No short-changing: Local governments to get higher cut of national taxes by 2026

MANILA, Philippines — Finance Secretary Ralph Recto said that local government units (LGU) are set to get a higher portion from national taxes, going from around 32% to 36%.

Several local executives previously questioned the national tax allotment (NTA) to their communities. The Mayors for Good Governance said that LGUs are entitled to 40% from the national revenue collection, citing the Supreme Court’s (SC) Mandanas-Garcia ruling.

The mayors said they had only been receiving 31% to 32%. However, following a dialogue with local chiefs, Recto said the Department of Finance (DOF) showed them computations of the NTA, demonstrating its compliance with the ruling.

Recto said there was somewhat of a meeting of the minds.

In a press chat on Thursday, January 16, Recto said their current NTA is also set to rise by 2026, as the TRAIN law would no longer carve out a portion of higher tax revenues by then.

“Today they're getting roughly 32%. We calculated yesterday to go up to about 35, the NTA, by 2026. More or less,” Recto said in a press chat.

“I think what is important is [that] no one is shortchanging the local government. And as promised, we are very transparent. We show them all the calculations,” he added.

The DOF chief said the current NTA distribution was backed by an opinion from the Department of Justice, as well as a resolution from the Development Budget Coordination Committee.

“We did not change those computations. Those were done after the Supreme Court ruled and during the previous administration,” he said.

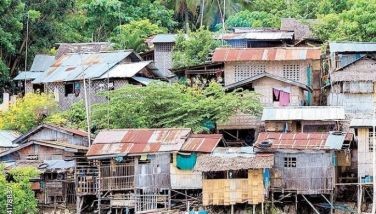

However, certain exemptions from the NTA computation were made, such as for the Bangsamoro Autonomous Region in Muslim Mindanao.

The DOF previously affirmed the Mandanas-Garcia ruling entitled LGUs to a 40% NTA to grant them greater fiscal autonomy.

Under the ruling, the DOF and other pertinent agencies were ordered to include the tax collection of the Bureau of Internal Revenue and Bureau of Customs in the computation of the NTA base.

The computation for the NTA made by the DOF was based on several laws in addition to the Supreme Court ruling.

- Latest

- Trending