Maharlika Corp. chief defends 1.5-year delay in investment

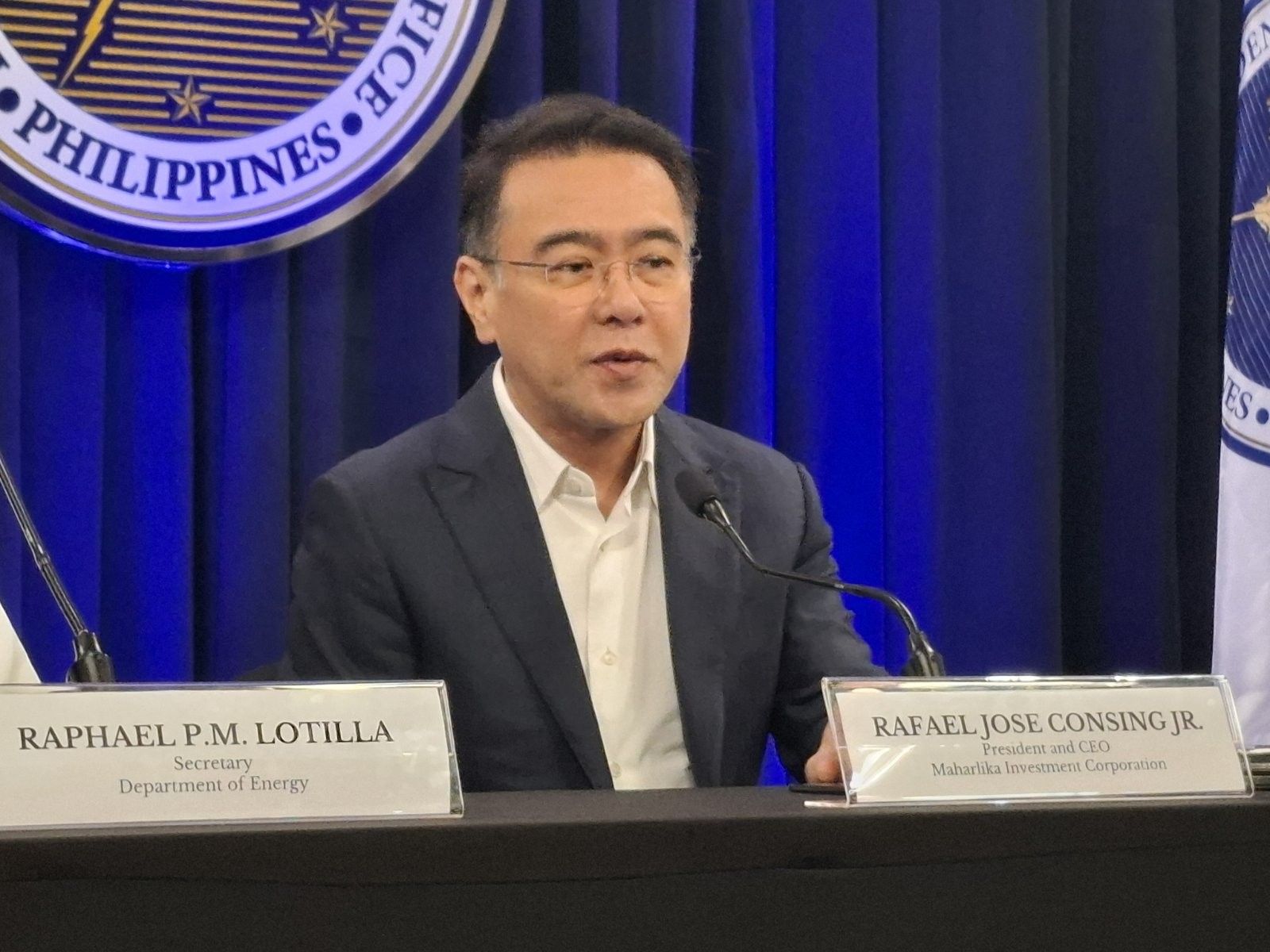

MANILA, Philippines — Maharlika Investment Corp. (MIC) Chief Rafael Consing Jr. on Tuesday, January 28, defended their recent maiden investment in the National Grid Corp. of the Philippines (NGCP), which came a year and a half after its controversial passage in law.

Since 2022, the Maharlika Investment Fund (MIF) has faced heavy criticism at every stage of the legislative process, both from lawmakers and economic experts, many of whom have raised concerns about the government's priorities.

While President Ferdinand Marcos Jr. signed the measure into law in 2023, critics have questioned what the MIC has to show for it more than a year later.

In a press briefing in Malacañan Palace on Tuesday, Consing was asked if there were challenges that lead to the MIC only getting its first investment in 2025 — the midway point of the president’s term.

Consing said that it was part and parcel of setting up an organization.

“It takes a bit of time in terms of looking for and executing these investments. So, I would not look at this as a delay but rather, it takes really that much time to undertake investments,” Consing said.

The MIC chief recounted that he joined the state-owned investment firm on Nov. 3, 2023. A board was appointed on December 3, and the first board meeting was on Jan. 3, 2024.

Since then, the MIC had to set up the organization, obtain approvals, write frameworks, draft charters and more.

“Once we have identified also our investment, it took time for us to undertake, well, due diligence, our preliminary due diligence, for example, in SGP and other projects that we will announce after SGP (Synergy Grid and Development Philippines Inc.),” Consing said.

The SGP was inclined to accept the government’s offer due to the new capital it could provide, as well as assistance to its rollout plan of the NGCP.

Another point of criticism for the MIF was how it needed to source its capital from Landbank and the Development Bank of the Philippines, which respectively provided the investment firm with P50 billion and P25 billion.

The International Monetary Fund recently urged the government to restore the capital of both state-owned banks.

“I don’t see any relief coming from us, rather, if you look at these banks, they are currently under regulatory relief. So, therefore, their T1 capital has not in fact suffered because of the fact that they have got their three-year regulatory reprieve,” Consing said.

A T1 refers to a bank's core capital. Consing mentioned that Landbank's T1 Capital is higher than global standards.

Aside from the P75 billion that it received from state-owned banks, the MIC also has P50 billion still held with the national treasury.

“That's really coming from the [Banko Sentral ng Pilipinas] dividends due to the Philippine government already been paid and the dividends coming from the PAGCOR. So, we have not drawn those just yet because we have not started deploying, but now that we have, then we will request for those funds to be released,” he said.

- Latest

- Trending