Kiyosaki’s definitions of asset and liability are wrong!

Robert Kiyosaki popularized the book “Rich Dad Poor Dad” and came up with that often quoted statement about assets and liabilities:

“An asset brings cashflow into your pocket. A liability takes money from your pocket!”

His favorite example is the house which, according to him, we all mistake to be an asset, but is actually a liability. Since his litmus test is the bringing in or taking out of money from our pocket, he further explains that for as long as you incur expenses on the house, it is a liability. This can be turned into an asset only when you are able to earn rent income from it.

His definitions of asset and liability are subscribed to by many because of their simplistic appeal, but I am just concerned that he might be misleading people who want to learn about personal finance.

There are three basic financial statements in accounting that he carelessly puts all together here, causing confusion. Assets and liabilities belong to the balance sheet. Expenses, which he mentions as the reason why our house is a liability belongs to the income statement. Then cashflow is a different financial statement altogether.

Let me try to explain these three financial statements as simply as possible.

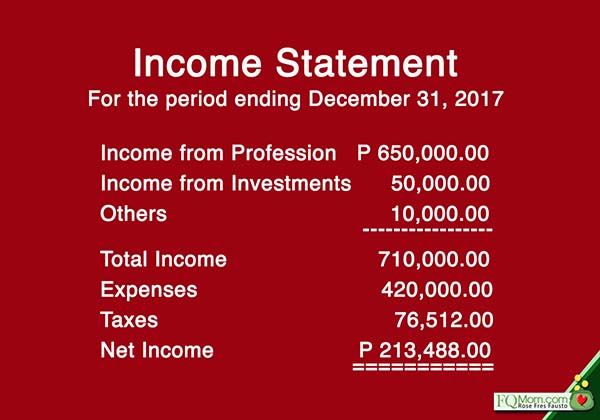

1. Income statement – reports the financial performance of a company (or in the case of a personal Income Statement, an individual) for a specific period of time, usually one year. It shows the revenues and the expenses incurred. Revenues minus expenses is your net income.

The income statement answers the questions “How much did you make, how much did you spend and how much was left? Ideally, your revenues should be more than your expenses, so that you can save and invest regularly.

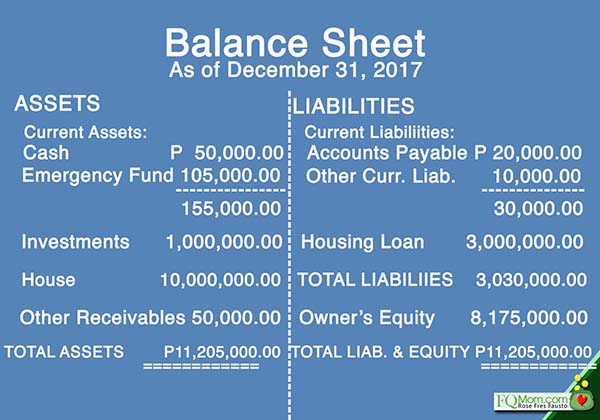

2. Balance sheet – reflects the financial condition of the company (or individual) at a specific point in time, usually yearend. On the left-hand side are your assets. Assets are resources that are bought or created for the benefit of the company (or individual) as they increase the value and can generate cash for the owner.

While the left-hand side of your balance sheet shows your resources or assets, the right hand side shows how you funded your assets, or the sources of funding your resources. That is why the two sides should always balance; hence, your balance sheet equation is:

Resources = Sources

Just remember this concept and your accounting intimidation will be lessened. ![]()

Sources of funding can either be your own which is referred to as Owner’s Equity or debts which are the liabilities. Yes, liabilities actually bring money to your pocket! So at this point, you can see that Kiyosaki’s definition is literally wrong. But don’t get me wrong, I still maintain that resorting to liabilities as your source of funding should be done prudently as you will have to pay them off.

The balance sheet answers the question, “How much are you worth?”

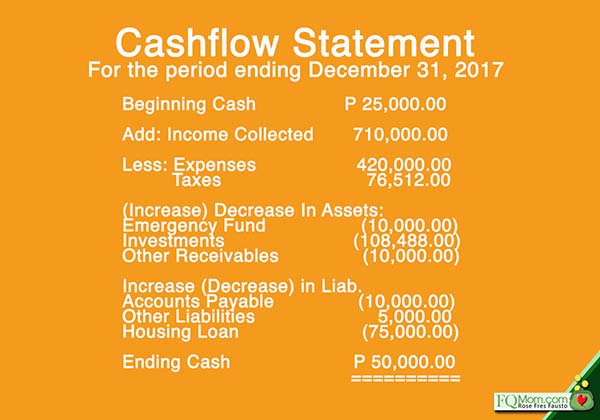

3. Cashflow statement – shows the movement of cash into and out of the company (or individual) for a given period of time. (Review: Both the income statement and the cashflow statement are expressed as a period of time, usually one year, while the Balance Sheet is a point in time, just a snapshot, usually the yearend).

If you notice in the above cashflow statement, an increase in an asset is actually a cash outflow. (You need to spend in order to buy an asset.) On the other hand, an increase in liabilities is a cash inflow. (Remember the right hand side are the sources of funding.) So subscribing to the Kiyosaki definitions will really mess up your accounting here.

The cashflow statement answers the questions, “Where did the money come from and where did it go?”

The cashflow also gives us an insight into the liquidity of a company or individual. Simply put, liquidity is the level of cash and ease of converting other assets to cash. Take note of this: a high level of net income does not necessarily mean high liquidity. There are cases when a company or individual with a high net income reflected in the Income Statement is actually illiquid. Usual reasons include uncollected revenues and other receivables.

It is also possible to be reflected as asset-rich in the balance sheet but illiquid. This happens if most of the assets are in real estate and other long-term resources/assets that are hard to convert to cash. Remember some time last year when the megastar mentioned that yes she’s a billionaire but was illiquid?

The reason why I bring up these erroneous definitions of some accounting terms is to avoid confusion for someone who’s trying to improve her finances and might start looking at financial statements of listed companies she wants to invest in. Not only that, since I also encourage all of you to have your personal financial statements (income statement, balance Sheet, cashflow), I don’t want you to mix things up just because of Kiyosaki’s simplistic but erroneous definitions. (Still, I don’t deny the power of Kiyosaki’s “Rich Dad” book series, I read them too, but I also want you to watch out for some of his not-so-good advice, and hyped up overpriced learning modules described and documented by some as scams. Click link.)

I hope the above discussions help you understand the different financial statements, and you consider preparing your own regularly in order to improve your spending and investing. The mere exercise of listing things down can decrease spending and increase saving and investing. It also gives you a record to look back to when you want to review your past performance and set your financial goals, including your retirement plans. ![]()

********************

ANNOUNCEMENT

Want to know your FQ score? Take it today. Click link to take the test. http://rebrand.ly/FQTest.

Rose Fres Fausto is a speaker and author of bestselling books “Raising Pinoy Boys” and “The Retelling of The Richest Man in Babylon” (English and Filipino versions). Click this link to read samples – Books of FQ Mom Rose. She is a behavioral economist, a certified gallup strengths coach and the grand prize winner of the first Sinag Financial Literacy Digital Journalism Awards. Follow her on Facebook and You Tube as FQ Mom, and Twitter & Instagram as theFQMom.