you can make it through.

Ready to take a step towards securing you and your family’s future? Access GInsure on the GCash dashboard or find it under “Grow.” No GCash yet? Download the GCash App on the Apple App Store, Google Play Store or Huawei App Gallery. Kaya mo, i-GCash mo!

Editor’s Note: This press release is sponsored by GCash. It is published by the Advertising Content Team that is independent from our Editorial Newsroom.