Money Management for Artists

“Anak, gutom ang aabutin mo dyan sa ginagawa mo!” is a line we always hear from parents of artistically inclined children.

A story about the great musician Maestro Ryan Cayabyab goes like this: At the tender age of six, the musically inclined boy witnessed the death of his mother Celerina Venzon Pujante. This was his mother’s dying wish to her four children, “Ipangako n’yo sa akin na walang sino man sa inyo ang papasok sa musika bilang hanap-buhay.” And she said so out of motherly love because she experienced the financial hardship of being an opera singer with low and irregular income.

Top photo: Celerina Venzon Pujante, Ryan Cayabyab’s mother as an opera singer. Bottom photo: The Cayabyab family photo in 1957 with Mom Celerina and Dad Alberto, siblings Melody, Barbara Ann, Alberto Jr., and Ryan.

Top photo: Celerina Venzon Pujante, Ryan Cayabyab’s mother as an opera singer. Bottom photo: The Cayabyab family photo in 1957 with Mom Celerina and Dad Alberto, siblings Melody, Barbara Ann, Alberto Jr., and Ryan.Cayabyab’s mother is not alone in this belief, “Gutom ang aabutin mo sa pa-art-art!”

We have preference for the stable income as we are all risk-averse and I tell you, one is most risk-averse when it comes to the welfare of his/her children.

Today, we see a lot of parents open up to the less stable artistic world that their children want to get into. It is a balancing act of being supportive and not over indulging (the latter for parents who can afford to continue child support endlessly).

Millennials and Gen Z are also becoming more adventurous and less afraid of trying out the artistic world, especially as they see all these famous artists raking in millions and receiving the adulation of their fans. But of course, surviving and thriving in this uncertain path remains a great challenge. The perennial question of “What will you do to fend for yourself financially?” has to be addressed. Here are some points that will help artists and everyone whose income is not stable:

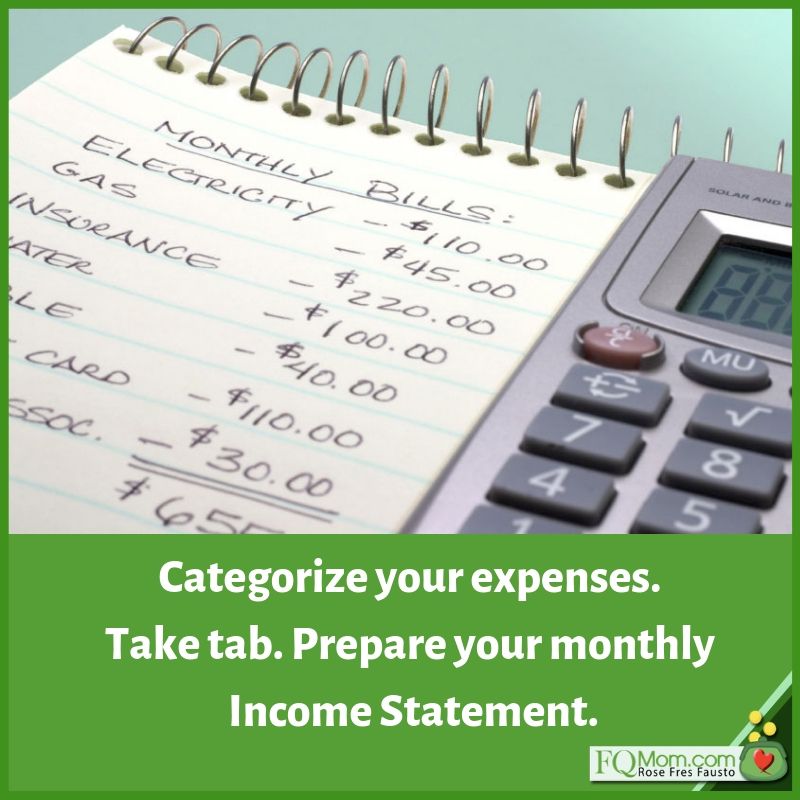

1. Categorize your expenses: Be aware of what are Living Expenses and Working Expenses. Living expenses are your personal expenses just like the expenses of someone who is in a regular corporate job – rent for home, food, transportation, recreation, etc. The working expenses are those needed to practice your profession – rent for your office, art and other office supplies, necessary courses, memberships, etc. This is now a tough thing to do because most artists do their work from home and their recurring expenses are usually merged – e.g. internet connection is for both living and working categories. But at least try to be aware so that you can figure out which ones are really necessary and which ones can be delayed as you start building your artistic profession. According to Burn Gutierrez of Rock to Riches and Angat Pilipinas Coalition for Financial Literacy, “In buying your equipment, do not settle for cheap ones that won’t last. Look for good quality second hand equipment in good condition.”

2. Take tab. Prepare your monthly Income Statement. It might be a hassle but it’s necessary that you have an easy to implement process to take tab of your earnings and expenses. This way, you also create a historical recording of how your money flows, what goes in, what goes out. This will also make you aware of the seasonality of your income so you know how to adjust accordingly. Gutierrez also suggests bringing baon during rehearsals and studio practices. You do not only save on costs but also become healthier as you can control the quality of your food.

3. Set your goals. Once you’re clear with what you want to achieve, all the saving and investing, and the income targets will be more meaningful and focused. Being clear with your goals will also help you allocate your limited and unstable sources of income. When the income starts pouring in, your goals will also guide you as your compass as to how you should be spending your money, “Should I use the money to invest in equipment, attend this course, or should I give myself a treat?”

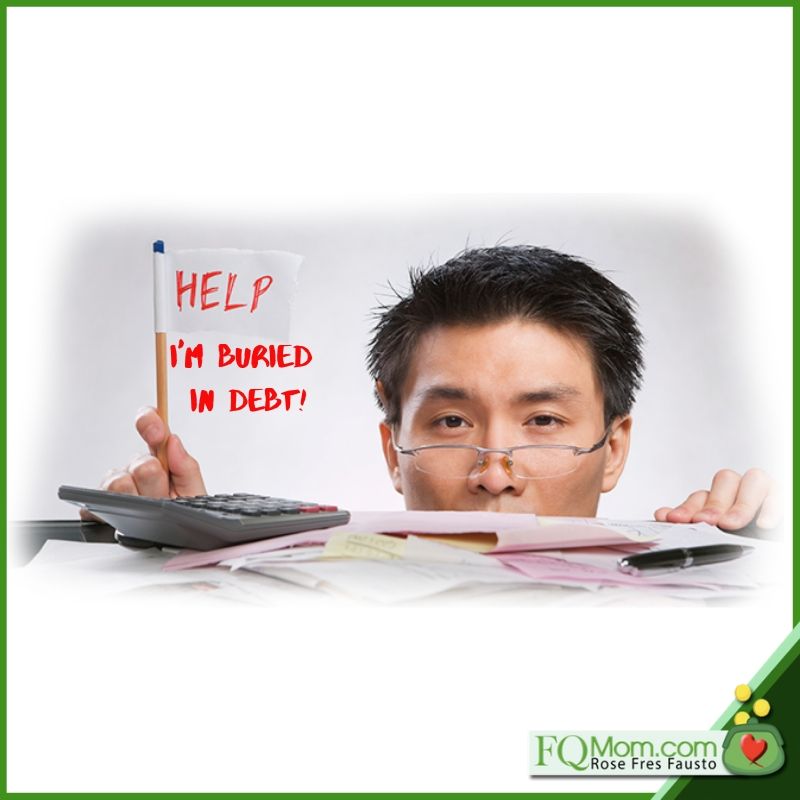

4. Pay down your debts. If for some reason, you already accumulated a considerable amount of debts, have a plan on how to pay them down. In a Wall Street Journal analysis on student loans in 2013, they found out that the top three schools with the most student debt load were art, music, and design schools. Debt concerns can be so toxic that most people will just ignore them hoping that they will go away, but they don’t. They haunt you. Debt burden really weighs you down and you don’t want this to hamper your creativity, which consequently, leads to lower engagements, and lower income. Free yourself from debt in order to free your creative juices to create your art.

5. Keep your steady income as long as you can. Because you will continue to spend regardless of the number of gigs that you receive, keep your steady income until such time as you are able to build a comfortable level of Emergency Fund. Continue to be good at your job. You don’t just give value to the source of your steady income, you also create important connections and good will that will lead you to more opportunities where you can use your artistic talents.

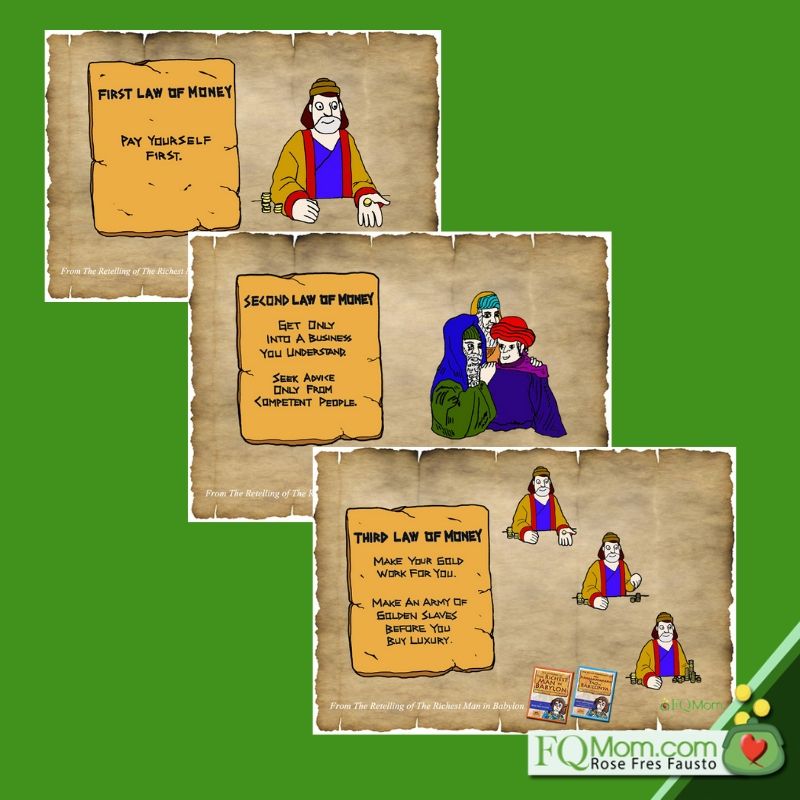

6. Follow the basic laws of money:

a. Pay yourself first. No matter how small (or big) your earnings are, you just have to set aside for your saving and investing. It might be difficult to do an automatic scheme because of your irregular income, but still try to do so. Automating may even serve as your nudge to earn more every month, as you know that a certain amount will be deducted and invested on that designated day of the month.

b. Get into a business that you understand and seek advice only from competent people. In creating your extra income, choose something that uses or is related to what you already know. Be careful with investment options that are too good to be true because most of the time, they are not true but scams! ![]()

c. Make your gold work for you. Make an army of golden slaves before you buy luxury. Once you land a high paying deal, it might be tempting for you to treat yourself and use that battered justification of “deserve ko naman e! ”Please, you know what you deserve? A financially healthy old self! And this can only be attained if you learn how to delay gratification. Again, FQ Mom’s simple guideline is “Buy luxury only if you can afford to buy 10 pieces of it.”

So, there you go. It’s an exciting world for artists these days. It’s now easier to reach out to your audience and share your craft as going online potentially connects you directly to everyone, but the temptations of misplaced and premature spending are also more abundant and harder to resist.

I hope the above guidelines help you practice your craft free from financial problems. Because our world needs more great artists, but not the starving kind! ![]() Cheers to high FQ!

Cheers to high FQ! ![]()

*********************************

ANNOUNCEMENTS

1. And speaking of artists, our FQwentuhan guest on Friday is top wedding photographer Pat Dy. Watch out for it.

2. Mom and Son Podcast - Season 3 Episode 11 (VJ SAMM ALVERO PT 1)

VJ Samm's 2 M's deserves 2 episodes so here we have the first part of our Samm Alvero Special! We discuss the story of her famous online show with MYX, Pop Cooltured. How did it start? What's the deal with her "Big Payong?" She shares her story and even about the time she received a lot of backlash and controversy for one of her episodes. Stream it now!

#MomAndSonPodcast

Spotify

https://open.spotify.com/episode/6091EKSpZpCWFAeb9UhOYQ?si=murC1BONQPmzkdAuxvrzog

Apple iTunes

https://podcasts.apple.com/ph/podcast/mom-and-son-podcast/id1449688689?mt=2

Google Podcasts

https://podcasts.google.com/?feed=aHR0cHM6Ly9mZWVkcy5idXp6c3Byb3V0LmNvbS8yNDE0NDcucnNz

Buzzsprout

YouTube

(originally uploaded in Anton Fausto’s YouTube channel: https://youtu.be/EdKb5ynMln0)

FQ Mom YouTube channel:

https://www.youtube.com/watch?v=cjtgGsjikvw&t=8s

3. Thanks to those who already bought the FQ Book, especially to those who took the time out to send me their feedback. Your feedback is food for my soul. To those who have not gotten their copy yet, here’s a short preview of FQ: The nth Intelligence

You may now purchase the book in major bookstores, or if you want autographed copies, please go to FQ Mom FB page (click SHOP), or FQMom.com (click BOOKS), or email us at FQMomm@gmail.com

4. Want to know where your FQ stands? Take the FQ Test Challenge now! Click link. http://rebrand.ly/FQTest

Rose Fres Fausto is a speaker and author of bestselling books Raising Pinoy Boys and The Retelling of The Richest Man in Babylon (English and Filipino versions). Click this link to read samples – Books of FQ Mom. She is a Behavioral Economist, Certified Gallup Strengths Coach and the grand prize winner of the first Sinag Financial Literacy Digital Journalism Awards. Follow her on Facebook&YouTube as FQ Mom, and Twitter&Instagram as theFQMom. Her latest book is FQ: The nth Intelligence.

ARTICLE ATTRIBUTIONS:

- Thanks to Burn Gutierrez of Rock to Riches and Angat Pilipinas Coalition for Financial Literacy for contributing some FQ tips.

- https://www.artsy.net/article/artsy-editorial-financial-advice-artists-four-experts - source for student loans coming from art, design, and music schools.

IMAGE ATTRIBUTIONS:

Photos from jimnettes.com,positivelyfilipino.com and Ryan Cayabyab, mirror.co.uk, uplarn.com, financialblogger.co.uk, and fwd.com.ph, modified and used to help deliver the message of the article.