Safe ka ba? Gcash partners with PNP, strengthens online security features

MANILA, Philippines — In an effort to combat fraudsters, GCash works with the Philippine National Police-Anti-cybercrime Group (PNP-ACG) in developing strategies versus scams and ensuring effective investigation of cybercrimes done using the app.

The signing of the memorandum of agreement that happened on November 24 strengthens Gcash’s partnership with authorities and regulators to help ensure the whole e-wallet ecosystem is safe for all.

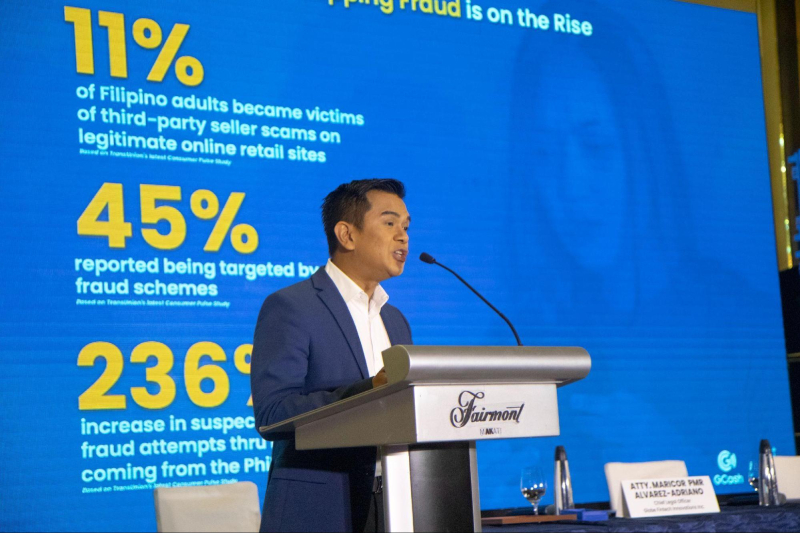

“I would like to express my confidence that through our stronger partnership with the PNP-ACG, we will be able to achieve more in the prevention, investigation, and prosecution of cybercrimes. GCash also assures the PNP-ACG that we will do whatever we can in order to successfully implement our agreement,” GCash Chief Legal Officer Atty. Maricor Alvarez-Adriano said.

Prior to this partnership, Gcash has already worked with PNP-ACG in holding several seminars on cybercrime protection to equip citizens with enough knowledge about various forms of cyber-enabled crimes such as phishing, smishing, online fraud, e-scams and vishing among others.

New app security feature

Aligned with the GSafeTayo campaign, Gcash also ramped up its platform’s security by introducing a new feature called “double authentication,” which will include a live selfie authentication feature.

Rolled out this Decemeber, this new Gcash feature can ensure that no one but the account owner has the ability to link their GCash account to a specific device.

“This feature removes customers’ dependence on SMS OTPs which has been exploited by some fraudsters to scam users. It will provide a unique identifier that can’t be phished by scammers. It also provides an additional layer of security to the current SMS OTP,” Winsley Bangit, chief customer officer of Gcash, said.

“We never stop innovating to make sure our 71 million users have the safest and most convenient experience when they use the app,” Bangit assured.

It can be recalled that GCash has already removed all clickable links in its official SMS and emails. This enables users to determine that received messages with links are scams.

The e-wallet has also migrated transaction notification messages to the in-app inbox and masked the names of send money recipients to further protect the users’ funds and personal data.

Providing consumers with more peace of mind

Apart from its new security feature, Gcash also announced “Online Shopping Protect,” a new product under its GInsure platform.

Powered by global insurance company, Chubb, this latest insurance product aims to provide peace of mind to online shoppers who use Gcash in their purchases.

For only P34 per month, users can get up to P20,000 in insurance coverage for incomplete deliveries, defective items, accidentally damaged or stolen products that were purchased using their GCash account.

Commiting to GSafeTayo

Having 71 million registered users, 1,600 partner billers and 5.2 million partner merchants and social sellers nationwide, Gcash is going all out to beef up its security measures to ensure users are safe and secure.

With #GsafeTayo, its revitalized security campaign, GCash is aiming to mitigate scam incidents by employing a combination of user education, increased cooperation with law enforcement agencies, as well as continuously upgrading its internal security platform.

- Latest