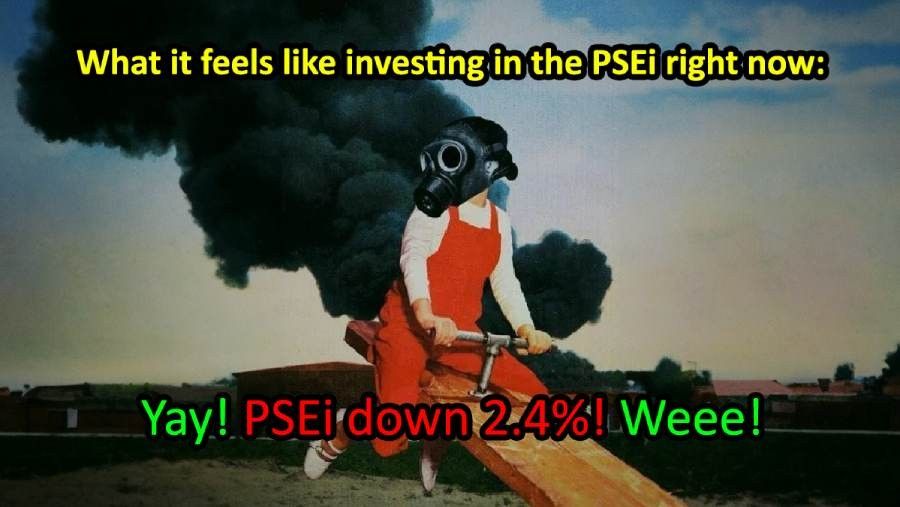

PSEi falls by 2.4% in one day

In what was an ugly day all across Asia, the PSEi dropped 153 points (down 2.4%) to 6,343. Lots of confusion in the chat, and while there is no One Clear Answer For Everything, the sentiment of the news on this tends to be that Asian markets are responding to concerns about the US economy and the potential for fewer-than-expected rate cuts by the US Federal Reserve as a result. According to Investing.com, the US payroll data “showed that U.S. job growth unexpectedly picked up in December, and the unemployment rate dropped, signaling a strong end to 2024 for the labor market.” They quote several analysts all saying similar shades of the same thing, that the “hot” employment market will probably give the US Federal Reserve “room” to leave rates unchanged, and that the longer rates are left unchanged, the fewer potential cuts we might see in FY25.

MB bottom-line: A lot of this is way outside of my comfort zone, but understanding why it’s happening is a second-order issue. What’s most important is to acknowledge that the PSEi is vulnerable to these kinds of external shocks to the system, and to adjust your own expectations accordingly. You can endeavor to expand your circle of knowledge by researching why valuations for Philippine-based companies would fall based on data that suggests US interest rates will remain elevated for longer than at first anticipated, but that exceeds the scope of this newsletter’s format, not to mention my time and knowledge. What I watch for in these times are the sectors that perform well (or least badly) when the poops hit the fan, and which get the most browned. Nothing here is causing me to make adjustments to my long-term holds, but I’m prepping myself to take action if the first few days of Trump’s presidency are as wild as advertised.

Merkado Barkada is a free daily newsletter on the PSE, investing and business in the Philippines. You can subscribe to the newsletter or follow on Twitter to receive the full daily updates.

- Latest