DITO gets $1.2-B bridge loan from China

DITO CME [DITO 2.35 4.0%; 139% avgVol] [link] said its subsidiary, DITO Telecommunity (DitoTel), received a bridge loan renewal from the Bank of China and China Minsheng Banking Corporation.

DITO said that the bridge loan will be “repaid and absorbed” into a larger $3.9 billion project financing loan that it is attempting to finalize and close before the end of 2023.

MB BOTTOM-LINE

For those who are unfamiliar, a bridge loan is a short-term loan that is given to help a company “bridge the gap” between its current situation and the signing of a longer-term loan.

Here, DITO has been working on the larger part of this deal (the long-term loan) for a long time, and while DITO’s shareholders will be relieved to see DITO making a deal with one of its largest lender (Bank of China), it won’t mean much unless the larger deal is closed.

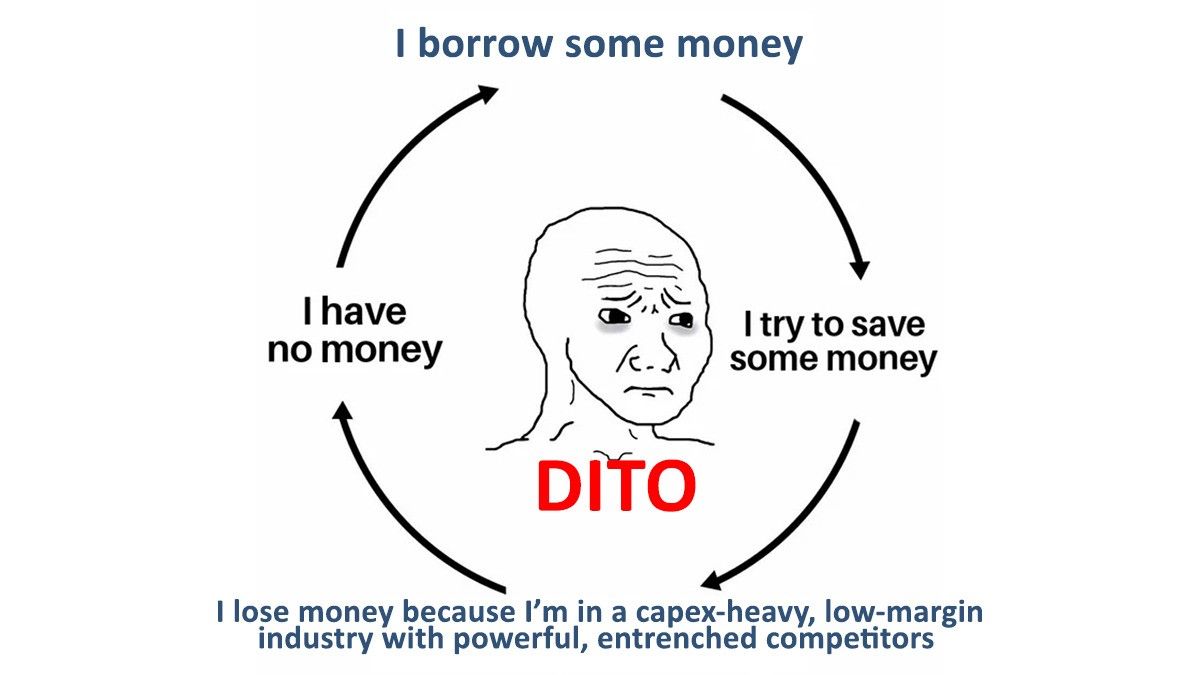

A lot has changed in the time that DITO’s management has been working on this deal, and DITO has continued to burn cash trying to expand its capex-heavy and low-margin business, so a bridge loan like this will give DITO breathing room (working capital) to maintain its growth pace without having to make tactical sacrifices to keep the lights on or make payroll.

--

Merkado Barkada's opinions are provided for informational purposes only, and should not be considered a recommendation to buy or sell any particular stock. These daily articles are not updated with new information, so each investor must do his or her own due diligence before trading, as the facts and figures in each particular article may have changed.

- Latest