CTS Global puts off investing for another year

CTS Global [CTS 0.75, up 1.4%; 14% avgVol] [link], the proprietary trading firm owned by the Lee Family (owners of COL Financial [COL 2.97, down 1.0%; 121% avgVol] and the Caylum Trading Institute), disclosed that its board voted to once again delay the disbursement of its April 2022 IPO proceeds. The board adjusted the “expected timeline of disbursement” for the scaling of its global trading operations, the expansion of its client roster, and for general corporate purposes from mid-2023 to Q4 2024. To date, CTS has only disbursed 41% of the IPO proceeds that it raised from investors in 2022.

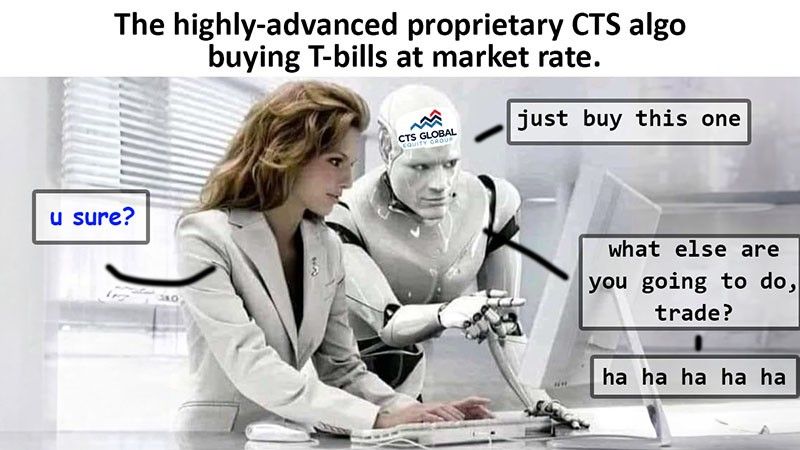

MB bottom-line: My frustrations with CTS are well documented and have traditionally clustered around the black-box nature of its proprietary trading system (What is the trading strategy, and under what conditions can we expect it to be successful?) and the willingness of the management team to make massive changes from its IPO prospectus in terms of how and when the money taken from the public will be used. If you remember back to CTS’s IPO, the main selling point was that the company would take our money and invest that money globally, and we’d all get to share in that return. The whole point of the IPO was to do this, as over 91% of the planned disbursements were for its “global trading operations”. They were also saying that they’d do this rather quickly, taking money from the public in April of 2022, and getting it out into the global markets over the next two months. Instead, what did the public get? CTS pushed P561 million into global markets through May and June, and then that’s it. They first voted to delay disbursement of the rest of the proceeds in June of that year, then again in September of that year, and now the board has done the same for the third time, except now with a one-year delay. I find it incredibly hostile to the investing public to allow a board to make such sweeping alterations to the representations made in a prospectus, that essentially remove the benefit of the proposed bargain for CTS investors without any say from those who put their money in. Delistings used to be like this before the PSE changed the rules to require a significant vote of the minority shareholders. While I’m not making the argument that material changes to a timeline are as potentially disadvantageous to minority shareholders as a delisting, I am saying that it appears to be a blindspot in the rules that remains anti-retail and anti-minority, and that could be fixed in a similar fashion. CTS isn’t the only company to have made drastic changes after taking public money. SP New Energy [SPNEC suspended] did the same, selling shares to the public based on the narrative of a plucky non-operational solar power project, through a PSE exception that seemed tailor-made for its listing, only to almost immediately pivot to buying up operational projects from its parent company in what is essentially a drawn-out backdoor listing of SPNEC’s parent company.

I see the arguments on both sides. To the credit of CTS and SPNEC, a prospectus isn’t a promise so much as it is a well-documented plan based on hundreds of shifting variables; those companies would probably say that their minority investors are better served by allowing their respective management teams to make adjustments to the plans to maximize value as those variables shift and change the operational landscape. The companies would probably further argue that, as equity investors, IPO buyers are simply stepping beside the owners and accepting the same high-risk, high-reward risk of loss that comes with share ownership. More ideologically, companies could also say that the publicly-traded nature of the stock makes it easy for buyers to sell their shares if they disagree with the company’s course of action.

On the investors’ side, we might acknowledge the limitations of a prospectus but insist on there being a need for a higher level of accountability to the plans outlined in a prospectus than that of your average Kickstarter. Companies might push back at the burdensome logistics of conducting a public float vote on any material changes to the plan, but this isn’t some exotic process with no precedent: the PSE requires companies to conduct votes on a wide range of topics, and all companies list with procedures on the books to conduct a “special” shareholder vote. Investors might also point to the rules about mandatory lock-ups that are in play to prevent rug pulls, and say that the PSE already recognizes the need to protect buyers from the whims of owners for some period after the IPO, and that the owners’ ability to make substantial changes to the prospectus without any kind of input is probably in the same category of wrong that the lock-up rules were meant to prevent. To the claim that the market is a viable exit strategy, investors might cite the CTS example where the stock was already trading at a substantial loss when these delay announcements were made to show how the ability to sell is not a cure-all but a remedy of last resort in some cases.

Which side should win? Well, in my books, it makes sense to look at the incentives. Do you want to incentivize the growth of trust in what has become a beleaguered IPO market, or do you want to incentivize the short-sighted mistreatment of minority shareholders under some inconsistent “buyer beware” ideology? Following a plan doesn’t guarantee results (just look at all the other IPOs), but allowing companies to unilaterally ditch a plan leaves minority shareholders vulnerable to becoming disenfranchised by the process of investing in IPOs, and that leaves the PSE vulnerable to losing potential investors at a time when it can least afford it.

---

Merkado Barkada is a free daily newsletter on the PSE, investing and business in the Philippines. You can subscribe to the newsletter or follow on Twitter to receive the full daily updates.

Merkado Barkada's opinions are provided for informational purposes only, and should not be considered a recommendation to buy or sell any particular stock. These daily articles are not updated with new information, so each investor must do his or her own due diligence before trading, as the facts and figures in each particular article may have changed.

- Latest