Metro Pacific revealed that GSIS now owns 12% of outstanding shares

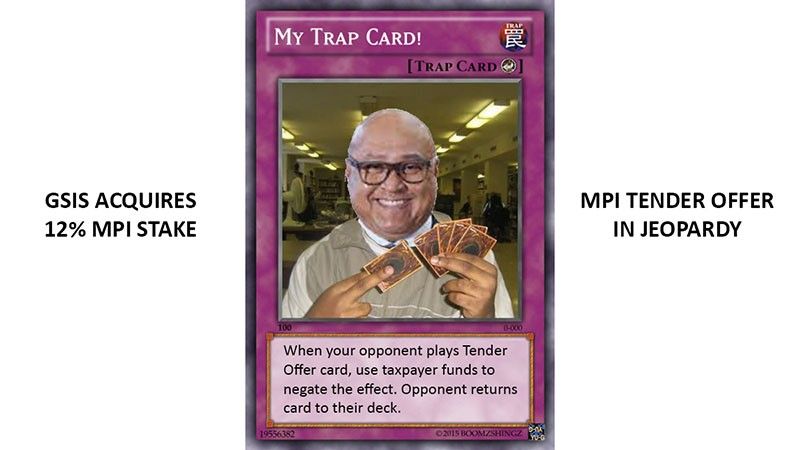

Metro Pacific [MPI 5.10, down 1.2%; 7% avgVol] [link] disclosed that it received a letter from the Government Service Insurance System (GSIS) that GSIS had acquired 2.49 billion shares of MPI between August 23 and September 4. This buying spree increased GSIS’s stake from around 3% to 12%. MPI is currently the subject of a tender offer from the MPI Consortium, which is a group of MPI owners and stakeholders looking to acquire enough of MPI’s outstanding public shares to delist MPI and take it private. Due to the size of its stake, GSIS now has the option of receiving a seat on MPI’s Board of Directors, and can single-handedly thwart the MPI Consortium’s delisting requirement of achieving ownership of at least 95% of MPI’s outstanding shares.

MB bottom-line: This move throws the entire tender offer into doubt. Remember that the MPI Consortium is not bound to accept all of the shares that were tendered during the offer period, so if GSIS ends up holding out and not tendering its newly acquired shares into the tender offer, then it’s not clear if the MPI Consortium will complete the tender offer and buy the shares that have been tendered. If GSIS holds out and MPI buys everything that’s been tendered, MPI’s public float will likely fall below the PSE’s minimum and cause trading in the shares to be suspended. The only thing I can think of here is that Wick Veloso, the head of GSIS, is planning to hold the potential delisting hostage in exchange for a sweetheart deal for GSIS’s stake. It’s possible for GSIS (or anyone, for that matter) to negotiate a private sale outside of the tender offer process, and such a sale doesn’t have to transact at the tender offer price. The timing of GSIS’s announcement, coming just after the early deadline for retail trader tender offers passed, makes me think that it was also part of GSIS’s goal to hold retail traders hostage as well to boost its leverage. Then, there’s the matter of the PSE’s potential amendments to the voluntary delisting rules. Would GSIS’s 12% stake count as part of the public float, or would it be excluded? Would MPI be allowed to voluntarily delist just for being below the minimum public ownership threshold, provided it buys all of the tender shares? Lots of questions here, and lots of moving parts.

---

Merkado Barkada is a free daily newsletter on the PSE, investing and business in the Philippines. You can subscribe to the newsletter or follow on Twitter to receive the full daily updates.

Merkado Barkada's opinions are provided for informational purposes only, and should not be considered a recommendation to buy or sell any particular stock. These daily articles are not updated with new information, so each investor must do his or her own due diligence before trading, as the facts and figures in each particular article may have changed.

- Latest