13 signs of a toxic relationship with money

I’ve discussed the importance of having a healthy relationship with money a number of times in my books, talks, articles, videos and podcasts. (Here are some of them 1, 2 .) In fact, I am giving a workshop on the importance of understanding your relationship with money today. A healthy relationship with money is a requisite to a high FQ.

You know how it’s sometimes easier to understand something by enumerating what it is not? It’s the same when it comes to giving a diagnosis on our relationship with money. So for today, let’s talk about symptoms of an unhealthy relationship with money.

1. You always worry that you don’t have enough money. This is a sign that you suffer from scarcity mentality. If you are a parent, please be careful not to over-use, “Wala tayong pera!” or in Ilocano, “Awan ti kwarta!” when you try to teach your children how to be frugal. I remember when the boys were still young and would ask for expensive toys which were not parent-approved or out of the budget, we never used the reason, “We don’t have money.” Although that’s the fastest way to get out of the purchase, we patiently explained, “We have that amount of money but we would rather use it for something else.” This way, you can teach your kids that buying something is not just a function of having or not having the money.

2. Spending makes you feel guilty. Don’t be a miser who just hoards money and never enjoys what you can buy with it. Money is a tool that allows us to enjoy life. My son articulated an antidote to feeling guilty about spending in this conversation he had with his workmates. He said, “When my officemates spend on something they always say, ‘Oh no, I’m so magastos, I splurged on something again!’ Then they asked about my spending. I said, ‘Well, I just automatically save and invest as soon as our salary is credited. That way, I can spend on anything guiltlessly!” There you go, the antidote of guilty spending is the first basic law of money: Pay yourself first!

3. You spend way beyond your income and carry huge credit card and other debts. It may sound harsh to someone who is carrying debts and have all the reasons why, but it’s a reality that if you regularly spend more than what you make, you have a big problem that you need to solve right away. “Live within your means” is just so basic and you can reason out all you want but you will never get out of this toxic relationship with money if you don’t drastically change something in order to observe this rule.

4. You think that you can only be happy once you have a certain amount of money. I have news for you, money itself is not the source of happiness and if you pin down your happiness on it, you are setting yourself for a huge disappointment. Somehow, this is comparable to those who say, “If I only meet the right partner, then I will be happy.” It doesn’t work that way. You have to be happy with yourself first, before you can find the right partner. In the same way, you have to know what your values are that money can help you fulfill instead of pinning your happiness on a certain amount.

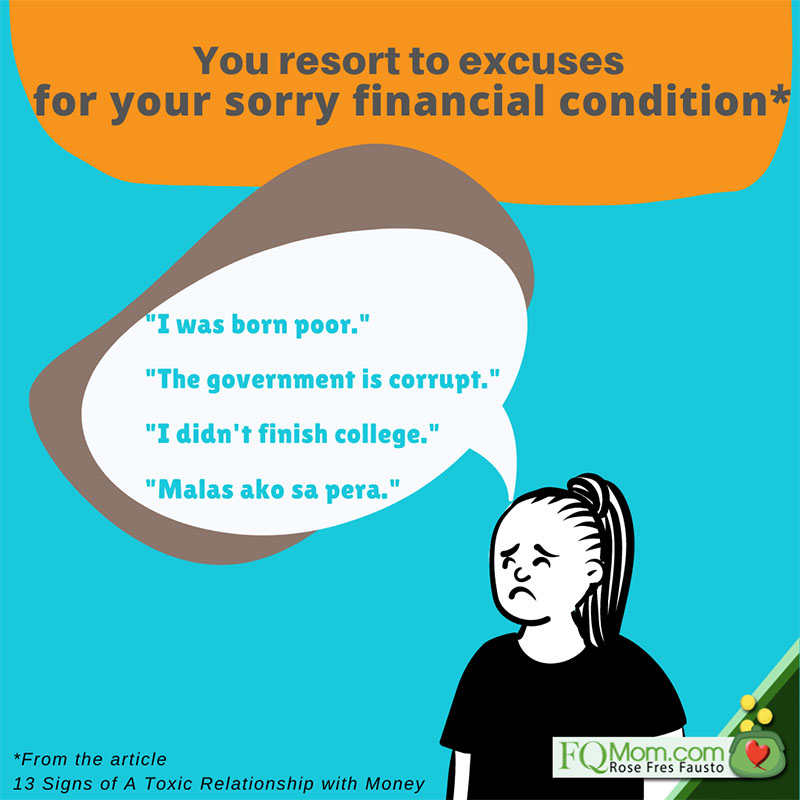

5. You resort to excuses instead of action items to deal with your sorry financial condition. There are a number of excuses such as: I was born poor, the government is corrupt, my parents and school didn’t teach me about FQ, I didn’t finish college, malas ako sa pera, I was swindled by a trusted friend or family member, and so on. While it is true that we are dealt with different sets of cards in life, we cannot keep on blaming our circumstances if we want to have a good life.

6. You resent rich people and are automatically suspicious of their source of wealth. While it’s true that there are rich people who didn’t get there through honest means, it is wrong to have that default perception that rich people are evil. We all want to be good people and having this mindset subconsciously makes you do things to avoid being wealthy.

7. You say you don’t want to be rich. This may be connected to number 6, or you may just be saying this because you are giving yourself that excuse not to prosper in life. It’s okay to not want to be rich, as long as you will not be a financial burden to anyone.

8. You spend on luxury prematurely. This goes against the third basic law of money which is to make your gold work for you, to make an army of golden slaves before you buy luxury. If you systematically disobey this law, you not only fail to enjoy the magic of compounding, but there may be a deeper reason why you have to buy those luxuries too soon. The FQ hack to observing the third basic law of delaying gratification is this: “Buy luxury only if you can afford to buy 10 pieces of it.”

9. You always get victimized by financial scams. Yes, you may be the victim the first time around, but if you repeatedly get attracted to scams, you’re no different from someone who always gets into a relationship with the wrong persons who abuse you. Remember, if it is too good to be true, it is not true! Do not be fooled that investments with assured high returns exist, even if these are being peddled by religious people. The higher the return, the higher the risk. The lower to risk, the lower the return.

10. You always have an excuse why you can’t save. You just have to figure out a way to save regularly, because there is no way you can have a healthy relationship with money without observing the golden rule, the first basic law of money: Pay yourself first. Start small and work your way up. It is the habit, preferably automated, that is more important.

11. You can’t talk about money. If you refuse to discuss money as if it were the dirtiest thing in the world, that is a big red flag that you have a toxic relationship with money. You have to be comfortable talking about it, at least with your family and those whose money behaviors affect your financial condition.

12. You can’t talk about anything else but money. If all you can talk about is money, that is also unhealthy. That is an obsession and is dangerous to your health and your relationships. Remember money is a tool. Understand your core values and make sure that the way you deal with money is in accordance with them. And hey, there’s so much more to life than money!

13. You use money to manipulate your children and the people around you. While it is true that money talks and having a lot of it gives you power, this is a slippery slope. Be very careful that you do not use it to manipulate your children and other people around you. We just heard our presidential spokesman blatantly announce on national television that the monetary donations of the “other oligarchs” were much more than that of the “flavor of the season oligarch” hence, the former’s cases were not pursued! While their donations were probably made to sincerely help the country, that terrible statement just shows how twisted their reasoning and governing has become. (And who are the real oligarchs anyway?) It’s sad that a noble gesture of donating to help others can turn into something like this. This is a good reminder to all of us to be careful in dealing with money.

There are more signs out there that give you hints of the state of your relationship with money. I hope you find time to reflect on the above and work your way into a healthy relationship with money. Cheers to high FQ!

************

ANNOUNCEMENTS

1. I’m going to give an online workshop on July 22, 2020 for the existing and prospective clients of ATRAM Trust Company. You may contact ATRAM if interested.

2. Reading is another coping mechanism for the lockdown. If you haven’t yet, may I invite you to read any of the FQ Mom books?

Attributions: Photos from canva, freepik.com and givenus.com, modified and used to help deliver the message of the article.