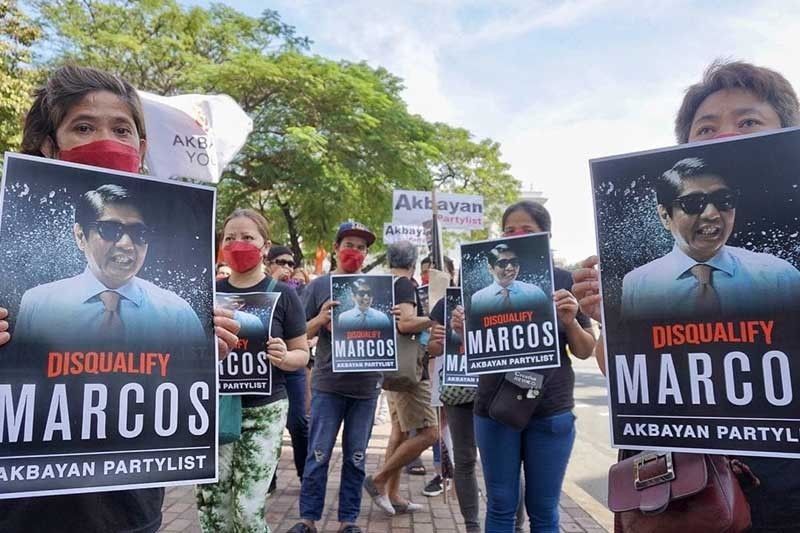

In voting to DQ, Guanzon says Marcos' acts 'a serious defect in one’s moral fiber'

MANILA, Philippines — Amid rising tensions between poll commissioners on the resolution of the disqualification cases against presidential aspirant Ferdinand “Bongbong” Marcos Jr., Commissioner Rowena Guanzon on Monday released a copy of her separate opinion ahead of the division’s promulgation of a ruling.

“Respondent’s repeated and persistent failure to file his [ITRs] for 1982, 1983, 10982 and 1985 constitutes an offense involving moral turpitude,” Guanzon said in her Separate Opinion on the disqualification case against Marcos.

The retiring commissioner voted to grant the petitions for disqualification and declare Marcos disqualified from running for the position of the President of the Philippines.

It remains unclear how Guanzon’s vote will figure in the resolution of the petitions as the Comelec First Division has yet to release a ruling in the case.

“Unfortunately, there is has yet no ponencia, no decision as of yet and so the separate opinion of Commissioner Guanzon basically stands alone in this case right now,” Comelec spokesperson James Jimenez said in a streamed conference by ABS-CBN.

As it is, Guanzon’s opinion remains a separate opinion, not a dissenting or concurring opinion.

Jimenez said that seeing that Guanzon will retire on Wednesday — and Tuesday is a holiday — her opinion will be on record of the Comelec, but it is unsure if it will be part of the records of the said disqualification case. But on disposition of the case, "we’re really going to wait for the ponencia because the ponencia will be controlling," he added.

Guanzon has been trading heated words with Commissioner Aimee Ferolino, who is assigned to write the main ruling, in recent days. Refuting Guanzon’s allegation of delay, Ferolino asserted that there is still reasonable time for her office to craft a resolution "of a complex and highly rated case."

Penalties

In her separate opinion, Guanzon stated that Marcos was not sentenced by final judgment to a penalty of more than 18 months because the CA decision, which became final and executory, did not mete out the penalty of three years of imprisonment against Marcos — which the trial court did.

The CA also did not impose the penalty of perpetual disqualification, she noted.

Guanzon added that the petitioners’ reliance on Article 73 of the Revised Penal Code is misplaced. The said article states that accessory penalties are imposed upon the convict does not cover failure to file Income Tax Return, the violation Marcos was convicted of.

"There is nothing in the 1977 National Internal Revenue Code which provides that the penalty of perpetual disqualification shall inhere in the other penalties imposed for violation of the law," she added.

Moral turpitude

But for Guanzon, Marcos’ conviction is an offense that involves moral turpitude — one of the grounds for disqualification under the Omnibus Elections Code.

“After an assiduous analysis of the arguments of the parties and the evidence on record, I find that Respondent’s repeated and persistent non-filing of income tax returns in 1982, 1983, 1984 and 1985, which resulted in his conviction, constitutes an offense involving moral turpitude,” she added.

The SC defines moral turpitude as anything done contrary to justice, modesty or good morals.

Guanzon said the portion in Republic of the Philippines v. Marcos II that Marcos Jr. quoted in refuting the claim that conviction for failure to file IRC constitutes a crime of moral turpitude is an obiter dictum, or an opinion on a question of law “not necessary in the determination of the case before the court.”

Marcos’ “repeated and consistent” failure to file the ITR while sitting in a high government post shows that the acts were not mere omissions, she said, and are “reflected already of a conscious design and intent to avoid a positive duty under the law and intent to evade the taxes due.”

She also pointed out that the respondent was not only a government official at that time but also a son of the then-sitting president, but he “acted as if the law did not apply to him.”

“Taken together, all of these circumstances reveal that Respondent’s failure to file his tax returns for almost half a decade is reflective of a serious defect in one’s moral fiber,” Guanzon said.

“For these reasons, I find that the totality of the circumstances shows that Respondent’s conviction for the offense of non-filing of his tax returns for four consecutive years involves moral turpitude,” the commissioner held.

Documents

Guanzon also gave more weight to the trial court certification, which stated that it has no records of the respondent’s compliance with the court rulings on the tax cases, presented by the petitioners against the receipt of payment of P67,137 submitted by Marcos.

She said the Land Bank of the Philippines official receipt presented by Marcos “contained an entry showing that the collection or payment was for a lease rental.” Marcos also did not explain this irregularity, the commissioner added.

The certification of the Bureau of Internal Revenue also does not state what it is for or what the payment was for.

“While the certification supposedly included a computation of tax deficiencies and fines as attachment, the said attachment did not appear to be a part of the certification; it did not bear any seal or attestation by the same signatories of the BIR Certification,” she added.

Marcos also did not provide evidence that the proof of payment had been transmitter to the trial court, making it appear that he "bypassed RTC Branch 105 altogether in serving his penalty."

Read Guanzon's Separate Opinion here:

- Latest

- Trending