Fringe benefits, non-cash incentives sought for workers

MANILA, Philippines — Labor groups yesterday urged employers nationwide to provide de minimis or fringe benefits and non-cash incentives to help workers cope with surging cost of basic commodities and services.

“We urge employers to provide de minimis, cash and non-cash benefits to their employees during these economically difficult times. Giving such benefits would be a great motivation for workers to be happy and industrious at work,” Associated Labor Unions spokesman Alan Tanjusay said.

The granting of non-cash assistance, he said, will not only help employees cope with the rising cost of living, but also maintain productivity in the workplace.

According to Tanjusay, de minimis or fringe benefits are not subject to income and withholding taxes.

Among possible non-cash benefits employers can provide, Tanjusay said, are monthly rice assistance, transportation and meal allowance.

“Rice subsidy of P2,000 or one 50-kilogram (sack) of rice per month, clothing allowance not more than P6,000 per year and actual medical assistance not exceeding P10,000 a year can be given to private employees,” Tanjusay noted.

Employers, he said, can extend to workers daily meal allowance for overtime work and night/graveyard shift pay not exceeding 25 percent of the basic minimum wage.

He said employers may also monetize unused vacation leave credits not exceeding 10 days during the year and grant employees achievement awards, which must be in the form of tangible personal property other than cash or gift certificates worth P10,000.

The spate of extraordinary rise in prices of basic commodities in the past months, Tanjusay said, is adversely affecting workers nationwide.

“The unusual rise in prices impacts and limits the labor force’s access to nutritious food necessary to their health and essential to their capacity to produce goods and provide quality services. With this unfavorable condition, we don’t expect a competitive economy on the part of workers in the weeks and months ahead,” Tanjusay explained.

Tanjusay also urged the government to raise the amount given as unconditional cash transfer program and extend the coverage from indigents to rank-and-file minimum wage earners and informal sector workers.

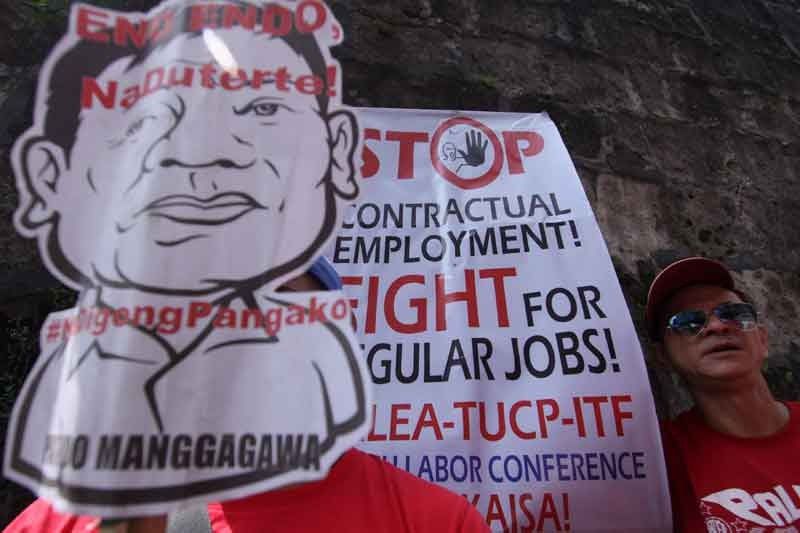

The majority of workers, Tanjusay said, are short-term contractual, new graduates and entry level employees with meager minimum wage and inadequate social protection insurance.

Meanwhile, the Department of Labor and Employment (DOLE) has amended its implementing rules and regulations on wage deduction.

Labor Secretary Silvestre Bello has issued Department Order No. 195, allowing employers to deduct amounts from the wages of employees under certain conditions.

“Wage deduction may be made with a written authorization of the employees for payment to the employer or a third person and the employer agrees to do so,” Bello said.

But Bello stressed that the employer shall not receive any pecuniary benefit directly or indirectly from the transaction.

“Nothing in this issuance shall be construed to cause the diminution or substitution of any benefits and privileges currently enjoyed by the employee,” Bello added.

Bello said the new rule shall take effect 15 days after publication in a national newspaper.

Under existing regulation, deductions are allowed with written authorization of the employees for payment to a third person and the employer agrees to do so.

DOLE, however, noted that non-interference in the disposal of workers’ wages remains.

- Latest

- Trending