Myopia (and your FQ)

I am myopic! When I was in my early teens, I was diagnosed with myopia, a condition of refractive error wherein the eye does not bend or refract the light properly to a single focus to see images clearly. In layman’s language, it means I’m nearsighted.

I write about myopia because today I will be at the first BSP Financial Education Expo to give a short talk on Behavioral Economics and moderate the panel on financial innovations. Why myopia? Because myopia is one of the three behavioral factors that affect the way we financially prepare for our retirement. (The other two are inertia and loss aversion.)

Around 40 percent of our population is afflicted with myopia, the health condition of the eyes, but I would think that close to 99 percent of our population is afflicted with behavioral myopia – i.e. our inability to see our future old self clearly. Yes, we are all present-bias! We systematically prioritize short-term pleasure over long-term well-being. The millennials are not alone in their YOLO and FOMO syndrome. Even supposedly rational adults suffer from this. We seem to act as if we’re forgetting YAGO.

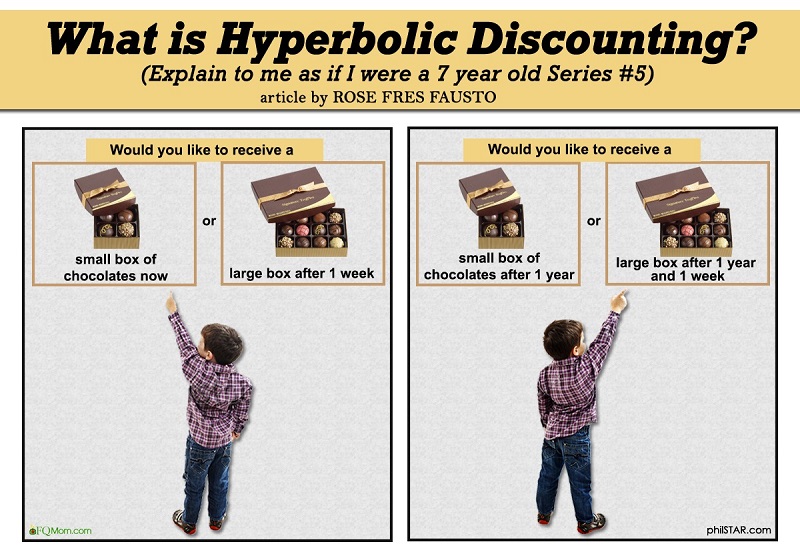

I wrote an article about this entitled Hyperbolic Discounting in my Explain to Me As If I Were a Seven Year Old Series where I discussed how we are able to make rational decisions when we are comparing two options, both in the future, versus two options, one today one in the future. When the present is involved, we tend to have a distorted way of discounting the later option such that we easily give in to the now pleasure or reward, resulting in an irrational decision. (Click to read article)

Let’s go back to my early teens diagnosis of my myopia. I was prescribed with correction glasses but you might wonder why you don’t see me wearing them. Because I didn’t really want to wear them. I found them a bother and maybe I also didn’t relish looking like a nerd way back my teenaged years. Because of this, there would be times when I’d be mistaken for a snob as someone smiling at me from afar wouldn’t get a smile back from me. Truth is, I’m not a snob, I just don’t see people’s faces from afar! But I do wear my glasses when I need to see things far away from me – e.g. while listening to lectures when seated far from the board, watching a movie in big movie houses, driving during the time when I used to drive, and in other cases when I have to focus on faraway objects.

It’s the same thing I do in my saving and investing. “I wear my glasses” in figuring out how much to save and invest and then operationalize it. Marvin and I discussed early on what kind of lifestyle we wanted in our old age. How much would this cost? How much should we save and invest in order to achieve this? I’m not claiming to have the perfect formula but based on our recorded past expenses and the general increase of goods and services, plus the increase in the standard of living that we’ve welcomed, we tried to operationalize it. This involved observing the three basic laws of money:

- Pay yourself first. This is done via automatic saving, taking out the agreed upon percentage from the income.

- Get into a business we understand. We have been investing in the stock market on a regular basis, again through automatic programs so as not to allow our emotional selves get in the way. This is coupled with asset allocation.

- Make your gold work for you. Make an army of golden slaves before you buy luxury. The Ilocana in me made this almost effortless that I even came up with a “mabagsik” guideline: Buy luxury only if you can afford to buy 10 pieces of it.

And just like what I do with my eyeglasses, I don’t need to wear them all the time. Once we’ve put in place the above systematic saving and investing, we are free to use the money that’s left without the guilt and worry. As I didn’t want to have that bother of wearing eyeglasses and maybe looking like a nerd, the same goes for my spending. Once the saving and investing have been prioritized, there’s no need to bother doing a lot of opportunity cost computations for every expense, and looking and acting stingy all the time, at the expense of enjoying the delayed luxury as prescribed in basic law no. 3.

So I hope you all remember. We’re all myopic when it comes to preparing financially for our retirement. Wear those “corrective glasses” in order to see your future selves clearly and prepare for it. Once you put a system in place to take care of your retirement saving and investing, “take off those glasses” then go ahead and enjoy the present.

Cheers to high FQ! ![]()

*********************************

ANNOUNCEMENTS

1. I’ll be at the Bangko Senral ng Pilipinas’ 1st Financial Education Stakeholders’ Expo from Nov. 27-28, 2018 (Tuesday to Wednesday) at the SMX Convention Center, Manila. On Day 2, November 28 (Wednesday), I’ll be giving a talk on “Fin-Ed Program Design Using Behavioral Economics” and also moderating the plenary session on Innovations in Financial Education. I hope to see you there! ![]()

2. Thanks to those who already bought the FQ Book, especially to those who took the time out to send me their feedback. Your feedback is food for my soul. To those who have not gotten their copy yet, here’s a short preview of "FQ: The nth Intelligence."

You may now purchase the book in major bookstores, or if you want autographed copies, please go to FQ Mom FB page (click SHOP), or FQMom.com (click BOOKS), or email us at FQMomm@gmail.com.

3. Want to know where your FQ stands? Take the FQ Test Challenge now! Click link: http://rebrand.ly/FQTest

Rose Fres Fausto is a speaker and author of bestselling books "Raising Pinoy Boys" and "The Retelling of The Richest Man in Babylon" (English and Filipino versions). Click this link to read samples – Books of FQ Mom. She is a behavioral economist, a certified Gallup strengths coach and the grand prize winner of the first Sinag Financial Literacy Digital Journalism Awards. Follow her on Facebook & YouTube as FQ Mom, and Twitter & Instagram as theFQMom. Her latest book is "FQ: The nth Intelligence."