Why we should reinvent re-tirement

We hear a lot of people say they want to retire before they reach the age of 60. We see a lot of articles enticing people to retire early.

What comes to mind when you hear the word retirement?

Have you ever wondered how we came about this concept of retirement?

In the beginning there was no retirement. People worked until they died. So who invented retirement?

Chancellor Otto Von Bismarck, the inventor of retirement.

Chancellor Otto Von Bismarck, the inventor of retirement.

In 1883, Chancellor Otto Von Bismarck of Germany had a problem. Marxists were threatening to take control of Europe. To prevent his countrymen from joining the Marxist group, Bismarck invented the concept of retirement and announced that he would pay pension to any nonworking German over age 65, 70 years old to be exact. This was of course a calculated political move because hardly anyone lived to reach that age at the time.

It was such a great move that it became a trend even in other countries. All around the world, as older workers showed less productivity in their jobs, it became a good idea to encourage them to leave their jobs to make way for the younger generation.

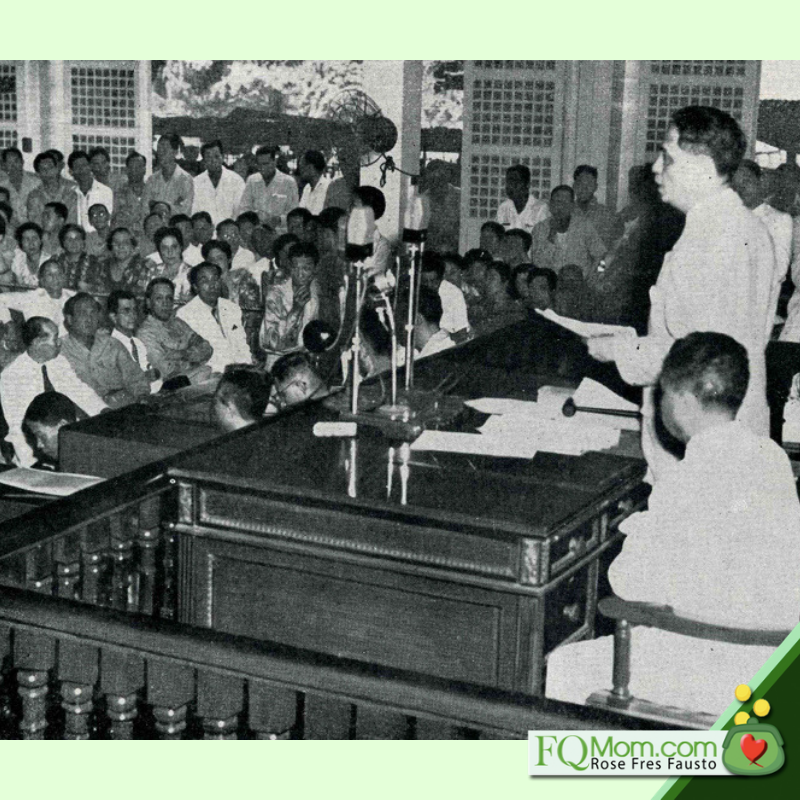

Franklin D. Roosevelt signing the Social Security Law in 1935.

Franklin D. Roosevelt signing the Social Security Law in 1935.

In 1935 US President Franklin D. Roosevelt signed into law the Social Security Act. This act guaranteed the income of the unemployed and the retirees. This law has remained relatively unchanged to this day.

Philippine President Manuel Acuña Roxas proposing the SSS Bill in 1948.

Philippine President Manuel Acuña Roxas proposing the SSS Bill in 1948.

In the Philippines it was President Manuel Acuña Roxas who proposed the Social Security bill in Congress during this State of the Nation Address (SONA) in 1948. After years of delay due to objections and amendments, it was only in 1957 when the SSS Law was finally implemented for the benefit of the private sector and self employed workers.

The Government Service and Security Service Insurance System (GSIS) was created earlier in 1936, to provide social security services for government employees. It was later on amended in 1997 to upgrade the benefits.

Life expectancy

In the 1800s when Otto Von Bismarck invented retirement and 65 became the anchored age, the average lifespan was only above 40 years. In 1935 when the Social Security was implemented in the US, the average American lifespan was 58 for males and 62 for females. Today, this has gone up to 77 for males and 82 for females based on 2015 World Health Organization data.

It might interest you to know that the Philippines ranked no. 124 out of 183 countries with 65 for males and 72 for females. The number one spot went to Japan at 81 for males and 87 for females.

With this phenomenon of longer life spans, retiring at 60 might not be a good idea anymore. Not good for our SSS and GSIS coffers, and also not good for the average person’s quality of life after retirement.

Do you want to know your estimated life span? Go to Life expectancy calculator. ![]() I checked out mine and got 85.5. However, this does not take into account the life spans of my mom and dad who both lived long reaching 87 and 91 years, respectively. So to be conservative (i.e. the longer I assume the more conservative I am in setting aside financially for my old age), I should even prepare for a life beyond 90 in order to have a buffer.

I checked out mine and got 85.5. However, this does not take into account the life spans of my mom and dad who both lived long reaching 87 and 91 years, respectively. So to be conservative (i.e. the longer I assume the more conservative I am in setting aside financially for my old age), I should even prepare for a life beyond 90 in order to have a buffer.

Know your estimated life span by accessing this link: Life expectancy calculator

Retirement should be reinvented.

The photo of two old people watching the sunset by the beach can only be joyful if this is not what you do everyday. Human beings are wired to continuously improve, evolve and be relevant. Take these away from them and no amount of comfort will give them meaningful existence.

Retirement should not be viewed as an end game or a chapter in life a lot of people consider “pay-back” time – “Kami naman ang alagaan nyo!” “Deserve namin lahat yang mga libreng sine, cake at 20% discount!”

Maybe a better way to treat this chapter is to go through the wisdom that you’ve accumulated and find a way how to continue contributing to society. This does not mean that you should continue to work like a horse (but should this bring you joy, go ahead, as long as you don’t sacrifice your health and family ties). This is the time when you should consciously look for meaning in your work. You should at least be aware of, and really working on your Ikigai, your intersection of what you love to do, what you’re good at, what the world needs, and what you can get paid for.

Incidentally, the country who’s on the top spot in life expectancy is Japan, the inventors of Ikigai! They call this the reason they get up each morning. Oh, and do you know that in Okinawa where the life span is famously long, they do not have a word for retirement in their local dialect?

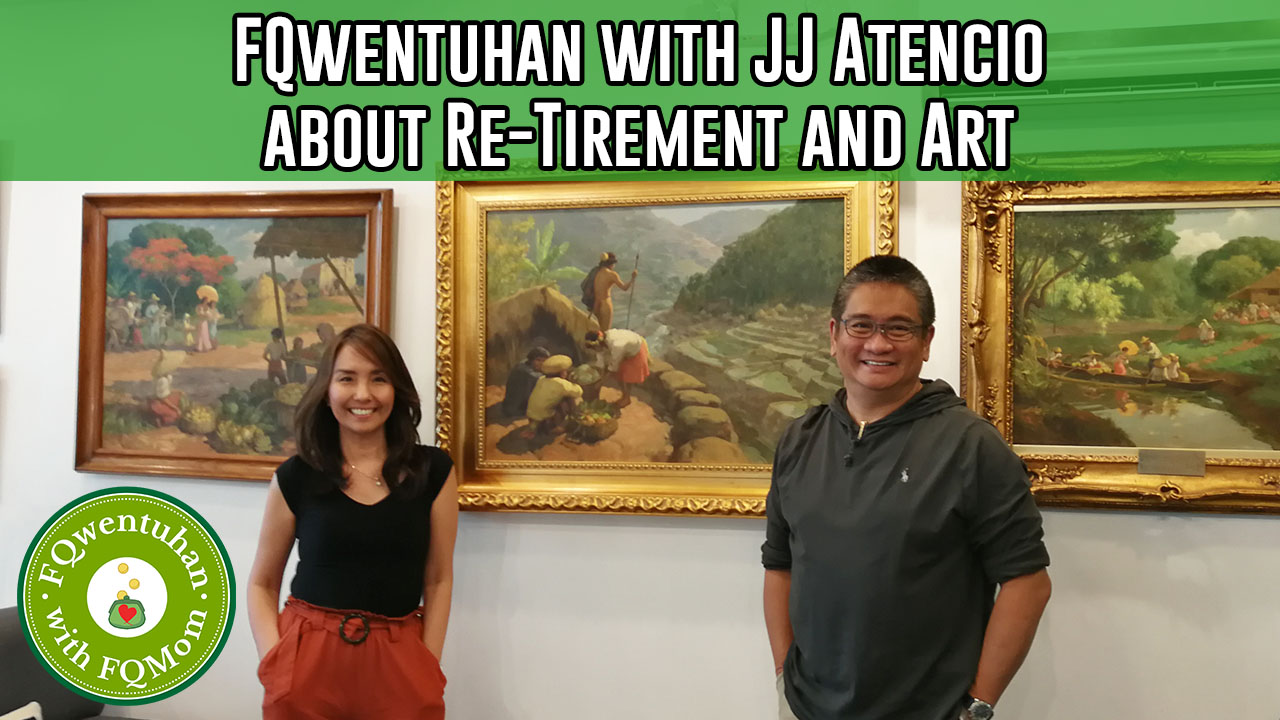

If all these are not enough to convince you to re-think and re-invent retirement, maybe my conversation with JJ Atencio in this week’s FQwentuhan will.

JJ Atencio, the former CEO of 8990 Holdings Inc. (listed in the PSEi with stock code HOUSE) retired over a year ago, and he is not just watching the sunset everyday. A few weeks ago, I had the privilege to visit him in his office that houses a superb collection of art pieces, you would think you’re in a museum. We talked about retirement spelled as “Re-Tirement” which means to change the tires. Join us on Friday. Cheers to high FQ!![]()

Watch FQwentuhan abour re-tirement and art with JJ Atencio on Aug. 9, 2019 via our FQ Mom You tube channel.

Watch FQwentuhan abour re-tirement and art with JJ Atencio on Aug. 9, 2019 via our FQ Mom You tube channel.

*********************************

ANNOUNCEMENTS

1. Mom and Son Podcast - Season 3 Episode 6 (Why do we celebrate?)

Why do people celebrate birthdays, anniversaries, graduations, accomplishments and anything in general? We discuss the functional and practical aspect of why we celebrate things, from historical celebrations to our personal stories.

Today is also an important day because it's the FQ Dad, Marvin Fausto's birthday! Happy Birthday!

#MomAndSonPodcast

Stream the episode now using these links:

Spotify

https://open.spotify.com/episode/2mP4BiAg4ZEJo12fZnrOvC?si=EX8c24ugT9ODuG1gPzjJpQ

Buzzsprout

https://www.buzzsprout.com/241447/1504996-mom-and-son-podcast-season-3-episode-6-we-do-we-celebrate

Apple iTunes

https://podcasts.apple.com/ph/podcast/mom-and-son-podcast/id1449688689?mt=2

Google Podcasts

https://podcasts.google.com/?feed=aHR0cHM6Ly9mZWVkcy5idXp6c3Byb3V0LmNvbS8yNDE0NDcucnNz

YouTube

(originally uploaded in Anton's Youtube channel: https://youtu.be/q4Igf2JGfNQ)

https://www.youtube.com/watch?v=s0XPwkMdCcU

2. Thanks to those who already bought the FQ Book, especially to those who took the time out to send me their feedback. Your feedback is food for my soul. To those who have not gotten their copy yet, here’s a short preview of "FQ: The nth Intelligence."

You may now purchase the book in major bookstores, or if you want autographed copies, please go to FQ Mom FB page (click SHOP), or FQMom.com (click BOOKS), or email us at FQMomm@gmail.com

3. Want to know where your FQ stands? Take the FQ Test Challenge now! Click link: http://rebrand.ly/FQTest

Rose Fres Fausto is a speaker and author of bestselling books "Raising Pinoy Boys" and "The Retelling of The Richest Man in Babylon' (English and Filipino versions). Click this link to read samples – Books of FQ Mom. She is a behavioral economist, a certified Gallup strengths coach and the grand prize winner of the first Sinag Financial Literacy Digital Journalism Awards. Follow her on Facebook&YouTube as FQ Mom, and Twitter&Instagram as theFQMom. Her latest book is "FQ: The nth Intelligence."