Financial Education Stakeholders Expo 2019

On November 25 to 26, 2019 the Bangko Sentral ng Pilipinas held its annual Financial Education Stakeholders Expo.

This event was started last year when the late governor Nesting Espenilla was still around. He was a champion of financial inclusion, and that was why he gamely joined my video series project on The Retelling of The Richest Man in Babylon. (Click First Law of Money as read by the governor, and Childhood Money Memory of Gov. Nesting to know more about him.)

My participation last year was to speak about Behavioral Economics at the plenary, then later on moderated the panel discussion on financial innovations. (Click BSP FinEd Expo 2018)

This year, newly appointed Governor Ben Diokno delivered the opening remarks.

The expo was the venue of the launch of the Financial Education Integration Policy and Roadmap. Congratulations to DepEd, represented by Undersecretary Annalyn Sevilla, Pia Roman Tayag, Managing Director at BSP and the head of the expo, and everyone involved in this project.

For 2019 my role was to moderate the session on Investing in the Stock Market. The audience consisted of beginners and long-time players in stock market investing.

The session was hosted by John Garcia, the Assistant Department Head of Marketing Services of the Philippine Stock Exchange (PSE).

PSE COO Roel Refran who’s a CPA lawyer (top 4 in bar exams and also among the top 20 in the CPA board) gave his welcome remarks. Oh, did you know that he was also a bronze medalist during the Mr. Philippines competition in 2002 and 2004?

This was followed by a Stock Market 101 talk by Sarah Padilla, the energetic Assistant Manager at the Market Education group of PSE.

She was followed by Grace Calubaquib, Assistant Vice President and Head of the Surveillance Department, which has been spun off as a separate entity called CMIC (Capital Market Integrity Corp.) She talked about Investor Protection, a very timely topic given news about fraud that recently happened at R & L Investments, the 50-year old stock brokerage that suffered from PhP700 million loss due to fraudulent transactions.

In order to digest all these presentations, the participants were given a short coffee break. The session resumed with the short presentations of two brokers. Fernando Martinez of Eagle Equities talked about practical tips in investing with a traditional broker and matters on the psychology of investing.

He was followed by Dino Bate, president of COL Financial who spoke about practical tips in investing with an online stock broker. He delivered his message using three characters named Dennis Disiplinado, Sarah Sigurista, and Mario Matatakutin.

Before I started the panel discussion, I reminded the audience that despite the fact that the stock market provides the highest returns in the long run among all asset classes, only a miniscule less than 1% of our population is investing in it.

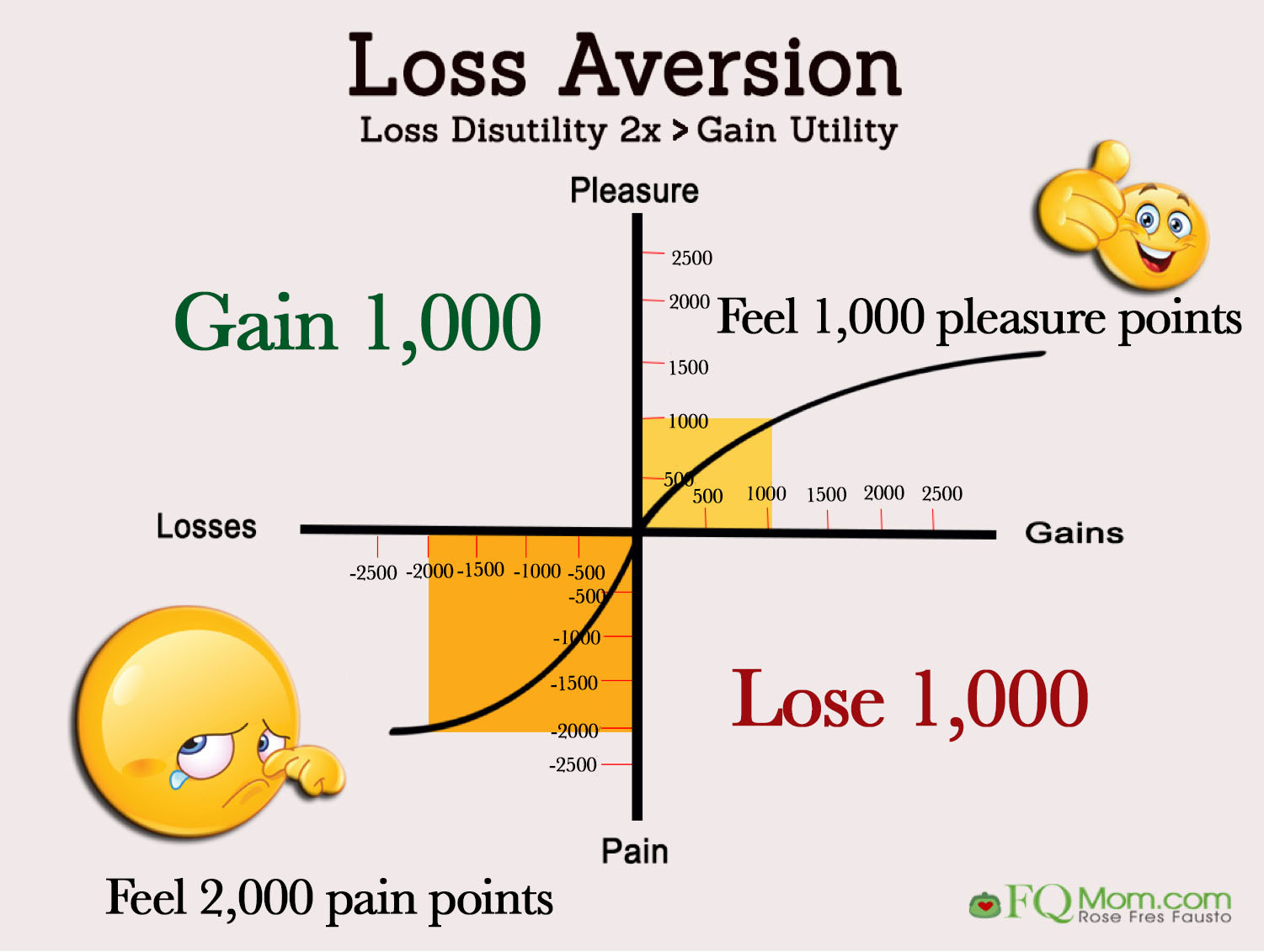

I briefly talked about one fundamental reason why. It is called Loss Aversion.

What is Loss Aversion?

This is the Bahavioral Economics principle that explains the way we treat wins or gains and losses. Let’s say we gain PhP1,000 and we get 1,000 pleasure or happy points for that. Rationally, if we lose that same amount, we should get negative 1,000 happy points or 1,000 pain points. Unfortunately, we are not wired like a computer. We are wired to feel the impact of a loss twice as much as the impact of a gain. So, losing that same 1,000 pesos that gave us 1,000 pleasure points will translate to 2,000 pain points. The Tagalog saying, “Pera na naging bato pa!” really feels awful.

Since this is the way humans are wired, we would rather avoid losses than try to acquire gains. In the stock market, we feel this loss every single day, in fact every single minute if we watch it all the time! So that is the psychological bias that works against us, making us shy away from this important investment vehicle that we should all take part in.

But you know what the real loss is?

It is when you reach the age of 60 and you look back and see the difference of earnings that you could have made if you just calmly, routinely, regularly, and automatically invested in the stock market.

Let me say it again. Everyone must have equity investments in their retirement portfolio. And the most efficient way is to just invest in equity index funds, no need to try to beat the market. It’s a zero-sum game. You are better off just automating it, then do what you do best, which hopefully is your own profession.

Cheers to relaxed equity investing! ![]()

*********************************

ANNOUNCEMENTS

1. To read more about Loss Aversion, you may click these links:

https://www.philstar.com/lifestyle/health-and-family/2017/04/19/1799337/loss-aversion

www.philstar.com/lifestyle/health-and-family/2017/04/26/1799329/lifestyle

2. Watch out for the highlights of the BSP Financial Education Stakeholders Expo on Friday.

3. Come join our FinLit Summit on April 4-5, 2020!

4. Mom and Son Podcast - Season 4 Episode 9 (THE IMPORTANCE OF "ME TIME")

Last week of November! Good day everyone, we have a short but sweet solo episode today for the Mom and Son Podcast. I discuss the importance and value of having “ME TIME.” What does it mean and why is this being discussed? As the Christmas season has already arrived (at least here in the Philippines), being with other people, reuniting with loved ones is extremely highlighted that we may believe that it should always be like this. The void or disparity between someone who is with other people and someone who is just with himself is a lot more evident and this episode discusses why that’s not a bad thing. I invite everyone to join this episode and try to further appreciate the activity of being with yourself and enjoy this “Mandatory ME Time,” that is introduced and explained in this episode.

#MomAndSonPodcast

Spotify

https://open.spotify.com/episode/6oZfYADIZHqYoNQmiFLxeb?si=81u8c-0nSaqJQxd4uGQHQw

Buzzsprout

Apple iTunes

https://podcasts.apple.com/ph/podcast/mom-and-son-podcast/id1449688689?mt=2

Google Podcasts

https://podcasts.google.com/?feed=aHR0cHM6Ly9mZWVkcy5idXp6c3Byb3V0LmNvbS8yNDE0NDcucnNz

YouTube

Originally uploaded on Anton Fausto's YouTube Channel:

https://youtu.be/txIt1bYPj4U

FQ Mom Link: https://youtu.be/uuc6Sk1ufNY

5. Thanks to those who already bought the FQ Book, especially to those who took the time out to send me their feedback. Your feedback is food for my soul. To those who have not gotten their copy yet, here’s a short preview of FQ: The nth Intelligence

You may now purchase the book in major bookstores, or if you want autographed copies, please go to FQ Mom FB page (click SHOP), or FQMom.com (click BOOKS), or email us at FQMomm@gmail.com

6. Want to know where your FQ stands? Take the FQ Test Challenge now! Click link. http://rebrand.ly/FQTest

Rose Fres Fausto is a speaker and author of bestselling books Raising Pinoy Boys and The Retelling of The Richest Man in Babylon (English and Filipino versions). Click this link to read samples – Books of FQ Mom. She is a Behavioral Economist, Certified Gallup Strengths Coach and the grand prize winner of the first Sinag Financial Literacy Digital Journalism Awards. Follow her on Facebook & YouTube as FQ Mom, and Twitter & Instagram as theFQMom. Her latest book is FQ: The nth Intelligence.

ATTRIBUTIONS: The Global Filipino Investors