PSE threatening to make life hard for HLCM minority shareholders

As most readers will know, Holcim PH [HLCM suspended] was suspended after one of its most significant shareholders, Holderfin, purchased a 9.2% stake in HLCM from Sumitomo Osaka Cement without any warning to the public. That pushed HLCM’s public float below the PSE’s minimum threshold, requiring the stock to be suspended. After the stock was suspended, Holderfin decided, on its own, to conduct a tender offer for HLCM shares for the purpose of delisting HLCM from the PSE.

> Straight-forward tender offer, right? Nope. I received several confused and angry emails from readers who are minority shareholders of HCLM, who shared with me the emails they received from their brokers about how to tender shares. The problem is that there is no clarity from the PSE on whether or not the PSE will lift the trading suspension.

> What's the problem? Well, the crucial point is what will happen on the settlement date when the tender offer shares actually need to be transferred from the shareholders to Holderfin. The PSE's point is that since the shares are technically suspended, shareholders can't use the PSE's infrastructure to transfer the shares to Holderfin. The PSE might be able to lift the suspension to permit the transfer of shares easily on its system at the settlement date, but so far it's not clear what the PSE will do (or not do).

> What are the steps if the PSE doesn’t lift the suspension? If the PSE doesn’t lift the suspension, the minority shareholder has to first contact their broker to request “upliftment” of their HLCM scriptless shares into certificated shares, which can take a month or longer to complete. The request must include photocopies of ID and other annoying proofs, and brokers usually charge a fee for the conversion plus a courier charge to have the physical certificates delivered to the shareholder. The second step is to send all the required documents to the Tender Offer Agent, including an Application to Tender Shares (in triplicate), photocopies of ID, two original copies of Deed of Absolute Sale, two original copies of Irrevocable Proxy, photocopy of TIN, two original copies of signature cards, plus an original copy of CAR from the BIR or Special Power of Attorney.

> Are there any other issues? Yes! Selling shares off the exchange will expose the seller to capital gains tax and documentary stamp tax.

> What are the steps if they do lift the suspension? The minority shareholder just logs into their brokerage account, clicks on the Tender Offer, enters the number of shares they wish to tender, and then hits “submit”. That's really it.

> But why was the stock suspended in the first place? Because Sumitomo stake sale reduced the public float below the PSE’s minimum public ownership threshold.

> What’s the purpose of the PSE’s minimum public ownership threshold? To encourage liquidity by diversifying the shareholder base to include minority shareholders.

> What is the purpose of a suspension? To encourage compliance with the rule that is meant to enhance liquidity and minority participation. The suspension punishes both owners and minority shareholders alike, but a suspension is more punishing to minority shareholders who lack the sophistication, time, energy, and resources to make a private sale in the case of a prolonged suspension. Owners are in a much better position to make a private sale at a price that is not significantly disadvantaged.

> Who is responsible for this situation? Not the minority shareholders. Holderfin made the threshold-busting purchase on its own, without influence from minority holders, and decided to conduct the tender offer on its own without seeking approval from minority holders.

MB BOTTOM-LINE

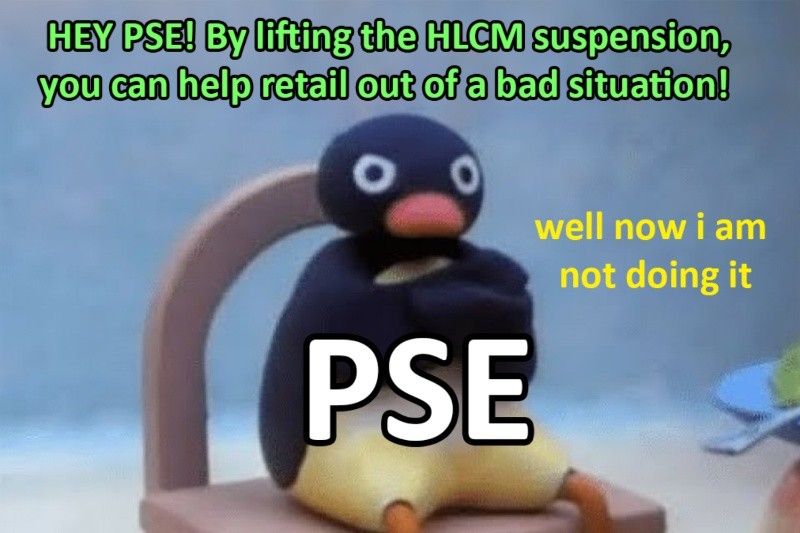

The tender offer period runs until August 30, but it’s been active since July 10, and this level of confusion is a terrible look for the exchange. Do you want to encourage retail participation, or not? Do you want to make investing easy and safe for the general public, or do you want to make things needlessly complicated and frightening to people who are only trying to better their family’s financial standing in this crazy life? What interest does the PSE have here in making it harder for minority shareholders to exit their positions? I get that the PSE might feel a little spurned by the company’s decision to leave the exchange, but this petty “will they / won’t they” issue seems calibrated only to grief HCLM’s ownership. HLCM’s minority shareholders are caught in the middle of this passive-aggressive standoff. Judging by the emails that I’ve received, there are people in a full-blown panic about what to do in this situation, and that’s on the PSE.

--

Merkado Barkada's opinions are provided for informational purposes only, and should not be considered a recommendation to buy or sell any particular stock. These daily articles are not updated with new information, so each investor must do his or her own due diligence before trading, as the facts and figures in each particular article may have changed.

- Latest