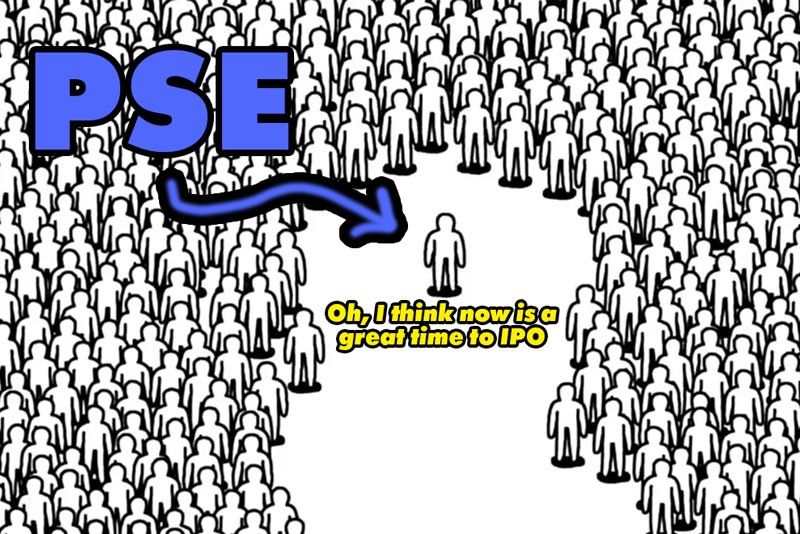

PSE says conditions are ripe for IPOs, plus more market updates

PSE [PSE 163.20 0.1%; 36% avgVol] [link] hopes that the “positive signal” of Petron’s follow-on offering of preferred shares will encourage other companies to think that “it’s a good time to raise capital again” on the PSE. The PSE’s President, Ramon Monzon, said that it might be a good time to consider going to market since the country’s fundamentals are improving and inflation is cooling.

MB Quick Take: The reason why there are so many delistings, and why there have been several IPO deferrals like North Star, Ovialand, and now SMPH REIT, is that market valuations are very low right now. While it might be true that the country’s fundamentals are improving and that inflation is under control, investors are just not willing to pay a premium for equity investments, and so owners are not keen to “sell low”. Some companies don’t care as much about valuation and are willing to plow an IPO straight into a terrible market (remember MerryMart during COVID?), but for most, they like to sell into a market that is interested. Our market is comatose right now.

Bangko Sentral ng Pilipinas (BSP) [link] Governor Eli Remolona said that the Monetary Board “will consider [a rate cut]” if inflation falls to below 4%, which is the upper limit of the government’s target band for inflation. The Monetary Board of the BSP has “paused” hikes for two meetings in a row. Some within the BSP are projecting that inflation may fall below 4% in October of this year.

MB Quick Take: To me, it seems like the BSP has been itching to cut rates for quite some time. Of course, interest rate cuts would be great for the stock prices of some of our fixed-income stocks, like REITs, and it could help signal to new home buyers or car buyers to take on debt to fund that purchase. It’s also not really the kind of thing that you would want to get wrong by acting too quickly. While year-on-year inflation is coming down in a mathematical sense, the month-on-month inflation is not, and the headlong rush to encourage more and more lending feels a little risky to me. But I’m just a blogger, so take that as you will.

ACEN [ACEN 5.19 0.4%; 116% avgVol] [link] board approved a joint venture with the Norwegian Investment Fund (Norfund) to provide “sustainable and affordable telecom tower solarization solutions” in the Philippines. Norfund is owned by the Norwegian Government, and according to the press release, is “used as a tool for strengthening the private sector in developing countries.”

MB Quick Take: As this article about telco tower solarization in India explains [link], once the capex is spent to build the towers, the biggest cost associated with operating the towers is energy/electricity. Some towers are located in remote areas. But almost all towers operate in areas that are more likely to be free from shade or obstruction by nature of their use, making them great targets for solarization efforts such as this. In India, over 20% of their towers have already been solarized, and they’re converting 2,000 to 3,000 towers to solar power each month. It’s not all sunshine and unicorns, though, since panels may not be appropriate for every site, and there may be supply-side issues with some of the other components of the setup that could delay roll-out, like the electronic controllers, the batteries (if any), and the panels themselves.

--

Merkado Barkada's opinions are provided for informational purposes only, and should not be considered a recommendation to buy or sell any particular stock. These daily articles are not updated with new information, so each investor must do his or her own due diligence before trading, as the facts and figures in each particular article may have changed.

- Latest