The week ahead

The PSEi comes into this week having now spent seven consecutive days above the psychological 7k mark. That’s the longest we’ve spent at this level since January 2023 (10 consecutive >7k closes between January 17 and January 30). I have my eyes on yields and gold right now.

> PH: A big week starts today with the listing of the PCOR prefs and the pricing of the DITO follow-on offering. On Wednesday, the VLL prefs offer will close. On Thursday, the DITO FOO offer period will start. We end the week with a Q2 REIT dividend payment to PREIT shareholders.

> International: There are going to be a number of key financial figures giving speeches next week in the US leading into the Friday morning (our time) release of the latest jobs data.

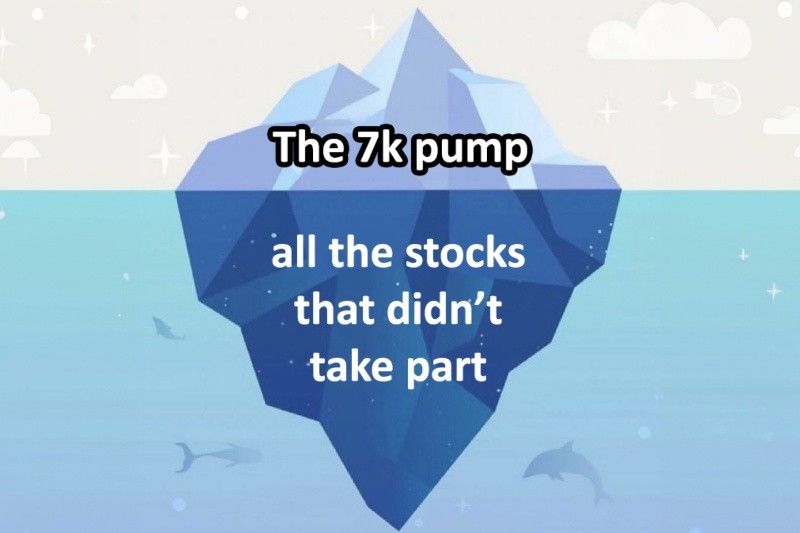

MB BOTTOM-LINE: It’s nice to see the Listing Notices section of the EDGE website so busy with companies trying to raise money right now, even if the majority of the action is all about refinancing old debt. I love a good equity listing, but it’s good to see buyers in the debt market, too. Movement is healthy. That said, with the PSEi spending some time above 7k with some confidence, it’s important to remember that this is a high tide that is not floating all boats. A lot of the action to this point has been focused in a handful of PSEi stocks, and the volume that we’ve seen over the past two months has not trickled down to some of the sleepier stocks. Our market still feels largely event-driven. That’s how I’m trading it, at least. I’m not snatching up whatever I can right now under the theory that I need to get ahead of the swarms of buyers while the prices are still cheap. I’m holding what I already have and using events to add to those existing positions.

Merkado Barkada is a free daily newsletter on the PSE, investing and business in the Philippines. You can subscribe to the newsletter or follow on Twitter to receive the full daily updates.

- Latest