Inflation, rates and currency

There have a been a lot of developments recently on inflation, interest rates, and currency valuation projections, so I just wanted to group those all in one place and talk about that briefly. Last week, the BSP held steady on PH rates while I was on leave. That was largely expected. Earlier this week, US Federal Reserve Chairman Jerome Powell gave statements [link] that seemed to indicate that he felt as though the US was back on a “disinflationary path”; inflation appears to be cooling, and its inflation and employment goals appear to “have come back much closer to balance”. Despite that, Mr. Powell was still hesitant to cut rates too soon and stressed “patience” with the process and a desire to see more and better confirmations in the data. Closer to home, InsiderPH reported yesterday on AP Securities’ projections that our own June inflation could surprise to the downside thanks to the possibility of lower pressures on food prices, and that this, combined with higher base inflation figures starting in August, “would eventually lay the groundwork for an October rate cut, which may be followed by another one in December.”

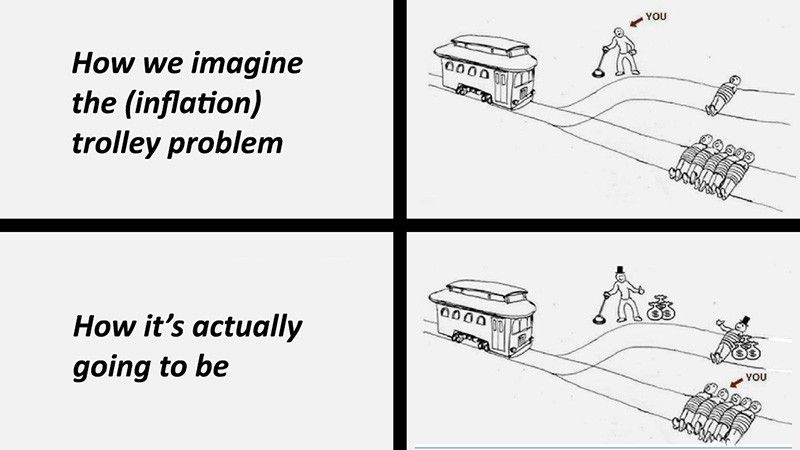

MB bottom-line: A lot of this discussion is way above my pay grade, but I’m interested to see what might happen here if the US Federal Reserve does nothing for the remainder of FY24 and we, based on our own needs and circumstances, manage to push through two 25 bp rate cuts as AP Securities speculates could happen. That would reduce the interest rate differential between the Philippines and the United States, and it would (likely) result in an outflow of capital from PH-denominated bonds and fixed-income securities, which could erode the value of the Philippine Peso relative to the US Dollar. Thankfully we have a real-world case study that we can look at since the Bank of Canada went ahead and cut Canada’s prime rate by 25 basis points back in June. Since that time, the value of the Canadian Dollar has fallen approximately 1.2% relative to the US Dollar, but this loss of value was neither immediate nor consistent. If we experienced a similar slide in the Peso’s value after a 25 bp cut, we’d be looking at a P59.40/$1 exchange rate by November, and possibly something that breaches the P60/$1 mark by the end of the year if the BSP manifests AP’s prediction and does both of the prediction’s rate cuts. This back-of-the-envelope math is hilariously dumb and ignores a world of variables and black swan-type events that could completely change the inputs and make the analysis useless. The point here being that, in isolation, we’d expect the value of the Peso to drop if we cut our rate first. Will it happen as my caveman computation has predicted? Who knows. But if we cut and they don’t, it’s not going to make life any easier for holders of US-denominated debt. That’s all I know.

---

Merkado Barkada is a free daily newsletter on the PSE, investing and business in the Philippines. You can subscribe to the newsletter or follow on Twitter to receive the full daily updates.

Merkado Barkada's opinions are provided for informational purposes only, and should not be considered a recommendation to buy or sell any particular stock. These daily articles are not updated with new information, so each investor must do his or her own due diligence before trading, as the facts and figures in each particular article may have changed

- Latest