The problem with risk appetite

Only less than 1% of our population invests in the stock market. And this is despite the fact that it is the asset class that gives the highest returns in the long run.

Most people would say “I don’t have the risk appetite for that!” They don’t want to see the value of their hard-earned money fluctuate in the short and medium term, even if they are investing for retirement.

Financial institutions are required to ask customers certain questions that will determine their “risk appetite” before they are allowed to invest in certain assets. Risk appetite refers to the amount of risk or uncertainty one is willing to take in order to attain an objective. Those who would answer that capital preservation as priority will be categorized as low risk appetite investors, without much regard for the specific purpose of the investment.

So what is wrong with just relying on your “appetite” when it comes to investing?

It’s very similar to what’s going to happen to you if you just eat what is appetizing to you. Check out your kid’s diet. I hear moms say, “He doesn’t want to eat his vegetables, he just wants to eat bacon and hotdog!” or “He loves to eat sweets all the time – ice cream, candies, cakes, chocolates, instead of fruits!”

If you allow this to happen year in and year out, you are raising a very unhealthy kid. And I hate to be rude, but it’s your fault, you’re the parent. You cannot allow your child to eat based on his appetite alone. You have to lead by example and by design in your house.

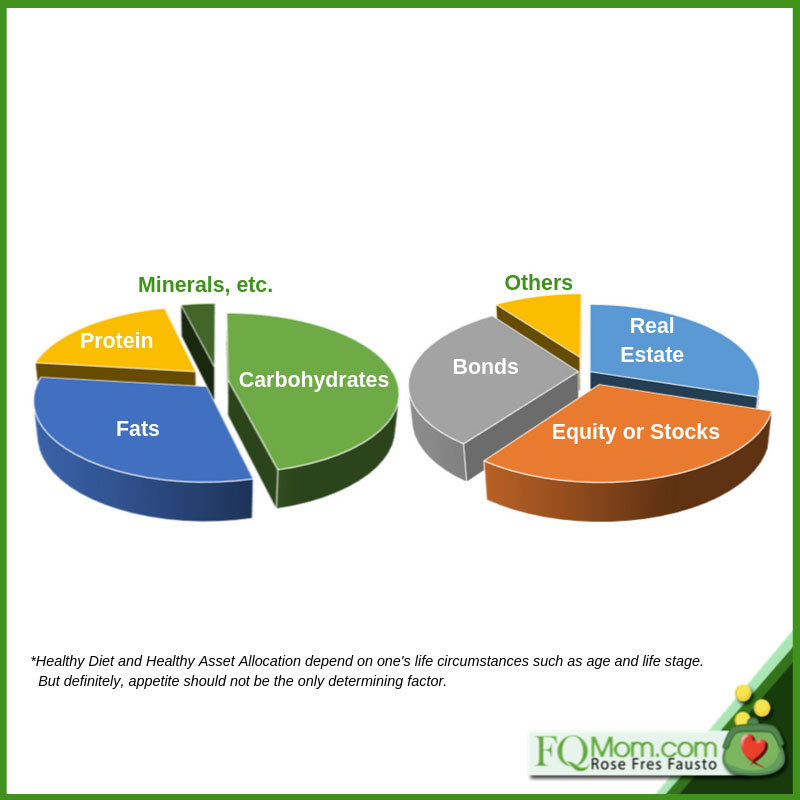

A healthy balanced diet is what your child needs right from the start. It’s the same with your portfolio, and we call this asset allocation. You may not have the appetite for risks, but if you are saving and investing for your retirement and do not include any risk in your portfolio, your wealth accumulation will be hampered and you may never have a decent retirement nest egg. All of your hard-earned savings will just be eaten up by inflation.

The other side of the risk appetite spectrum

And yet for some people, risk is what they want. They are so ready to put in lifetime savings, or even borrow when they hear too-good-to-be-true investments with high returns kuno! And this would include those who believe that they can actively trade the stock market and make money with no proper training but just a little daw theory (as in “tataas daw, babagsak daw”) that they gather from the online grapevine.

Aspire to have a healthy asset allocation regardless of your appetite for risk

For those who have very low tolerance for risk, decide on your asset allocation at the start of your investing journey. Decide on the percentage that should take in risks. For as long as you have your fixed expenses in the short term covered, and you have adequately allocated a significant portion of fixed income in your investment portfolio, allow your “risky” investments to run their course. If you cannot stomach the daily fluctuations of the market, heed what the Father of Index Investing John Bogle said, “Don’t peek, don’t peek, don’t peek!” Just check them out during your regular updates, maybe quarterly or annually, so your nerves remain calm.

For those with huge risk appetites, again start with asset allocation as discussed above. Then just limit your investment adventures to the percentage you have rationally allocated for your risky investments.

So remember, you may have low or high risk appetite, but this shouldn’t be the only factor that determines your investment portfolio. Just like how we should eat a balanced diet to be healthy, so should our portfolio be in order to be financially sound. We should have a healthy asset allocation depending on our circumstances.

To read more on asset allocation, please click: There is romance in asset allocation.

Cheers to high FQ!

*********************************

ANNOUNCEMENTS

1. FQMom.com turns 5 this September (and also my birth month)! We are inviting all of you to join our month-long celebration. We offer free courier service on book orders. Talks booked in September will also get special discounts/freebies.

2. Mom and Son Podcast - Season 3 Episode 12 (Coach Chot Reyes)

PUSO! Today we sit down and talk with one of the main men behind the battlecry of our national Philippine Men's Basketball Team, Gilas Pilipinas. Learn how Coach Chot's love for basketball began, his journey to become a basketball coach. (1:50) The FIBA World Cup just finished and he shares his opinions on how the team performed after going winless this year. (14:08) We also reminisce on the historic game back in 2013 when we broke the curse against our Asian basketball rivals - South Korea. (22:30) Coach Tab Baldwin of the Ateneo Blue Eagles also had a statement about Philippine Basketball Culture and Coach Chot comments on this. (24:51) Lastly, we talk about the Philippine Basketball Program in general and what he believes we should do if we want to legitimately compete with the best in the world. (29:46)

#MomAndSonPodcast

Stream the episode now using these links:

Spotify

https://open.spotify.com/episode/2kV3fjBVOO290TNLXRNz1E?si=2cJMThPrSnq2Pz-zKwn5JQ

Apple iTunes

https://podcasts.apple.com/ph/podcast/mom-and-son-podcast/id1449688689?mt=2

Google Podcasts

https://podcasts.google.com/?feed=aHR0cHM6Ly9mZWVkcy5idXp6c3Byb3V0LmNvbS8yNDE0NDcucnNz

Buzzsprout

https://www.buzzsprout.com/241447/1714627-mom-and-son-podcast-season-3-episode-12-coach-chot-reyes

YouTube

(originally uploaded in Anton Fausto’s YouTube channel: https://www.youtube.com/watch?v=hGfOy09ukeQ)

FQ Mom YouTube channel:

https://www.youtube.com/watch?v=sW4cbHyzHNE

3. Thanks to those who already bought the FQ Book, especially to those who took the time out to send me their feedback. Your feedback is food for my soul. To those who have not gotten their copy yet, here’s a short preview of “FQ: The nth Intelligence”

You may now purchase the book in major bookstores, or if you want autographed copies, please go to FQ Mom FB page (click SHOP), or FQMom.com (click BOOKS), or email us at FQMomm@gmail.com

4. Want to know where your FQ stands? Take the FQ test challenge now! Click link: http://rebrand.ly/

Rose Fres Fausto is a speaker and author of bestselling books “Raising Pinoy Boys” and “The Retelling of The Richest Man in Babylon” (English and Filipino versions). Click this link to read samples – Books of FQ Mom. She is a behavioral economist, a certified Gallup strengths coach and the grand prize winner of the first Sinag Financial Literacy Digital Journalism Awards. Follow her on Facebook&YouTube as FQ Mom, and Twitter&Instagram as theFQMom. Her latest book is “FQ: The nth Intelligence.”