‘Help, I’ve been working for 10 years and still no savings!’

Today, we give way to a letter for help from a reader who wants to improve his FQ and financial well-being. Here’s his letter sent via email.

Hi Rose!

I took the FQ test and got a score of 50!

Even if you get a dismal FQ Score at the start, remember that it is not cast in stone, as you can still improve it.

I pity myself for my poor knowledge in finance. I really want to improve my FQ - not only my knowledge but also my attitude and habits with regard to financial expenses, savings and investments.

I am an OFW and earning just enough to accommodate the needs of my family in the Philippines and myself here abroad. Sad to say, after working for almost 10 years, I still don't have savings yet. I tried hard but it seems like I'm doing it wrong. I'm 33 and I’m worrying so much. I would like to seek your advice how to go about it. Right now, I am constantly monitoring my expenses and cash flow just to track where my earned money goes. Unfortunately, at the end of the month I can only save 0.37 percent amount from my salary.

My wife back home does not show any interest when I discuss about plans to save and invest. My family is living in a compound with my wife’s relatives. Unfortunately, she acquired the typical Pinoy way of spending money. For example, when it’s holiday or when there’s a special occasion, it is a must to buy new clothes, buy gifts, or give “pakimkim” (cash gifts), prepare food for invited and uninvited visitors. I would oftentimes say no to these expenses, but that would always result in her getting mad, consequently, making me feel bad. This is my main obstacle why I can’t do the saving and investing that I should have started a long time ago.

Sorry napakwento na ako ng marami. Anyway, thank you so much for your help in advance.

Lio B.

My reply

Hi Lio. Thank you for allowing me to share your story with our readers. I’m sure your story resonates with many of our kababayans, especially the OFWs.

Your FQ Score. 50 is low but it is not cast in stone, as you can still bring this up. Make sure you already know the answers to Part 1, Knowledge, and have them as your guide in making your financial decisions. Part 2 Behavior is the big challenge for you, and I hear you when you say your wife’s spending habits are your biggest obstacles in implementing your saving and investing plans.

What to do

I’m glad that you are already tracking your expenses. You were very precise when you said, “I can only save 0.37 percent of my income!” Continue tracking your expenses, and also ask your wife to do the same. But I guess, we should go a bit deeper here.

Here are some of the things I suggest you do:

1. You and your wife should try to figure out and understand your respective money values. If you already have a copy of “FQ: The nth Intelligence,” go through the childhood money memory exercises.

I’m sure you will hit raw nerves here. Your wife will understand why she spends so much on festivities, despite your plea to save and invest. You will also understand any deep-rooted money issues yourself. Hopefully, you two can discuss openly and healthily, without judgment and with loving heart with one goal – i.e. to understand each other well when it comes to your respective relationship with money.

2. Then proceed to do the next exercise on aligning your money habits with your core values. This will be an opportune time for the two of you to set out your goals as a family. Each goal has a financial component. With agreed upon goals, the two of you can cooperate to achieve them together. The good thing about knowing what you are saving and investing for is that when you see one overspending on something, you can just say, “Hon, do you think this unnecessary expense will set us back in fulfilling our common goals?” instead of the negative, “You’re very magastos…yada…yada…!”

3. Follow the three basic laws of money:

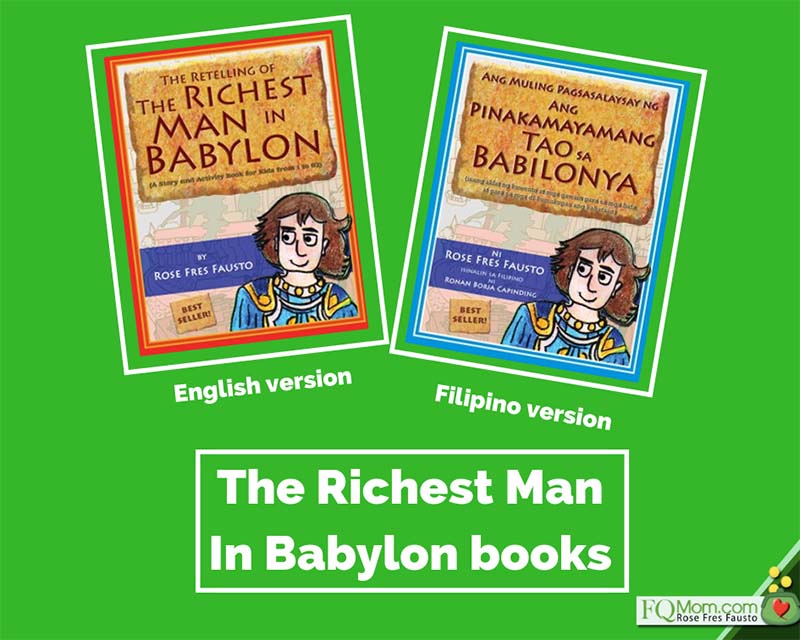

The three basic laws of money are outlined and narrated in easy to understand story in the books above, now in English and Tagalog versions.

a. First Law: Pay yourself first. The first item where your income should go to is “for yourself” in the form of savings and investments. Your 0.37 percent savings rate is not prioritizing yourself. You can explain to your wife that if you are only saving what we call in the vernacular as “tira-tira” or scraps, then you can just imagine your future old selves - living on…“tira-tira” and most likely become financial burdens to your loved ones and society. Save at least 10 percent of your income. List down all your actual expenses for one month. Chances are, there are a lot of items there that you can eliminate in order to pay yourself first. If jumping from 0.37 percent to 10 percent is a big shock, then work your way up – month by month, but do it on your way to 20 percent and make big increases when you get pay hikes.

Save up for your Emergency Fund (amount equivalent to three to six months of your expenses) placed in money market instruments or time deposits. After you’ve completed this, you can now invest for your medium and long-term goals, including retirement. Invest in equity index funds. Ask about automatic features such as the Easy Investment Program of COL Fund Source in COL Financial. Their platform makes all the country’s major mutual funds available online. You can also ask banks about their similar instruments in the form of UITF (Unit Investment Trust Funds). Check the insurance provided to you by your employer. If you don’t have, you may also include the purchase of term insurance in your necessary expenses.

b. Second Law: Get into a business that you understand and seek advice only from competent people. Increasing your income is the obvious way to improve your financial condition. May I just remind you about this second basic law of money? You may be lured into deals and businesses that seem to be working well for your relatives and friends. But please find out where your competence is and that’s where you devote your time and resources. Be careful with those who peddle high return low risk investment propositions to avoid scams. For the meantime, do well in your current job and improve your skills, while you set aside savings and investments regularly from your income into passive investments as mentioned above.

c. Third Law: Make your gold work for you. Make an army of golden slaves before you buy luxury. This is what you should convince your wife to observe. Tell her it’s okay to enjoy luxury, but do so at the right time and not prematurely. You have to make sure that you have accumulated enough cushion before you do this. Delaying gratification is the only way you can allow yourself to benefit from the power of compounding. As simple guideline, I say, “Buy luxury only if you can afford to buy 10 pieces of it.”

The laws of money are pretty simple and straightforward. Unfortunately, simple is not always easy. And that is why it is important to get to the bottom of it. After you understand your respective money issues, and come up with your united family goals, you can now design things in order to make it easier for you to achieve your financial goals. One way is to make it automatic as discussed in the first law of money. Another way is for the two of you to add some positive vibes to your conversations about money. What would make you enjoy money talks? Would an image-rich poster of your goals that you can look at on a daily basis help you save more? If so, use that poster as your screen saver on your cellphone or any device that you see every day. Would a monthly reporting to each other of both your expenses and extra income you earn entice you to save more? Does your wife have an income-generating activity at home? Encourage her to have one. Think of these simple things then work your way up to achieving your goals together as husband and wife. As I always say, “A husband and wife are not just united as one heart and soul, but also one Balance Sheet!” So it is imperative that you are on the same page when it comes to money matters.

When a husband and wife are united in their money values and behavior, married life will be a lot more peaceful and joyful.

Cheers to a high FQ couple! ![]()

*********************************

ANNOUNCEMENTS

1. If you want to professionalize homemaking, check out the seminars of H&S in collaboration with Kenvale of Australia. Visit their FB Page “Homestyle & Skills.” I look forward to seeing you in my session on Oct. 3, 2018. Click link to sign up - #HomeGoals.

If you’ve already registered, please join our H&S FQ Mom group on Facebook. You will find your Homework there! ![]()

2. I’ll be giving an FQ Talk (Finance 101) for Avida Land on Oct. 13, 2018 (Saturday), 3:00 p.m. at the Ascott Hotel, BGC. This is a by-invitation event so please get in touch with Ms. Karen Trixy Kalalo at (+63) 917-836-2889.

3. I’ll be giving an FQ Talk at the East Bay Residences on Oct. 14, 2018. If you’re a Rockwell East Bay client, I look forward to seeing you there. If you know someone who is a client, ask to be their guest. ![]()

4. Thanks to those who already bought the FQ Book, especially to those who took the time out to send me their feedback. Your feedback is food for my soul. To those who have not gotten their copy yet, here’s a short preview of “FQ: The nth Intelligence.”

You may now purchase the book in major bookstores, or if you want autographed copies, please go to FQ Mom FB page (click SHOP), or FQMom.com (click BOOKS), or email us at FQMomm@gmail.com.

5. Want to know where your FQ stands? Take the FQ Test Challenge now! Click link: http://rebrand.ly/FQTest.

Rose Fres Fausto is a speaker and author of bestselling books “Raising Pinoy Boys” and “The Retelling of The Richest Man in Babylon” (English and Filipino versions). Click this link to read samples – Books of FQ Mom. She is a behavioral economist, a certified Gallup strengths coach and the grand prize winner of the first Sinag Financial Literacy Digital Journalism Awards. Follow her on Facebook & YouTube as FQ Mom, and Twitter & Instagram as theFQMom. Her latest book is “FQ: The nth Intelligence.”