Amid calls to abandon Maharlika dream, Marcos signs investment fund into law

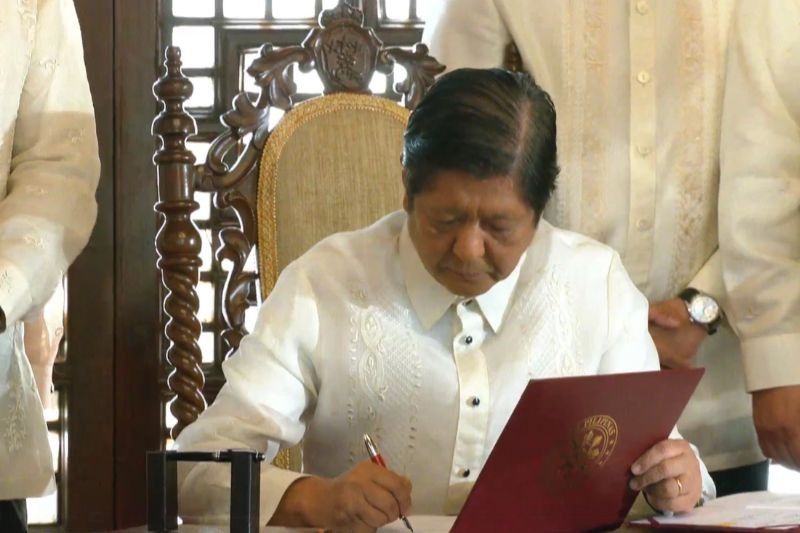

MANILA, Philippines (Updated 5:02 p.m.; July 19, 2023) — President Ferdinand “Bongbong” Marcos Jr. has signed the Maharlika Investment Fund into law, greenlighting the creation of the country’s first sovereign wealth fund despite public outrage over the measure.

Ranking senators last month ironed out a redundant provision of the bill over Viber, causing a delay in transmitting it to the Malacañang for the president's approval. The Office of the President received the enrolled bill in early July.

Before the MIF bill’s swift passage in Congress, Marcos bared in 2022 that he personally crafted the pitch for the country to have its own sovereign wealth fund.

Now law or Republic Act 11954, the MIF or will be used by the government to park taxpayer money in all sorts of investment instruments to help fund priority programs.

Opposition to the investment fund has largely come from business groups, academia, economists, opposition lawmakers, and civil society. They flagged several provisions as problematic, including the use of state pension funds as seed money.

Besides funding sources, some experts have also lamented that taxpayers' funds stockpiled for the Maharlika could be used instead to fund projects directly.

This prompted economic managers of the Marcos administration, led by Finance Sec. Benjamin Diokno, to smooth things over by way of press briefings and some roadshows to attract the investing public.

Their main pitch was that the Philippines would be able to invest in its future. After all, returns from the projected investment could be used, in theory, to bankroll socioeconomic and infrastructure projects.

The MIF is a “bold step towards our country’s economic transformation” post-pandemic which will be managed with “financial, not political” decisions, Marcos said during the signing Tuesday.

“The fund will fail if we do not make money on the fund. It’s that simple. But there are so many opportunities we cannot allow to slip by, and that is why we are putting (it) up,” Marcos added.

Maharlika’s final look

The final "corrected" Maharlika Investment Fund bill that made it to the hands of the president included an eleventh-hour correction on the double provisions of the prescriptive period.

The final version that Senate President Juan Miguel Zubiri and House Speaker Martin Romualdez signed off on settled for the ten-year period for crimes, merging two sections. This was a correction that the Makabayan bloc in the House said defied the principles of transparency and accountability for not following proper procedures in the legislative process.

Senate Secretary Renato Bantug Jr. told reporters, however, that senators had originally voted for a ten-year and not a 20-year prescriptive period and insisted no legislative rule was bypassed in the process.

Funding sources

According to the final copy of the measure, the Maharlika Investment Corp. will get at least P75 billion in paid-up capital this year. Broken down, the Land Bank of the Philippines and the Development Bank of the Philippines will pitch in P50 billion and P25 billion each.

The national government is contributing P50 billion, composed of the Bangko Sentral ng Pilipinas’ dividends. For the first two years of the fund’s existence, the central bank will need to remit all its declared dividends to the fund.

The signed copy of the Maharlika revealed changes in how the BSP’s dividends will be spent after the first two years of bankrolling the sovereign wealth fund.

In the final version, the central bank’s dividends will be used to fund its capitalization once it meets its Maharlika obligations.

These marked a stark departure from the bill’s previous iteration, as 50% of those dividends were stated to bankroll the wealth fund after the first two fiscal years.

The government’s share from state-owned Philippine Gaming Corp., pegged at 10% yearly lasting five years, also joined the funding mix.

The capital stock will comprise P500 billion, divided into 5 billion shares priced at P100 apiece. It will be built by 3.75 billion common shares, equivalent to P375 billion, and 1.25 billion preferred shares (P125 billion).

Problematic management structure

The Palace briefing on the bill on Tuesday spotlighted key differences in the Marhalika’s governance structure.

Marcos Jr. assured the public a month ago that the Maharlika will be run by finance professionals. Back then, he reiterated that he sought the removal of the president, the central bank governor and the finance secretary from the helm of the controversial fund’s board to ensure independence and that the fund be “well-managed professionally.”

A briefing paper handed out to Palace reporters on Tuesday showed otherwise.

In this version, the Maharlika Investment Corp. board of directors will be composed of nine members. The finance secretary—currently Benjamin Diokno—was designated chairperson in the final version of the bill.

Rounding out the board are the CEO of the MIC, the president and CEO of Land Bank of the Philippines, the president and CEO of the Development Bank of the Philippines, two regular directors, and three independent directors from the private sector.

The fund’s management structure went through several changes as it hurdled the scrutiny of the House and Senate. In Senate Bill 1814, the board of directors numbered at 15 but the Senate Bill 2020 trimmed it to nine directors, with three coming from the private sector.

Economics professors from the University of the Philippines blasted the MIF in a strongly-worded paper in June, saying that it “violates fundamental principles of economic and finance and poses a serious risk to the economy and the public sector.”

Marcos’ public image and political clout on the line

Political analyst Cleve Arguelles said that the temporary delay from the MIF’s approval on the third reading in the Senate to its transmittal to the president could signal lawmakers’ attempt to read public sentiment about the measure.

“My sense is that the Senate was gauging public opinion and they want it clear that Marcos Jr.'s fingerprints were all over the MIF bill, so it's clear to the public that this is his idea and he is accountable [for] how the Fund will eventually perform,” Arguelles said.

Arguelles said that Marcos also invested significant political capital to railroad its passage.

“There is no doubt that Marcos Jr. is betting his political capital on MIF given its name ‘Maharlika’ that is popularly associated with the legacy of his father and their entire family and how he mobilized his Cabinet and allies in the Congress to publicly champion it,” he said.

“It's definitely risky, but I can also see why they may be tempted by the partisan and patronage benefits that they can get from a huge chunk of no-audit money like the MIF,” Arguelles said.

(Editor's Note: This has been updated to reflect the funding sources of the BSP. An earlier version of this article indicated that the BSP's "dividends will be split evenly, with 50% each bankrolling Maharlika’s funding and the BSP’s capitalization.")

- Latest

- Trending