Figaro sells P170M worth of voting prefs to its owner

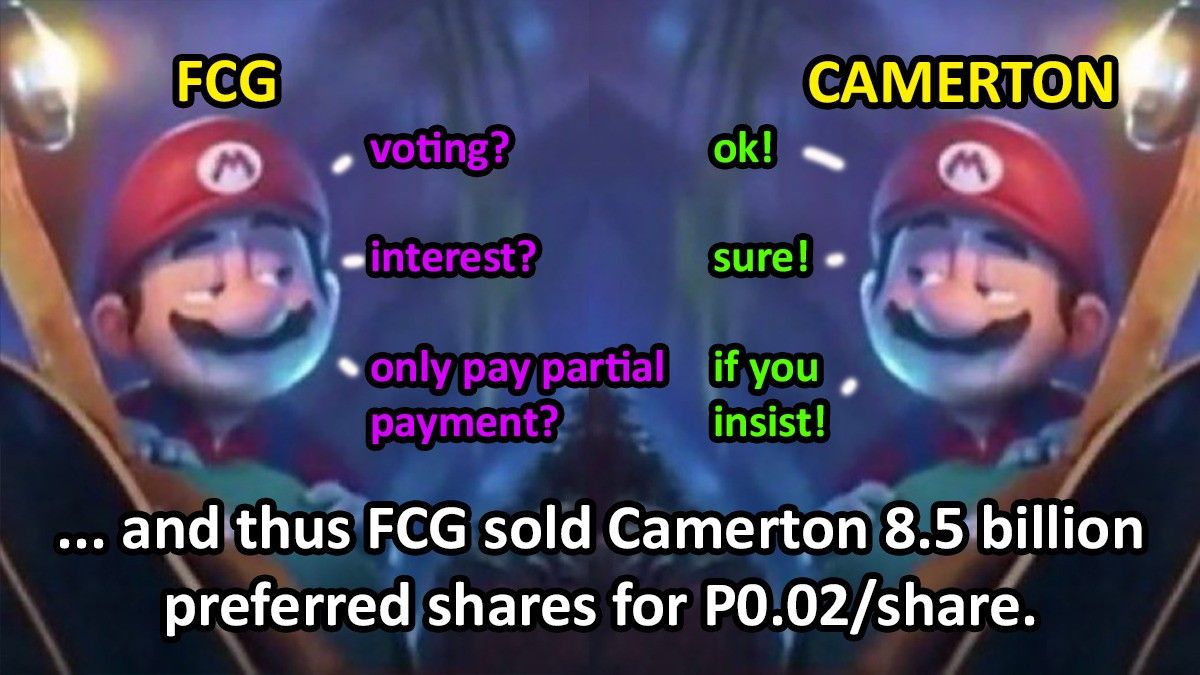

Figaro [FCG 0.72 2.9%; 59% avgVol] [link], Jerry Liu’s restaurant holdco, disclosed that it sold 8.5 billion preferred shares (with voting rights) to Camerton Inc, at a price of P0.02/share for a total subscription price of P170 million. Camerton Inc is FCG’s parent company, and Jerry Liu’s private holdco.

Camerton will only need to pay P42.5 million of that amount in cash initially to take ownership of the entire block of shares.

The balance of the payment will be due whenever the FCG board decides, which is conveniently controlled by Jerry Liu through Camerton.

MB BOTTOM-LINE

This is a classic Jerry Liu move.

On the open market, a share of FCG’s common stock goes for P0.72/share.

This is the class of shares that traditionally holds the voting rights of the company, and the one that is considered by the PSE and the SEC when calculating a company’s public float for the purposes of adhering to the exchange’s minimum public float rule which is in place to achieve a variety of investor-positive goals, like liquidity and minority investor protection.

The larger the public float, the less monkey business that a board can pull.

So here, Jerry Liu was able to buy 8.5 billion votes, which would have cost P6.1 billion on the open market, for just P170 million, plus the right to receive 1% interest, plus the right to vote and receive that interest despite not paying the full subscription amount.

He was able to do this without triggering the PSE’s minimum public float rule, despite the fact that if FCG had issued 8.5 billion common shares to Camerton, that FCG’s public float would have immediately dropped from 23.58% down to a tiny 9.23%, and FCG would most certainly have been suspended.

Now let me be clear: Jerry Liu, FCG, and Camerton have done nothing wrong (as far as I can tell) according to the rules that the SEC and the PSE have established for this sort of transaction, and we don’t know the exact voting terms that the preferred shares will have (the disclosures did not specify).

But this is exactly the type of sweetheart, self-dealing transaction that the minimum public float rule is (at least partially) intended to discourage, and it is this kind of operation that can make investing in PSE companies less attractive to both foreign and domestic investors.

The market sucks right now (there’s no way to sugarcoat it) and there is no One Cause To Rule Them All that we could simply fix and make the PSE into a vibrant and healthy marketplace in-line with our SE Asian peers. But we know that these kinds of moves are hostile to investor participation.

We know that there’s no way an arms-length board of directors would have approved this sale. Again, I’m not alleging that anyone involved here has acted in bad faith or has broken any rules.

I’m just frustrated by how trivial it is to side-step them.

--

Merkado Barkada's opinions are provided for informational purposes only, and should not be considered a recommendation to buy or sell any particular stock. These daily articles are not updated with new information, so each investor must do his or her own due diligence before trading, as the facts and figures in each particular article may have changed.

- Latest