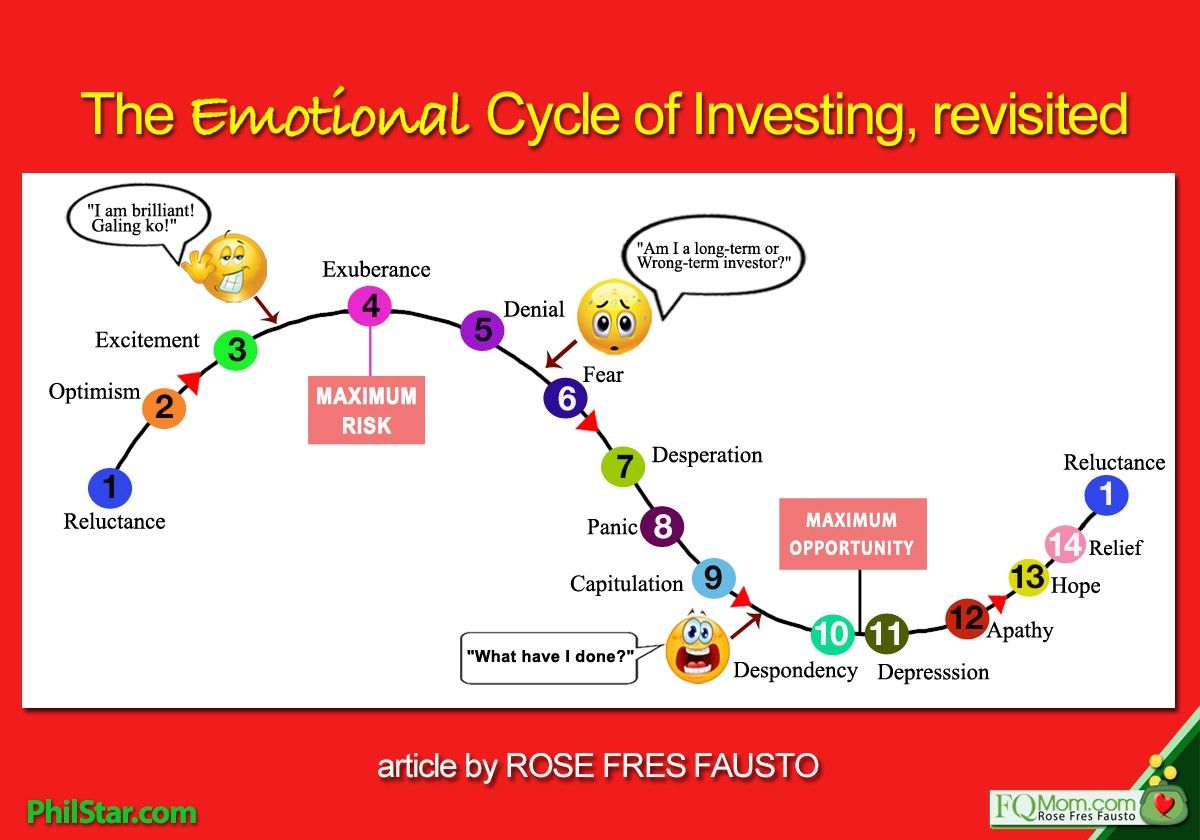

The emotional cycle of investing, revisited

The stock market is the asset class that gives the highest returns in the long run. That’s a fact backed up by historical records. We all have long-term needs because we will all grow old (if we’re lucky) and it is our duty to prepare for a decent old age, and not be a burden to our loved ones and society. That’s not just a fact but common sense. Therefore, we all have to be invested in the stock market in one way or another, as soon as we start working, or even earlier. #RaisingChildrenWithHighFQ ![]() (Click Why Should Our Young Kids Be Invested In The Stock Market to read more on this.)

(Click Why Should Our Young Kids Be Invested In The Stock Market to read more on this.)

But how come only less than one percent of our population is doing so? Answer: Human wiring makes it difficult to behave rationally and stay invested in the stock market.

Although the stock market gives us the highest returns in the long run, it does not move in a straight line but includes an exciting or terrifying, depending on your mindset, roller coaster ride in the short term!

I have written about the emotional cycle of the market a couple of years ago. (Click The Emo Cycle of Investing)

Let’s revisit it but this time let’s make use of the power of images. Our brain can process images a lot faster than words and also retains the message longer compared to text. Can you identify where we are right now? Or more specifically, where are you right now? Can you try to superimpose your own face on the emojis? I’m sure that will be fun and more effective. ![]()

1. Reluctance. Whenever I ask someone why he is not investing in the stock market, the most common answer is it’s too risky. He is reluctant due to lack of knowledge, experience, and horror stories of losses heard from others. The Loss Aversion Principle in Behavioral Economics (B.E.) is at play. Because we experience losses more strongly than gains, we just try to prevent losses more than we try to make gains. (Click Loss Aversion: The Psychology of Money Series to read about it and FQ Live! with Edward Lee re Myopic Loss Aversion to watch video on the subject matter.)

2. Optimism. Then he hears a good number of happy, usually yabang, stories about people making money in the stock market and he changes his loss aversion from aversion to losing money, to aversion of missing out on the opportunity. #FOMO ![]()

3. Excitement. At first, either due to careful study, or beginner’s luck, but usually due to market trend, he makes decent profits from his maiden investments. He gets excited and talks to his friends and family about his gains and encourages them to join him.

4. Exuberance. As he makes more money, he changes his initial asset allocation to increase his stock portfolio. He even gets overconfident that he tells his family and friends to just let him invest their money for them. He is an instant star fund manager! The more aggressive ones even take up loans to increase their portfolio. All daw theories (“tataas daw!”) are subscribed to. And since herd mentality (another B.E. principle which is joining the bandwagon or doing what everybody else is doing) is at play here, he feels safe. He is experiencing Irrational Exuberance – a term originated by former Fed Chairman Allan Greenspan and used as the title of a bestselling book by Nobel laureate Robert Schiller.

5. Denial. Reality catches up. He is no Warren Buffet after all. It’s just that the market trend was really on the rise in the previous phase, but of course, he doesn’t see it that way yet. He still insists that his stock picks and timing are impeccable. In fact, he buys more in order to average down. He is also somehow affected by another B.E. principle namely, Sunk Cost Fallacy - becoming psychologically invested in costs already incurred regardless of what the current and future costs and benefits are. In other words, he continues to “throw good money after bad.” (Click Sunk Cost Fallacy: The Psychology of Money Series to read the article and FQ Live! with Wilson Sy on Sunk Cost Fallacy to watch video on the subject matter.)

6. Fear. Reality sets in and he finally acknowledges that he is no Warren Buffet after all. He is now scared as he sees his portfolio value shrinking each day.

7. Desperation. He now starts pulling his hair and regrets why he didn’t realize his profits when he could. He doesn’t know what to do at this point and he does things, sometimes selling, sometimes doing quick crazy trades, just to put his portfolio back in the black.

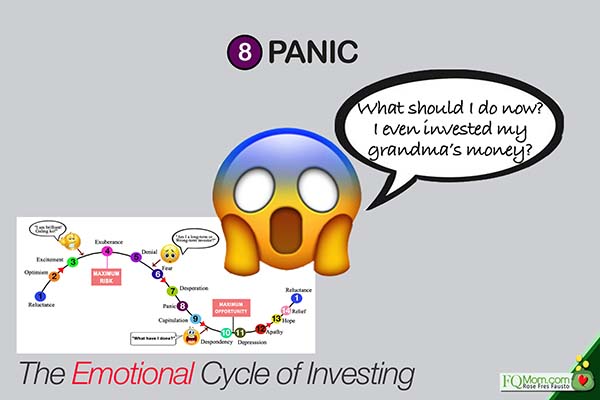

8. Panic. This is probably the most emo in a hyper kind of way among the stages. He is not able to eat well and sleep well at night. He is consumed by the losses and feels hopeless and at the mercy of the market. Because he is on panic mode experiencing ego depletion (a B.E. principle that says that humans are unable to make sound decisions because of physical or emotional fatigue), he continues to make really bad decisions, further worsening his situation. (Click Ego Depletion to read article and FQ Live! Ego Depletion to watch video.)

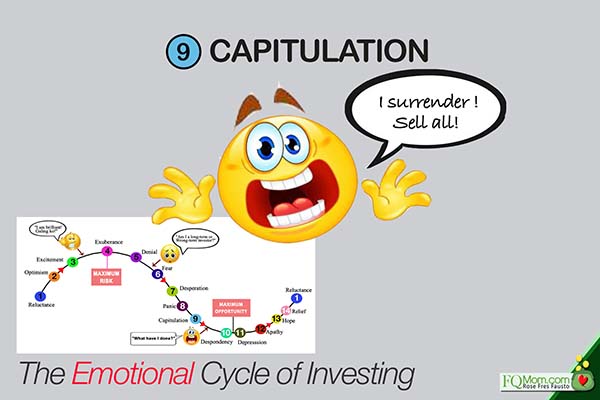

9. Capitulation. Capitulation means surrender. He just reached his breaking point and wants to sell everything. All he wants is to be out of the market, regardless of price.

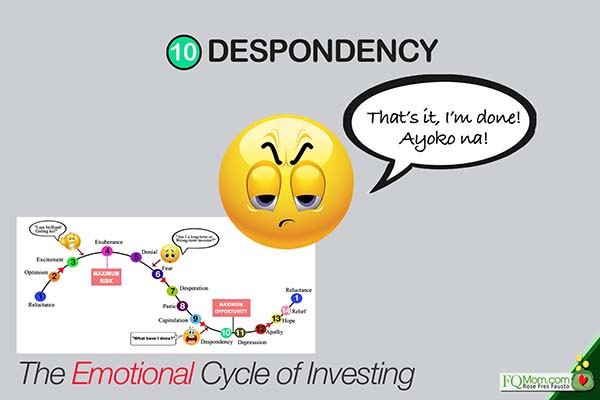

10. Despondency. After selling his position he resolves not to enter the market again.

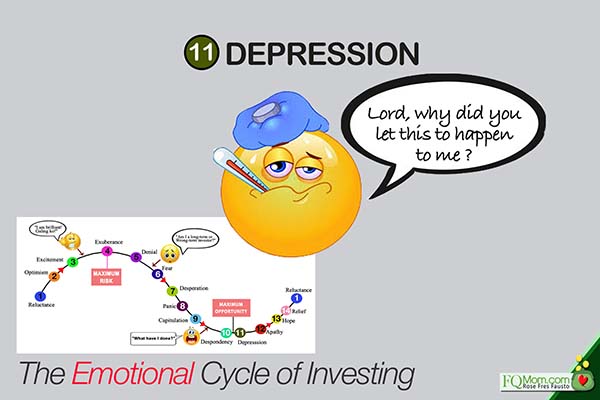

11. Depression. He is now crying, sulking and praying hard. He stops seeing his stock market buddies, who at this point, he considers as bad influence in his life.

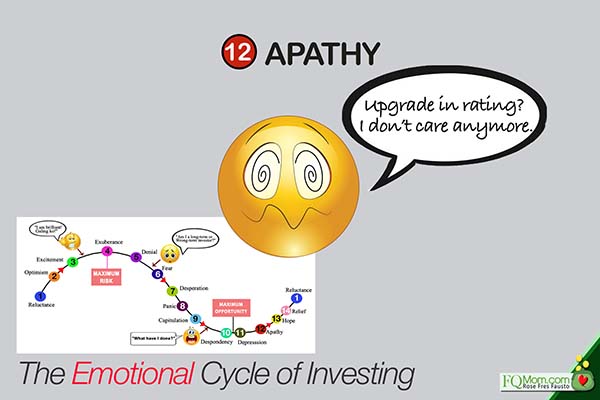

12. Apathy. He is done with crying and sulking. But he is totally indifferent and unresponsive to any good news about the stock market.

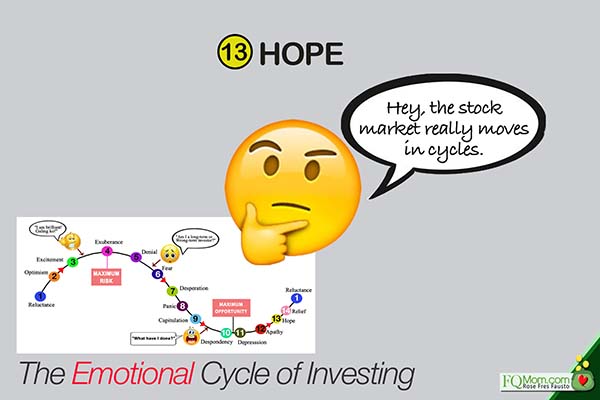

13. Hope. Eventually, he realizes that the market really moves in cycles. Then he starts to think of the opportunities that await him.

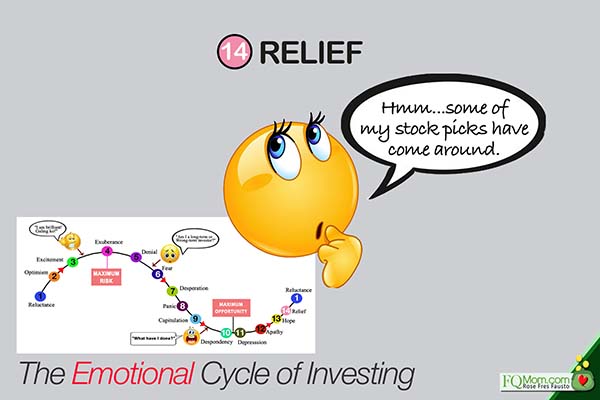

14. Relief. He sees the market turning positive again.

And so this investor starts to gain confidence once again, and he is about to enter another cycle of emotional investing as he moves from stage 14 Relief to stage 1 Reluctance and so on and so forth.

You may ask, “Can we accurately plot where we are right now so we can exactly predict when to get in and when to get out?” Although some self-proclaimed investment gurus may say yes and that we should still hold our horses and wait for the lowest level, I am openly admitting that I can’t, but I am happy with my investment returns for the last three decades.

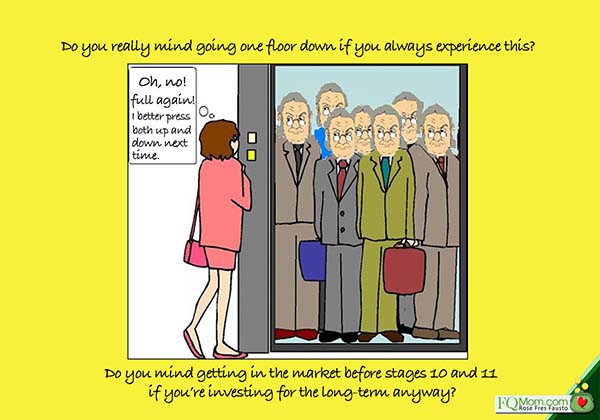

Again, let me use another image to end this article using this limited analogy. Imagine yourself on the ground floor of a building on your way to the top floor. You click the button going up. Unfortunately, since there a lot of people waiting at the basement, this is usually what happens.

So what do you do? Don’t you sometimes just ride the elevator and not mind going down to the basement because you know it’s going up anyway? Think about it. ![]()

********************

ANNOUNCEMENTS

1. Watch out for my next book FQ: The nth Intelligence coming out soon. This is in collaboration with ABS-CBN Publishing Inc.

2. After its successful maiden run, FMCP (Fund Management Certificate Program) is now accepting enrollees for its second run. Click https://docs.google.com/forms/d/e/1FAIpQLSd3HCy1ThKz9p7fYC6t81VsvKt3RIJrFpm916BcLoZgUtUc_g/viewform

3. Want to know your FQ score? Take it today. Click link to take the test. http://rebrand.ly/FQTest

Rose Fres Fausto is a speaker and author of bestselling books “Raising Pinoy Boys” and “The Retelling of The Richest Man in Babylon” (English and Filipino versions). Click this link to read samples – Books of FQ Mom. She is a behavioral economist, a certified gallup strengths coach and the grand prize winner of the first Sinag Financial Literacy Digital Journalism Awards. Follow her on Facebook & YouTube as FQ Mom, and Twitter & Instagram as theFQMom.