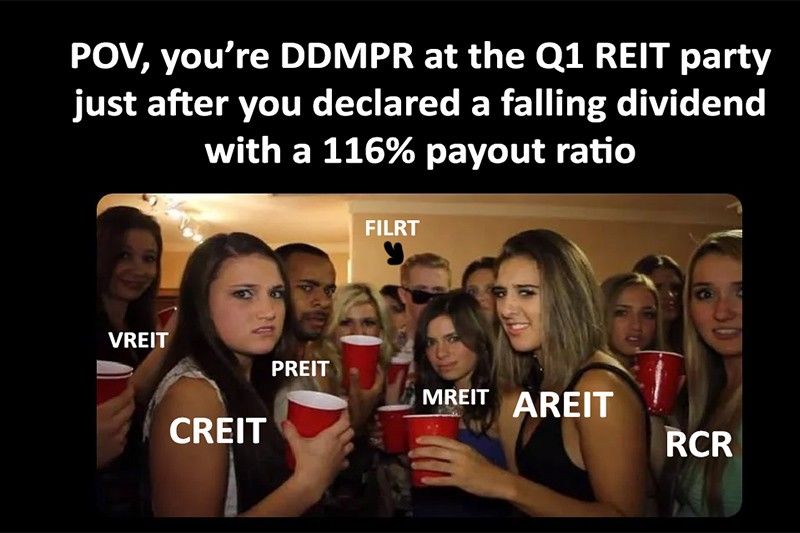

DDMPR declares falling Q1 div at 116% payout ratio

DDMP [DDMPR 1.17, up 0.9%; 37% avgVol] [link] declared a Q1/24 dividend of P0.023476, payable on July 15 to shareholders of record as of June 19. The dividend has an annualized yield of 8.03% based on the previous closing price. The total amount of the dividend is P419 million, which is 116% of the P362 million in distributable income that DDMPR reported for the quarter. Relative to DDMPR’s IPO price, the dividend increased DDMPR’s total stock and dividend return to -32.29%, up from its pre-dividend total return of -32.33%. DDMP REIT Fund Managers reported that DDMPR’s occupancy as of March 31 was just 76%, with occupancy at its main building (DoubleDragon Plaza) listed at just 70.8%.

MB bottom-line: The dividend amount is up 1.4% from DDMPR’s disastrous Q4/23 dividend, but it’s down 7.5% y/y and down 15.8% from Q1/22. DDMPR is the second-oldest REIT on the PSE. It issued its first dividend to shareholders in Q4/20. Its sponsor, DoubleDragon [DD 10.48 ?10.0%; 581% avgVol], is bursting at the seams with potential assets that could be downloaded to DDMPR to diversify the REIT’s portfolio and breathe some much-needed life into this stagnating afterthought. DDMPR’s assets are fine, but their strategy in how to monetize those assets is outdated. Gone are the days when high commercial rents from POGOs could excuse the growing issue of collections from those POGOs. Now we have DDMPR suffering from high (and going higher) rates of delinquency. Gone are the days when investors were lapping up the chance to get in on the commercial office space game. Now we have the threat of a POGO ban and the existential threat of AI putting all of the “easy” BPO leasing opportunities at risk. Gone are the days when DDMPR’s inactivity could be explained away by its newness. Now we’re left picking through the rubble of yet another disappointing Quarterly Report, yet another y/y dividend reduction, and bagholders have heard no plan from management on what they’ll do to right the ship.

---

Merkado Barkada is a free daily newsletter on the PSE, investing and business in the Philippines. You can subscribe to the newsletter or follow on Twitter to receive the full daily updates.

Merkado Barkada's opinions are provided for informational purposes only, and should not be considered a recommendation to buy or sell any particular stock. These daily articles are not updated with new information, so each investor must do his or her own due diligence before trading, as the facts and figures in each particular article may have changed.

- Latest