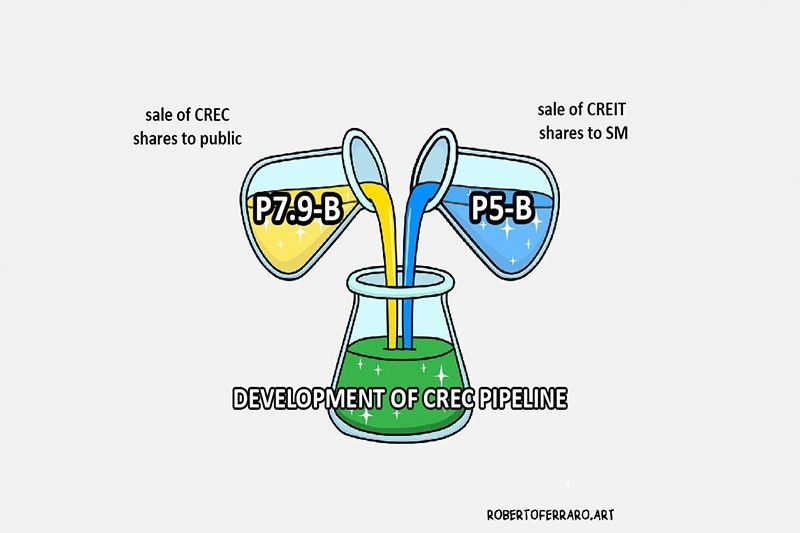

Citicore Renewable Energy Corporation [CREC 3.88 pre-IPO] [link], the parent company of Citicore Energy REIT [CREIT 2.85 unch; 37% avgVol], has scheduled its IPO for May 31 after postponing its listing due to market conditions and negotiating a P5 billion stock sale of CREIT shares to the SM Investments [SM 975.00 ?0.5%; 156% avgVol] group. CREC’s updated prospectus shows that the Edgar Saavedra company has reduced the size of the IPO transaction from P12.9 billion to P7.9 billion.

MB BOTTOM-LINE: While OceanaGold is going to beat CREC to market and be the PSE’s first IPO of 2024, CREC is going to be the first voluntary IPO and the first non-secondary IPO of the year. CREC’s listing is not being compelled by law; the sale of shares was always intended to fund the company’s development of its project pipeline, so it makes sense now that it managed to sell some of its CREIT holdings for P5 billion that it would reduce the amount that it’s selling by exactly that amount. I doubt Mr. Saavedra is perfectly happy with the market conditions as they are right now, but his long-term development plans depend on getting these projects financed and started in a timely manner. He isn’t letting “perfect” be the enemy of “good enough”, and for that I have a good deal of respect. I’ll do a deeper dive on the upcoming IPOs soon. It’s been a while, so there’s a lot to go over!

Merkado Barkada is a free daily newsletter on the PSE, investing and business in the Philippines. You can subscribe to the newsletter or follow on Twitter to receive the full daily updates.