‘There can only be one queen!’ (The story of our big investment called home)

No matter how great your relationship is with your mother-in-law or your own mother for that matter, there can only be one queen in a household! So for couples intending to get married or are already married, have your own home and spare the family drama.

In George Clason’s Babylon Series “Seven Cures of the Lean Purse,” the fifth cure is “Make of thy dwelling a profitable investment.” This 1926 classic recognizes that no man can fully enjoy life if his children and wife are not housed in a good home. And of course, I will add that peace at home is elusive if there is more that one queen.

I was 24 when I got married and among the first things that Marvin and I prepared for was our own living space. Fortunately, his parents owned an apartment with six doors, intended to be the starting homes of their six children. We occupied Unit 10-D and offered to pay rent. Of course, my in-laws didn’t allow it so it was free rent for the duration of our stay there, but we spent for the renovation before the wedding and also the maintenance thereafter.

Fast-forward to four years after the wedding and our 75-square-meter home was becoming too small for our growing family. We had two kids then who were both energetic young boys. It was time to build our own house.

We looked into our savings and investments, our two income family cash flow, and the housing loan benefits. Hmm... we weren’t sure whether the total amount could build us the dream house we wanted for our growing family. Marvin and I had planned to have three children raised in an airy home with sufficient play space.

Then I remembered my mom’s advice about building a home. She and my dad built twice. She said, “Building a house is pretty much like marriage. You take a leap of faith. Don’t wait for the time when you feel 100 percent sure that you have enough money to build one; for if you do, that time might never come, or will be too late that your children are all grown up preparing to leave your ‘dream house!’”

And so we embarked on our Dream House Project armed with our savings, terminated investments, housing loan, lots of photos taken for our pegs, and lots of hope, excitement and determination. Upon the advice of my brother-in-law, we didn’t hire a contractor in order to save on cost. We did save on cost and but we were not prepared for the amount of work it entailed. But looking back, that decision put me in a situation to think hard about my being a working mom at that time. It highlighted the fact that I was just giving my young kids what was left of my limited time, not to mention the quality of that left-over time. But that’s another story. ![]()

At the start of our construction, we were a happy young couple each time we visited the site. We were always treated to the sight of fast rising dream house from ground zero. Timetable: Check! And then came the rainy season and all sorts of external factors. From an original timetable of six months, construction went on for 12 months. The original budget also ballooned to almost 50 percent more! The finishing stage was painstakingly slow and expensive that Marvin and I called it the “inishing stage!” as in inish na inish na kami dahil hindi matapos-tapos!

We moved in to our house even without simple landscape, so it was a bit dusty. The money we were willing to pour in was finished and we didn’t want to scrape everything out from our savings. Both trained as risk analysts, borrowing on top of the subsidized employee housing loan was out of the question. Instead of turning our Dream House into a Nightmare Money Pit, we just said, “Okay, it’s habitable enough, let’s move in.”

After several months and thanks to my consultancy job with USAID, there was enough cash to have the landscape done. Later on, new furniture and appliances were added. In a few years, and after saving up for it, we started looking for the owner of the adjacent lot. Years passed but we could not find the owner. It was only after a year of our bunso praying for it every single night during our family bedtime prayer, “Dear Jesus, please help us find the owner of the next lot and allow us to buy it” and we did find the owner and finally bought it! Another year later, we built on the property to include a nice recreational area with a swimming pool, my husband’s man-cave, dance studio and party area, still mindful of what we can afford without sacrificing the basic needs of our family.

Our home is now over two decades years old. It has been the venue of a lot of happy moments with family and friends. Its lot value has grown over tenfold from our original purchase price. It was definitely a great investment. But more than that, it’s the non-monetary returns that we value more. Clason’s fifth cure “Make of thy dwelling a profitable investment” is indeed true. Our home has been the repository of our family memories - regular meals spent together talking, parties big and small to celebrate milestone and non-milestone events, singing after dinner, dancing, watching movies together, getting sick and recovering, arguing and settling things among ourselves, family meetings, discussing dreams big and small, praying together, my writing moments, study sessions, shoots and other school activities, and many many more.

This is where Marvin and I build our family with love and care. From the time we started married life at the 75-square-meter apartment in 1989 up to now, it has been easier for us to do so because he made sure that there should only be one queen in the house! ![]()

![]()

*********************************

ANNOUNCEMENTS

1. Know more about how Sam Mangubat, Tawag ng Tanghalan Season 1 First Runner-Up and Youtube Idol, manages his finances, his financial journey, and how the FQ book impacted him. You will learn a lot from our FQwentuhan! Watch our FQwentuhan tomorrow on FQ Mom Facebook page and Youtube channel.

2. I’ll be giving a talk at the University of Sto. Tomas courtesy of the UST Psychology Society entitled “Project Hamon (Handling Money)." It will be on Oct. 19, 2018 (Friday) at the TARC Auditorium, UST Graduate School. Kindly get in touch with Gerard Sanchez of the UST Psychology Society at 0917-413-3007.

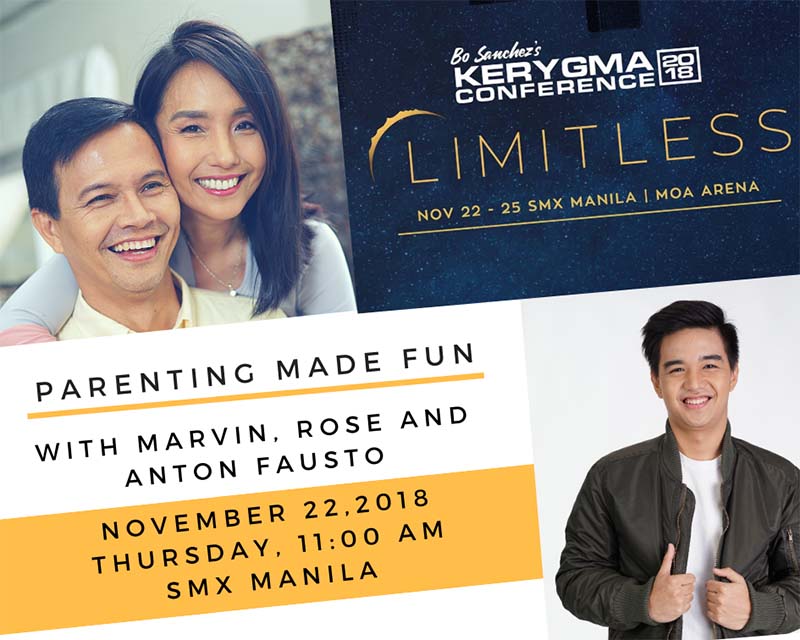

3. The biggest Catholic inspirational and learning event is finally here again! Kerygma Conference 2018: Limitless! Marvin and I are so excited because we will be sharing the stage with our bunso, Anton Fausto, in our talk “Parenting Made Fun.” We will be there on November 22 (Thursday) at 11:00 a.m., SMX Convention Center, Manila. For tickets and more information, visit www.kerygmaconference.com.

4. I’ll be at the Bangko Senral ng Pilipinas’ 1st Financial Education Stakeholders’ Expo on November 27 to 28, 2018 (Tuesday to Wednesday) at the SMX Convention Center, Manila. On Day 2, November 28 (Wednesday), I’ll be giving a talk on “Fin-Ed Program Design Using Behavioral Economics” and also moderating the plenary session on Innovations in Financial Education. I hope to see you there! ![]()

5. Thanks to those who already bought the FQ Book, especially to those who took the time out to send me their feedback. Your feedback is food for my soul. To those who have not gotten their copy yet, here’s a short preview of “FQ: The nth Intelligence.”

You may now purchase the book in major bookstores, or if you want autographed copies, please go to FQ Mom FB page (click SHOP), or FQMom.com (click BOOKS), or email us at FQMomm@gmail.com.

6. Want to know where your FQ stands? Take the FQ Test Challenge now! Click link: http://rebrand.ly/FQTest.

Rose Fres Fausto is a speaker and author of bestselling books “Raising Pinoy Boys” and “The Retelling of The Richest Man in Babylon” (English and Filipino versions). Click this link to read samples – Books of FQ Mom. She is a behavioral economist, a certified Gallup strengths coach and the grand prize winner of the first Sinag Financial Literacy Digital Journalism Awards. Follow her on Facebook & YouTube as FQ Mom, and Twitter & Instagram as theFQMom. Her latest book is “FQ: The nth Intelligence.”