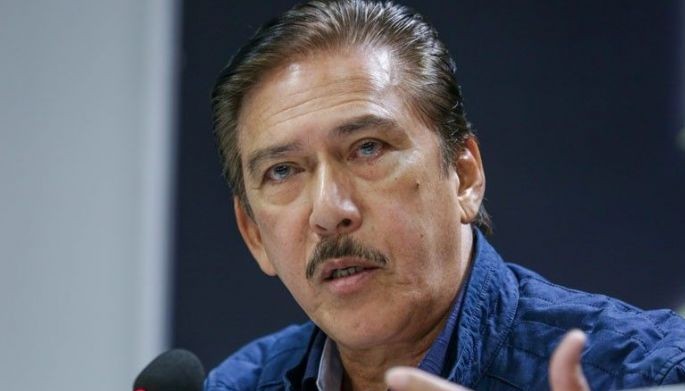

MANILA, Philippines — The second tax reform package, shunned by senators, will have a sponsor after all in the person of Senate President Vicente Sotto III.

In an interview with dzMM yesterday, Sotto said he is willing to sponsor the second tax reform package being pushed by Malacañang as long as it will not lead to new or higher taxes as claimed by economic managers.

Sotto said he will closely study the proposed second package of the Tax Reform for Acceleration and Inclusion (TRAIN 2) submitted by the Department of Finance (DOF) to the Senate.

Senate Majority Leader Juan Miguel Zubiri told reporters last week that during an all-senators caucus, none of his colleagues offered to sponsor the measure, apparently for fear of antagonizing the public, which was reeling from the continued rise in the prices of goods – a phenomenon widely blamed on TRAIN 1.

“It could be good because it (TRAIN 2) would not impose new taxes,” Sotto said. “But we have to be steadfast because some big corporations have started to lobby (against removing incentives).”

TRAIN 2 primarily removes many fiscal and tax incentives for various industries, especially those located in economic zones. At the same time, however, TRAIN 2 seeks to reduce corporate income tax from 30 percent to 25 percent.

TRAIN-1 was about new and higher taxes on oil products, among other levies, and lower income tax for millions of individual taxpayers.

Sotto said he might file the bill yesterday but there was no word yet as of press time whether he did so or not.

Earlier, Zubiri said his remarks about his colleagues’ unwillingness to sponsor TRAIN 2 were followed by “calls from high places” protesting his statement.

“I told them (callers) can’t I be honest?” Zubiri told “The Chiefs” on Cignal TV’s One News Monday night. “But it doesn’t mean we’re not going to hear it in the Senate. I’d like to see our government agencies actually delivering on their promises on TRAIN 1,” he said, referring to the infrastructure projects and cash subsidies for the poor.

He vowed to grill DOF officials over their previous assurance – at Senate hearings – that TRAIN 1 would not be burdensome.

“What the hell were you telling us? So now the opposite has happened,” the senator said, referring to the rising prices of commodities.

He warned that removing fiscal incentives could force investors to relocate to neighboring countries in the region, leaving more Filipinos jobless.

Zubiri said he would seek an audience with President Duterte to warn him against imposing new taxes or removing tax incentives.

House priority

At the House of Representatives, Speaker Gloria Macapagal-Arroyo said TRAIN 2 would be a priority under her leadership.

“Yes,” she told reporters when asked if TRAIN-2 is a priority measure. “It’s not called TRAIN-2 because TRAIN-2 is misleading. This is going to be a corporate incentives reform. Remember in the SONA (State of the Nation Address) of President Duterte, it’s there,” she said.

She recalled that when she was elected Speaker on July 23, she made a commitment that her “first and foremost job is to carry out the legislative agenda of the President.”

Asked about her timeframe for approving what the DOF has labeled TRAIN-2, she said, “I don’t want to be specific about the timeline.”

Another House leader, deputy speaker and Batangas Rep. Raneo Abu, said TRAIN-2 “is not a tax bill.”

“It is a corrective measure to address redundant incentives (57 percent) given to firms which fixed income earners are in a way subsidizing. We should support infant industries but it should be time bound. We are lowering the corporate income tax, that will cushion the effect of removing the incentives of those companies which for so long enjoy the incentives but no inputs to exports and labor,” he said.

Arroyo was scheduled to get a closed-door briefing from the administration’s economic managers on the proposed P3.76-trillion 2019 national budget at noon yesterday after she sat for two hours in the hearing of the committee on ways and means on TRAIN-2.

“The economic managers are giving me a briefing on the budget but I plan to segue to discussing the causes of inflation. We have to address them one by one,” she said.

Arroyo, an economist by education and training, refused to say what advice she had given President Duterte on fighting inflation last week when they met at the House of Representatives.

According to the Philippine Statistics Authority, inflation in June rose to 5.2 percent, the highest in more than five years.

Finance officials have blamed the rise in inflation on the increase in the price of crude oil in the world market and on the depreciation of the peso against the US dollar. They have also blamed big spenders among Filipinos.

They claimed that TRAIN-1 accounts for only 0.4 percent or less than one percent of inflation.

But TRAIN critics said the law is largely to blame for the rise in the cost of products and services.

They said the claim that TRAIN contributes less than one percent to inflation is “fake news.”

They cited the increase in the prices of diesel, in particular – about P9-10 per liter – since the law was enacted.

Of that increase, the new tax on diesel – including the 12-percent value added tax on it – is about P3, which is clearly 33.33 percent or one-third of the P9-P10 hike, they stressed.

Sen. Sonny Angara, who chairs the Senate committee on ways and means, has said the highest projected inflation rate when the DOF was badgering Congress to pass the TRAIN law was 0.9 percent.