RCBC prexy denies hand in $100-M money laundering scandal

MANILA, Philippines – Rizal Commercial Banking Corporation (RCBC) on Tuesday once again claimed that its bank has no involvement in the alleged money laundering of $100 million in the country.

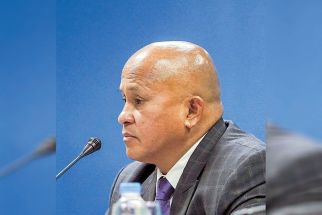

In his opening statement at the Senate Blue Ribbon Committee, RCBC president and Chief Executive Officer Lorenzo Tan clarified that RCBC has no knowledge in the alleged money laundering scandal, citing that the bank is committed to upholding anti-money laundering programs.

“On behalf of the bank, we vehemently deny and disavow any and all knowledge complicity or participation in the alleged money laundering of 100 million dollar in the Philippines,” Tan said.

READ: RCBC denies alleged money laundering

Primary tabsTan said RCBC is strictly complying with “the prevailing laws and applicable rules and regulations of the Bangko Sentral ng Philippines (BSP) including those necessary to curb money laundering” to ensure and monitor that its systems, measures and polices is consistent with the laws of BSP. He added that it also formed its own anti-money laundering program with members of it composed of Senior committee and heads.

“The bank used this country’s laws and policies against money laundering as a defining and sacred part of the bank’s corporate policy and governance culture,” Tan said.

“Among others, the bank has board-approved and updated money-laundering prevention program manual as a department dedicated to anti-money laundering matters, money laundering,” he added.

Tan disclosed that RCBC is conducting its own investigation and will ensure that its erring employees and officials will be penalized if found involved in the alleged money laundering incident.

“We assure the honorable committee and the public that should any deviation from the bank’s policies and procedures be uncovered or should any employee or officer be found to have participated in any anomalous or unlawful transaction, the bank shall hold the erring individuals accountable and meet out the penalties they deserve,” Tan said.

The RCBC executive also explained that inward remittance to clients' accounts is fully automated from end-to-end.

Tan also cleared himself from involvement in the case by clarifying that he does not personally know RCBC Jupiter Makati Branch Manager Maia Santos Deguito who allegedly aided the transfer of the millions that suspiciously went through the country’s financial system, including local casinos and several accounts in her branch. Deguito accused Tan of having knowledge in the transaction.

“These allegations are baseless and malicious. To set the record straight, I do not personally know Ms. Deguito and had nether nor had maintained any relationship direct dealing with her. More importantly, I have no personal knowledge of much less personal participation in any of the transactions that are subject of this inquiry,” Tan said.

Tan explained that since RCBC is the fifth largest bank in the country with over 472 branches, it processes “in excess 2 million transactions every month with an average monthly peso-value of approximately 1 trillion.”

“These transactions are not known to me and these do not and would not have had to be approved as me even as a chief executive officer and president because to impose such a requirement would slowdown the process that needs to be expeditious and efficient,” Tan said.

RCBC and its branch manager as well as some of its account holders made it to the headlines after news on the alleged laundering of $100 million hacked from the US account of the Bangladesh's central bank surfaced.

- Latest

- Trending