Economic managers allay senators’ Maharlika fears

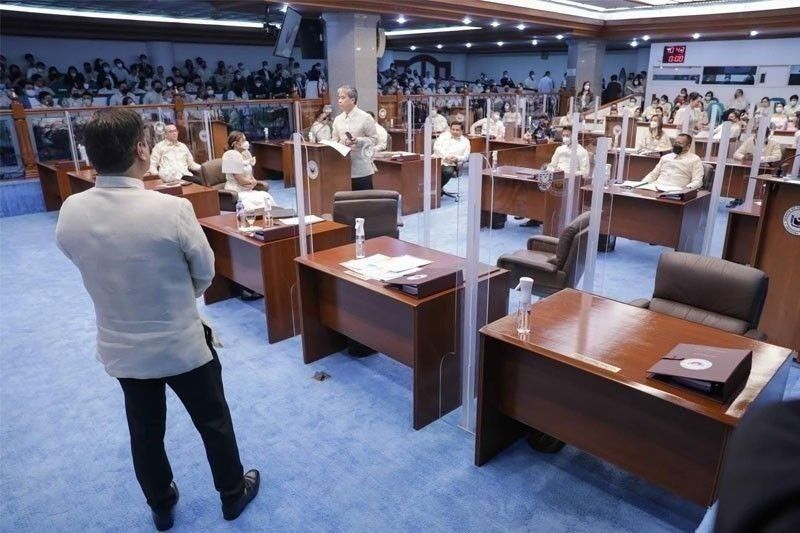

MANILA, Philippines — Economic managers came in full force to the Senate on Monday to allay fears on the proposed Maharlika Investment Fund (MIF), but senators said while many of their concerns were addressed, the devil would still be in the details.

Finance Secretary Benjamin Diokno, Budget Secretary Amenah Pangandaman, Socioeconomic Planning Secretary Arsenio Balisacan, Bangko Sentral ng Pilipinas (BSP) Governor Felipe Medalla, National Treasurer Rosalia de Leon and other officials gave senators a briefing on the MIF, which is a priority of the Marcos administration.

Also present was Marikina City Rep. Stella Quimbo, one of the authors of the MIF bill approved in the House of Representatives last December. The closed-door briefing, which started at 6 p.m., lasted for nearly three hours.

Senate President Juan Miguel Zubiri said 15 senators were in attendance, including Sen. Risa Hontiveros of the minority bloc and Sen. Mark Villar, whose committee on banks and financial institutions starts today hearings on the MIF bill.

“What’s good is that many got a clearer picture, questions from the senators, issues we talk about in the (Senate) lounge, the problematic provisions, doubts – a lot of those were answered last night,” Zubiri told reporters in Filipino.

“I think the nitty-gritty will be in the committee hearings, because in the committee hearings, we’ll invite various sectors that will air their favorable or unfavorable response. We’d like to listen to all sides, and more questions will arise,” he said.

Zubiri said the economic managers made convincing arguments for the MIF which, they said, can greatly help the country achieve targeted growth and economic stability through strategic and profitable investments in key sectors like transportation and power.

The officials said the MIF is intended to support goals set in the Medium-Term Fiscal Framework, Eight-Point Socioeconomic Agenda and the Philippine Development Plan 2023-2028.

The officials gave assurances that the government will adopt the best practices for managing sovereign funds of other countries, like Indonesia, adding the Philippines is one of the few economies in the region that do not have one.

“Indonesia pumped up its economy, as matter of fact, it is part of the ‘VIP’ which is Vietnam, Indonesia and Philippines, in terms of the darlings of Southeast Asia. And it’s supposed to generate inter-generational benefits… They are also looking at royalties from extracted natural resources, such as mining, that can be accessed for future generations,” Zubiri said.

Economic managers are proposing P50 billion in seed fund to come from the Land Bank of the Philippines, P25 billion from the Development Bank of the Philippines, P17 billion from the BSP and at least 10 percent of the gross income of the Philippine Amusement and Gaming Corp. or roughly P6 billion annually.

Zubiri, however, indicated that the amendments being made in the House apparently did not come from the economic cluster of the Cabinet.

Other details that need to be threshed out in the committee hearings are the safeguards and the screening and qualifications of the fund managers, he said, adding the MIF may be approved within the first quarter.

“We will propose a lot of perfecting amendments to the House version. There are some amendments in the House they want to do. So it’s a work in progress. The MIF is a work in progress that House version is a good base to discuss and to debate on and we will of course give out perfecting amendments,” Zubiri said.

Batangas Rep. Ralph Recto, meanwhile, is asking the administration to exercise caution in selling its assets to avoid doing a “fire sale.”

According to Recto, the government’s reported plan to sell off its non-performing assets should be “curated well” so it would not lead to a “fire sale” of state-owned land, businesses and franchises.

“The rule in privatization is that we should not be selling the geese that lay the golden eggs,” Recto said in a statement. “We should be careful that what remains of state crown jewels are not included in a ‘baratilyo’ sale simply because we are raising funds for a project,” he said.

“We have the stewardship role to play for the next geneation,” he pointed out.

He added that if “derelict assets” are successfully auctioned off, proceeds should go to “activities high in both social and financial ROIs, like housing.”

“If all the taipans are stumbling to construct condo because it is where the money is, why won’t the government fund affordable housing projects?”

Recto said the microscopic share of shelter agencies in the national budget – less than one tenth of one percent – prompts the use of “off-budget sources” to wipe out the estimated 6.658 million housing backlog.

“So government should allocate funds for housing projects, not only by the Maharlika Investment Fund but even by the national budget,” he added. – Sheila Crisostomo

- Latest

- Trending