Gas expansion a detour in Philippine transition to cleaner, cheaper energy

MANILA, Philippines — In 2019, the provincial government of Negros Occidental took a crucial first step on the path to sustainable energy when it heeded the call of young advocates to keep coal out of the Western Visayas province.

Alfredo Marañon Jr.—governor at the time—issued the executive order opposing the establishment of any coal-fired plants in the face of plans at the time by SMC Global Power Holdings Corp., the power unit of conglomerate San Miguel Corp., to build a 300-megawatt coal-fired power plant in San Carlos City.

Three years later, Negrosanon youth are resisting the entry of another fossil fuel—gas. They are now asking local authorities to declare gas unwelcome in the province.

Krishna Ariola, lead convenor of Bacolod-based coalition Youth for Climate Hope, said the establishment of fossil gas infrastructure in the province will make it more difficult for Negros island to achieve a genuine transition to renewable energy.

Negros has been dubbed the country’s ‘clean energy hub’, yet most of its electricity comes from coal plants outside the island.

“The youth are always calling and demanding for genuine solutions that already exist… If this pushes through, it will just open the door for other LNG projects, not just in Visayas, but also in [other parts of the] Philippines,” Ariola said.

Although relatively cleaner than other fossil fuels, LNG emits methane into the atmosphere. Environmentalists also say that relying on it as a transitional power source will delay the shift to renewable energy at a time when cutting back on emissions is needed urgently.

From coal to gas

Negrosanon youth and concerned civil society organizations are opposing the 300-MW liquefied natural gas power plant project of Reliance Energy Development Inc., a subsidiary of SMC Global Power Holdings. The project, proposed to be built in San Carlos City, was in place of the coal project the conglomerate dropped from its portfolio.

In its project description for scoping submitted to the environment department, REDI said the proposed LNG power plant “will help augment the demand for reliable and affordable power supply” while supporting the energy department’s push for a shift to cleaner source of energy.

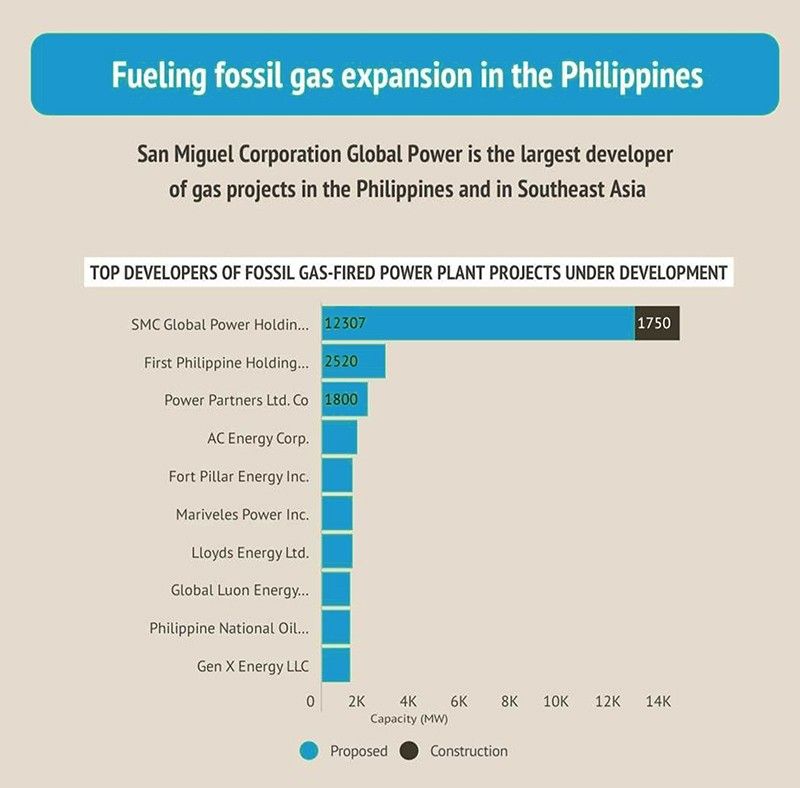

Quezon City-based think tank Center for Energy, Ecology and Development said in a report published early this month that Vietnam and the Philippines are leading Southeast Asia’s planned gas expansion, with 56.3 GW and 29.9 GW in development, respectively.

According to the report, SMC, a leader in coal expansion in the Philippines, is now the biggest developer of new fossil gas power in the region.

Lopez Group’s First Philippine Holdings Corp. was previously the largest developer of gas projects in the country.

The conglomerate’s 14.1 GW of proposed projects, which also include the massive 6.49-GW power plant in Navotas in Metro Manila and the 1.75-GW power plant along biodiversity-rich Verde Island Passage in Batangas, account for half of the planned gas expansion in the country.

SMC did not respond to requests for comment.

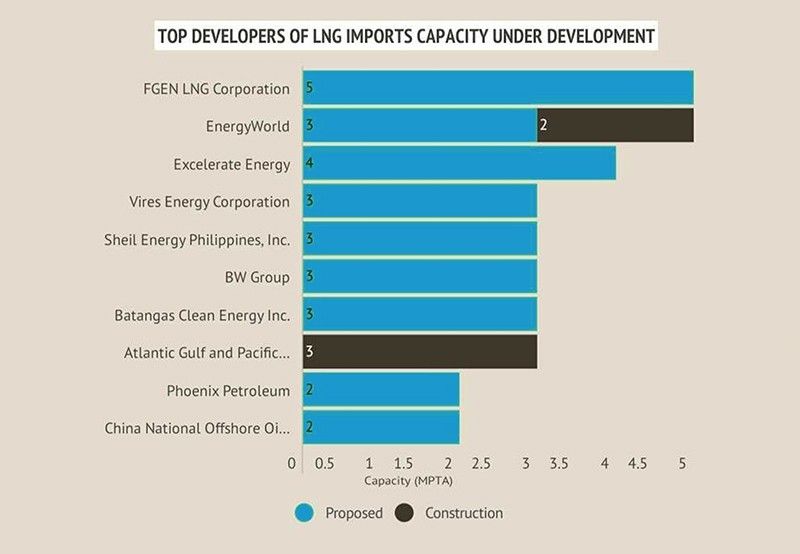

The Philippines has the second largest planned LNG import terminals in Southeast Asia, with 36.5 million tons per annum of LNG import capacity in development, the report also found. Once built, these will be the country’s first LNG terminals.

Other coal developers have also ventured into the fossil gas industry such as the Aboitiz Group and Meralco PowerGen, and AC Energy.

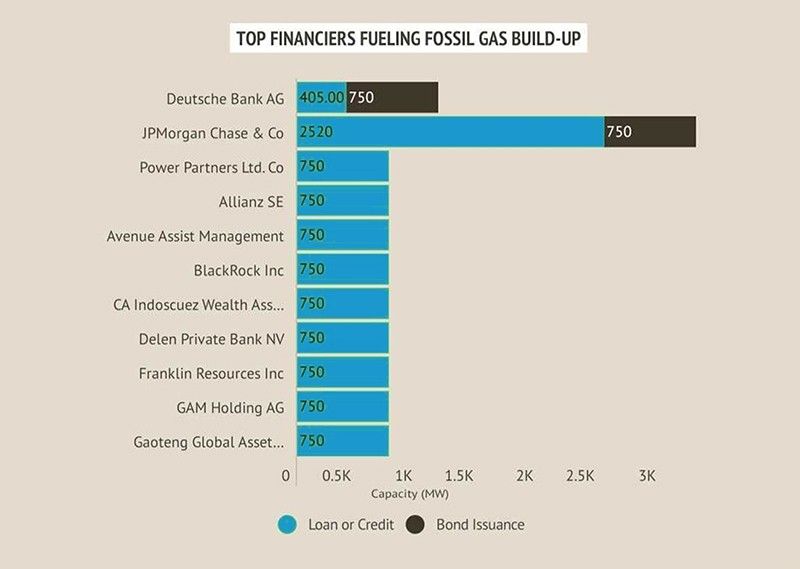

CEED also identified Deutsche Bank AG, JPMorgan Chase & Co., Standard Chartered PLC, Allianz SE, BlackRock, and GAM Holding as the top financiers of the fossil gas expansion in the country. All of these financial institutions have made net-zero pledges.

Transition fuel myth

In 2020, the Department of Energy announced a moratorium on new coal-fired power plants, creating an opportunity to develop the country’s renewable energy potential that has largely remained untapped.

The agency, however, scaled up the development of infrastructure to support the import of LNG in anticipation of the depletion of Malampaya deep water gas-to-power project.

Michael Sinocruz, DOE’s energy policy and planning bureau director, told Philstar.com that the LNG development “will be significant” in stabilizing the country’s natural gas supply to ensure the continued operations of the six existing power plants in the archipelago.

DOE is also aiming to transform the Philippines into a leading LNG hub in Asia.

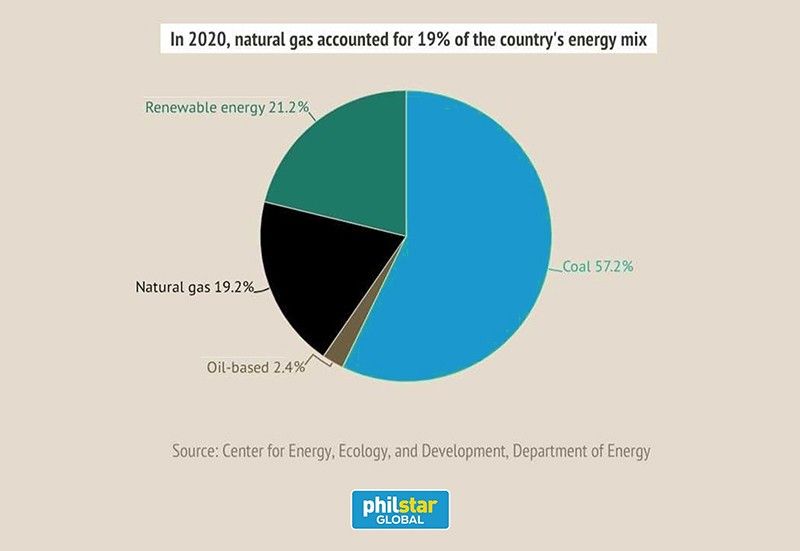

President-elect Ferdinand Marcos Jr. is eyeing fossil gas as a transition fuel to renewable energy, noting it would take a lot of time to deploy any power plant, including nuclear—his preferred source of energy. In 2020, natural gas accounted for 19% of the country’s power mix.

Gas has been pitched as a “bridge fuel” that can support decarbonization efforts. It has also been touted as a cleaner alternative to coal because it emits less carbon dioxide.

“The government’s primary goal of ensuring energy security and transitioning into the utilization of sustainable energy sources requires the aggressive development of both renewables and natural gas,” Sinocruz said.

Climate and clean energy campaigners, however, argue that increasing the share of LNG infrastructure is not a decarbonization strategy as it is primarily composed of methane—a more potent greenhouse gas—which leaks into the atmosphere at every stage of its life.

“LNG is not a bridge fuel. It is not cheap, it is not clean, and it does not facilitate the transition to cleaner, cheaper sources of energy. Instead, it blocks the transition,” said Sam Reynolds, energy finance analyst of US-based think tank Institute for Energy Economics and Financial Analysis.

Risky venture

The planned LNG plant will be built in the San Carlos Ecozone, which faces Tañon Strait, the country’s largest marine protected area.

Located between the islands of Cebu and Negros, Tañon Strait is a source of food and livelihood for many residents of the central Philippines.

Groups opposed to the project warn that the power plant will lead to increased shipping traffic, generate pollution, and destroy marine habitats, mangroves and wetlands along the shoreline.

San Carlos Bishop Gerry Alminaza, who is also the convenor of local clean energy advocacy group REpower Negros, said the proposed LNG plant “will drain life from the Tañon Strait, harm constituents, and take away the livelihood of fisherfolk.”

Volatility is an inherent characteristic of global LNG markets, according to Reynolds who said that countries reliant on LNG have faced severe energy shortages. He added that LNG prices are expected to remain high and volatile at least until 2026.

This means that increasing dependence on imported fossil fuels could exacerbate, not alleviate, energy security risks and high electricity costs.

Groups also stress that fossil gas technologies, which would operate for 20 to 25 years at minimum, will effectively stall the development of genuine renewable energy infrastructure.

“The Philippines is at a critical energy intersection. One road leads to greater dependence on dirtier, more expensive fossil fuels. The other road leads to energy self-sufficiency and affordability through the deployment of clean, domestically sourced renewable energy systems,” Reynolds said.

“While some LNG may be necessary to compensate for declining production from the Malampaya field, this should not justify an unprecedented expansion of LNG-related infrastructure,” he added.

‘Harness RE instead’

Instead of focusing on LNG, the DOE should ramp up the implementation of the more than a decade old Renewable Energy Act, and engage with private sectors and communities to accelerate the energy transition in the country, said Laurence Delina, assistant professor at The Hong Kong University of Science and Technology’s division of environment and sustainability.

Only 21% of the country’s generated power comes from renewable energy sources. The energy department set a target of 35% share of renewable energy in the mix by 2030. By 2040, the government is eyeing 50% share of renewable energy in the country’s overall generation mix.

“The renewable energy technologies that can ensure the country’s energy security are market-ready. We do not need a bridge to deploy them. They are technologically mature and with their costs fast declining, they make economic sense now,” Delina said.

To avert a fossil future for Southeast Asia, CEED recommended in its report that banks should prohibit all financing for new oil and gas fields, and LNG terminals. If gas expansion is deemed necessary, financial institutions must set stringent restrictions.

CEED added that banks should withdraw and prohibit financing for gas projects that violate people’s rights, and endanger critically important and biologically diverse ecosystems and habitats.

Keeping Negros free from planet-warming coal and gas has been an inter-generational struggle that began in 1997. Negrosanon youth are determined to continue the legacy of victories against fossil fuels—a legacy fought by their parents and grandparents.

“It’s great to see that young people are stepping up and are at the frontlines of forwarding renewable energy advocacy,” Ariola said.

“We want to win the [fight for] genuine transition to renewable energy not only because it’s necessary, but most especially it’s possible.”

--

This article was supported by Climate Tracker

- Latest