PSE moves to involuntarily delist two companies

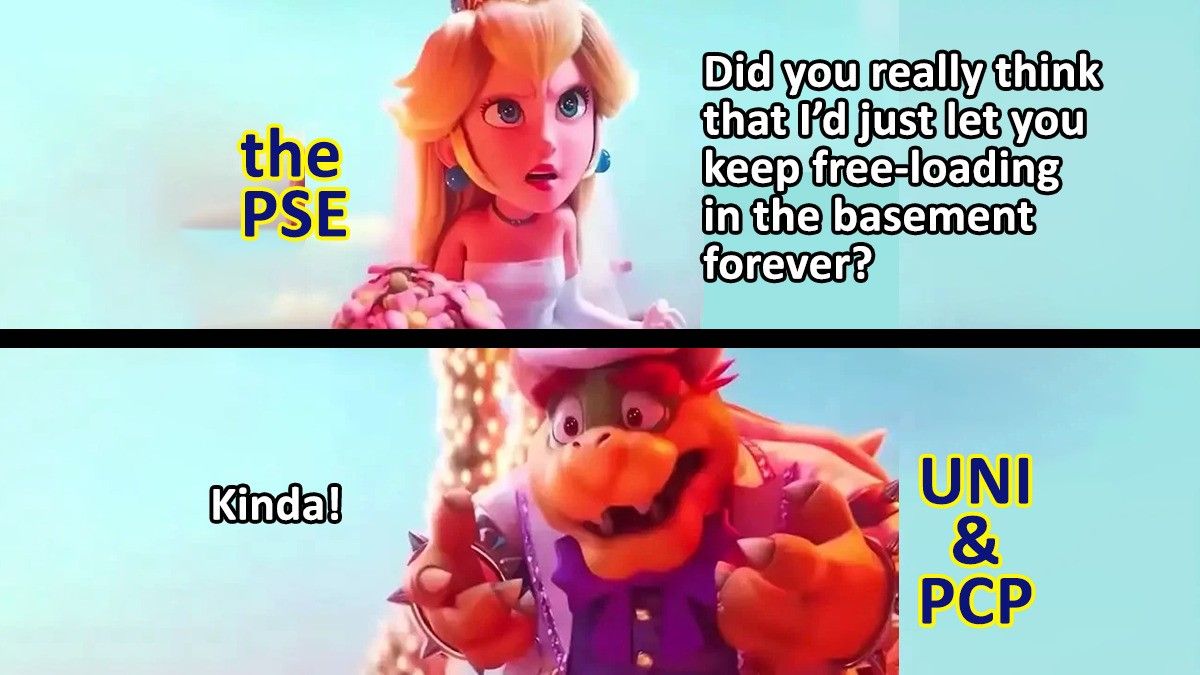

The Philippine Stock Exchange [PSE 165.00; 14% avgVol] [link] gave notice that it will delist Unioil Resources [UNI] and PICOP Resources [PCP] on 23 June 2023 for a long and frankly shocking history of regulatory disobedience.

UNI's rap sheet: The PSE noted that the company has maintained a negative stockholders’ equity balance since 2000 (that’s 23 years, for those who are following along at home on their calculators), has failed to submit quarterly reports for over five years, and has failed to submit annual reports for the past six years.

PCP's rap sheet: The PSE noted that (in addition to failing to pay all of its penalties and fees) the company has failed to submit annual reports for the past 15 years, failed to submit quarterly reports for the past 14 years, and has failed to submit Foreign Ownership Reports, Top 100 Stockholders reports, Number of Shareholders reports, and Public Ownership Reports since 2015. On top of that, PCP has failed to pay its annual listing fee to the PSE since 2009. And the cherry on top is that PCP had its rehabilitation plan terminated by the PSE for PCP’s “failure to comply with the terms and conditions of the modified alternative rehabilitation plan”.

Delisting, and then what? In both cases, the companies are prohibited from applying for relisting for five years, and all of the directors and executives attached to UNI and PCP will be prohibited from being elected as a director or hired as an executive of any company applying for listing for the next five years.

MB BOTTOM-LINE

PCP stopped paying the PSE its fee back in 2009, back when Julia Montes was 11 years old. She wouldn’t even begin dating Coco Martin for another five years. That's how long it's been. That’s what it seems to take to get this kind of regulatory attention. This is the exchange’s first attempt to involuntarily delist a company since the disastrous Calata Corporation debacle came to a head back in 2017. There’s a whole generation of PSE traders that have never seen the exchange exercise its regulatory oversight in this way before, so for them, seeing a decision notice like this is likely quite shocking. It’s even shocking for me, and I’ve been around for quite a while. With rap sheets as long and egregious as we see from UNI and PCP, it’s hard to believe that it’s taken this long for the exchange to act: “Sir, it’s been 15 years since UNI has given us financial reports. Should we get rid of them, or maybe wait another decade just in case?”

The weird part for me is that the Consolidated Listing and Disclosure Rules don’t leave a lot of doubt as to what happens when a company maintains a negative shareholders’ equity balance, as what happened with UNI. In the rules, if a company is negative for three years, the company “shall be subject to delisting”. That’s black and white. The PSE is compelled to initiate delisting. I'm sure there's a good reason why they haven't, but it does look weird.

Make no mistake, UNI and PCP are not the only companies that (up until yesterday) were basically zombies waiting for the PSE to do the needful. Either the PSE needs to enforce the rules as they’re written, or the SEC and PSE need to figure out what the new rules will be, because to this outsider, it looks like the system is absolutely not working in the spirit of the rules as they were written.

The other funny part (to me at least) is that the punishment for the people that caused something like this to happen is just that they can’t re-IPO the same company, or IPO another company. They can still (according to my reading of the rules) become elected as directors or executives in other PSE-listed companies in good standing. Just no “pagpag” directors doing IPOs. It feels like that prohibition is perhaps a little too narrow to truly have the bite that it should to prevent directors and executives from being this casual about their responsibilities to the shareholders in the public float. So what if some of the directors of these companies are currently sitting on boards. They should not be up for re-election for at least five years. Maybe then companies won't be so willing to let things get to this point.

--

Merkado Barkada's opinions are provided for informational purposes only, and should not be considered a recommendation to buy or sell any particular stock. These daily articles are not updated with new information, so each investor must do his or her own due diligence before trading, as the facts and figures in each particular article may have changed.

- Latest