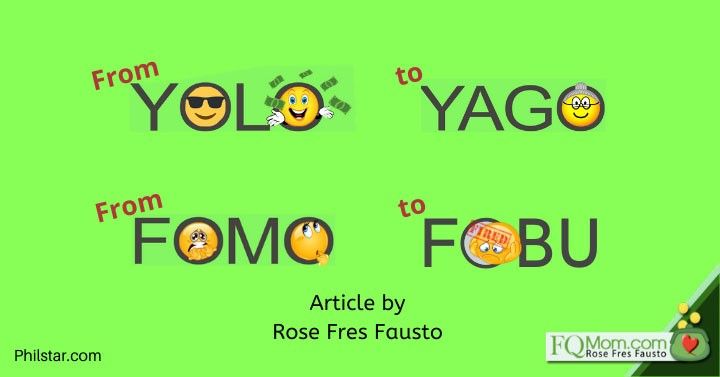

From YOLO to YAGO, from FOMO to FOBU

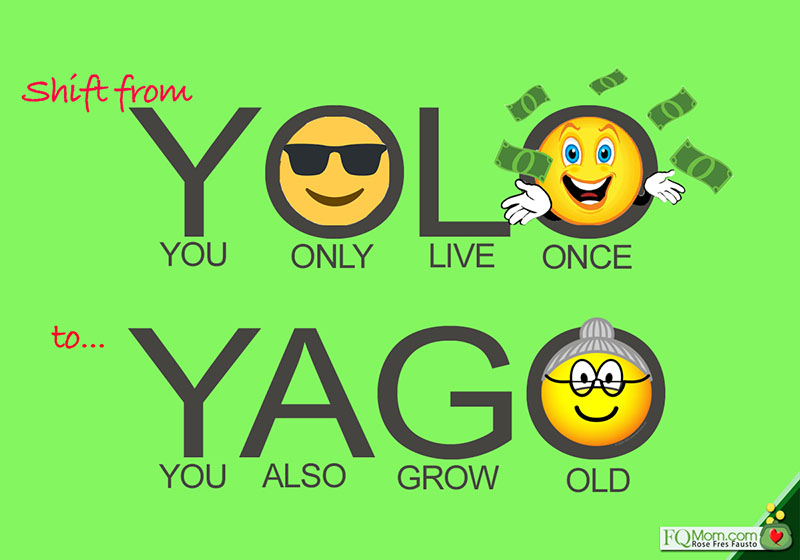

A couple of years ago, I came up with the term YAGO! It was a call to everyone who would use YOLO (You Only Live Once) as an excuse to postpone saving and investing for retirement. In articles and talks I’ve given I said, “Yes it’s okay to have fun because indeed you only live once, but don’t forget YAGO.

(More YAGO articles here: http://fqmom.com/really-fear-fomo-shift-yolo-yago/, http://fqmom.com/myopia-and-your-fq/)

BSP Financial Education Stakeholders 2019 link: https://www.philstar.com/lifestyle/health-and-family/2019/11/27/1972045/financial-education-stakeholders-expo-2019

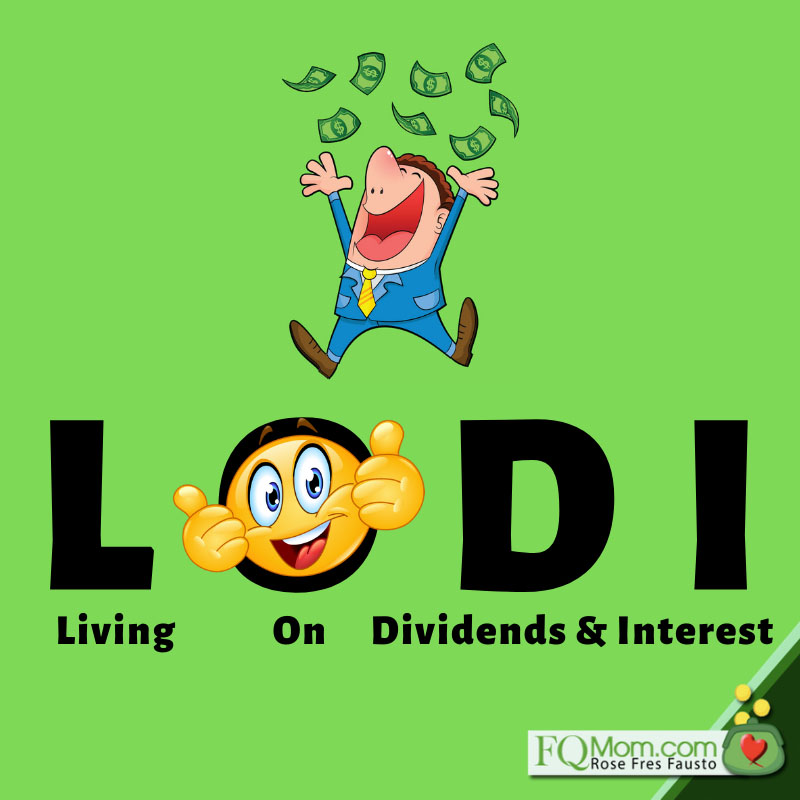

Then there was LODI with a twist, my kind of lodi or idol is the one who has successfully saved and invested for his old age. My kind of lodi means…

In last month’s BSP Stakeholders Expo, a speaker from PSE gave a presentation on Stock Investing 101. To convince the audience about the importance of investing in the stock market, she used my coined term YAGO with matching slide. Someone from the audience approached me to say, “Ma’am Rose, sa inyo galing yong YAGO. I know because I follow you. Nakalimutan n'yang banggitin 'yong pangalan mo! Dapat na-patent 'nyo 'yon!” :)

I’m just happy to help people remember the FQ lessons with the aid of all these catchy terms, memes and images, so if they have helped anyone reach out to people and help them prepare for their future old self, then that is great.

Today, I introduce a new term.

We are all familiar with FOMO, Fear of Missing Out. This is the anxiety that an exciting or interesting event may be currently happening elsewhere, often aroused by posts seen on social media. It makes people want to travel, engage in this and that experience, oftentimes even if they could not comfortably afford it yet.

But there’s something that should make us more fearful. It’s more fearful than not being able to experience all those envy-inducing IG-posted activities. It’s the fear of what’s going to happen if you suddenly lose your cashflow at the time when you have not yet adequately built your safety net.

So what is more fearful than FOMO? It’s FOBU!

Have you thought about it? What is going to happen if you suddenly lose your job or your current source of income? How long will it take you to replace your salary or your earnings from your business or profession? What if you suddenly get sick, meet an accident? What if you suddenly need to repair your car, leaking roof, etc.? Where will you get the money.

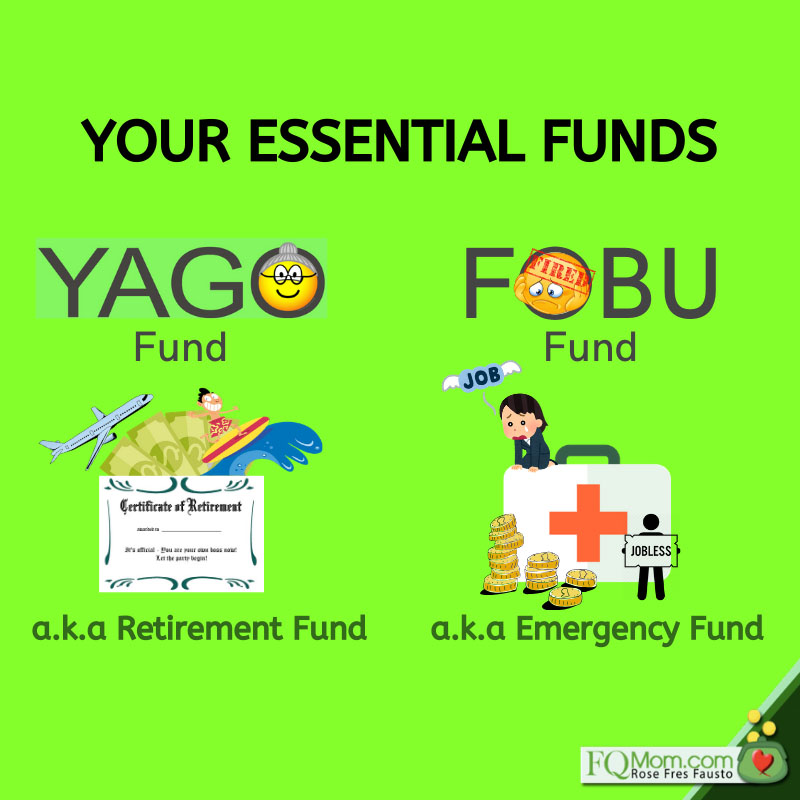

While we call our Retirement Fund our YAGO Fund, let’s call our Emergency Fund our FOBU Fund.

So, what will you do the next time you’re tempted to do any the following?

1. Book that flight so you won’t miss the fun trip that all your friends/officemates are going to.

2. Watch that expensive concert because you really love the music of the artists and everyone who’s cool seems to be going.

3. Join your foodie friends in their next expensive tasting menu restaurant adventure.

4. Book that facial treatment that promises to make you look like a million bucks (maybe because the price is close to it?)

5. Rent that expensive accommodation because it looks like the house of the Kardashians.

6. Buy or rent signature items so you can experience (and post) the thrill of wearing luxury.

7. Leave your current job because it’s so hard and “you are not following your passion” anymore (Oh c’mon! Do you even know that the word passion comes from the Latin word patior which means to suffer?)

The next time you feel like doing any of the above, close your eyes, take a deep breath and ask yourself, “Do I already have an adequately funded FOBU Fund?” Is it worth at least three to six months of my expenses? Is it in interest-bearing fixed income instrument(s) that I can easily withdraw when the need arises? Note that it doesn’t have to be in your ATM account, but please don’t put it in stocks or other assets that will be difficult for you to liquidate. (In the case of stocks or other equity investments, even if they are liquid, the market might not be in your favor when your emergency happens, and you might have to sell at a loss. Limit your equity investments to your medium and long-term funds like your YAGO Fund.)

So remember, as you get bombarded with YOLO and FOMO, please make sure you are not sacrificing your YAGO and FOBU Funds.

Those with dependents should also insure themselves adequately and efficiently. But let me get back to you once I come up with another catchy term for protection fund. Or maybe you have one in mind already? Tell us about it. :)

Cheers to high FQ!

*********************************

ANNOUNCEMENTS

1. Mom and Son Podcast - Season 4 Episode 12 (Cyril Sindac on Cuadro)

Today’s episode features one of Cuadro’s founders, Cyril Sindac. (The other, Javi Ocampo) We discuss how Cuadro was formed, the purpose behind it and why they put up this online platform for artists and art customers. People who are interested in purchasing quality local art can use this platform and artists who want to get their art out can do so through Cuadro. Learn their story and stream the episode now!

#MomAndSonPodcast

Spotify

https://open.spotify.com/episode/0u9W1p3hDiSNCNgGNJC6NV?si=zlEMpmytTK6TqeAbCvhJ5w

Apple iTunes

https://podcasts.apple.com/ph/podcast/mom-and-son-podcast/id1449688689?mt=2

Google Podcasts

https://podcasts.google.com/?feed=aHR0cHM6Ly9mZWVkcy5idXp6c3Byb3V0LmNvbS8yNDE0NDcucnNz

YouTube

Originally uploaded on Anton Fausto’s YouTube Channel: https://youtu.be/bYjYGu3MgIg

FQ Mom Link:

2. Thanks to those who already bought the FQ Book, especially to those who took the time out to send me their feedback. Your feedback is food for my soul. To those who have not gotten their copy yet, here’s a short preview of "FQ: The nth Intelligence."

You may now purchase the book in major bookstores, or if you want autographed copies, please go to FQ Mom FB page (click SHOP), or FQMom.com (click BOOKS), or email us at FQMomm@gmail.com.

3. Want to know where your FQ stands? Take the FQ Test Challenge now! Click link: http://rebrand.ly/FQTest

Rose Fres Fausto is a speaker and author of bestselling books "Raising Pinoy Boys" and "The Retelling of The Richest Man in Babylon" (English and Filipino versions). Click this link to read samples – Books of FQ Mom. She is a behavioral economist, a certified Gallup strengths coach and the grand prize winner of the first Sinag Financial Literacy Digital Journalism Awards. Follow her on Facebook & YouTube as FQ Mom, and Twitter & Instagram as theFQMom. Her latest book is "FQ: The nth Intelligence."